Trader Resume Samples

4.5

(108 votes) for

Trader Resume Samples

The Guide To Resume Tailoring

Guide the recruiter to the conclusion that you are the best candidate for the trader job. It’s actually very simple. Tailor your resume by picking relevant responsibilities from the examples below and then add your accomplishments. This way, you can position yourself in the best way to get hired.

Craft your perfect resume by picking job responsibilities written by professional recruiters

Pick from the thousands of curated job responsibilities used by the leading companies

Tailor your resume & cover letter with wording that best fits for each job you apply

Resume Builder

Create a Resume in Minutes with Professional Resume Templates

CHOOSE THE BEST TEMPLATE

- Choose from 15 Leading Templates. No need to think about design details.

USE PRE-WRITTEN BULLET POINTS

- Select from thousands of pre-written bullet points.

SAVE YOUR DOCUMENTS IN PDF FILES

- Instantly download in PDF format or share a custom link.

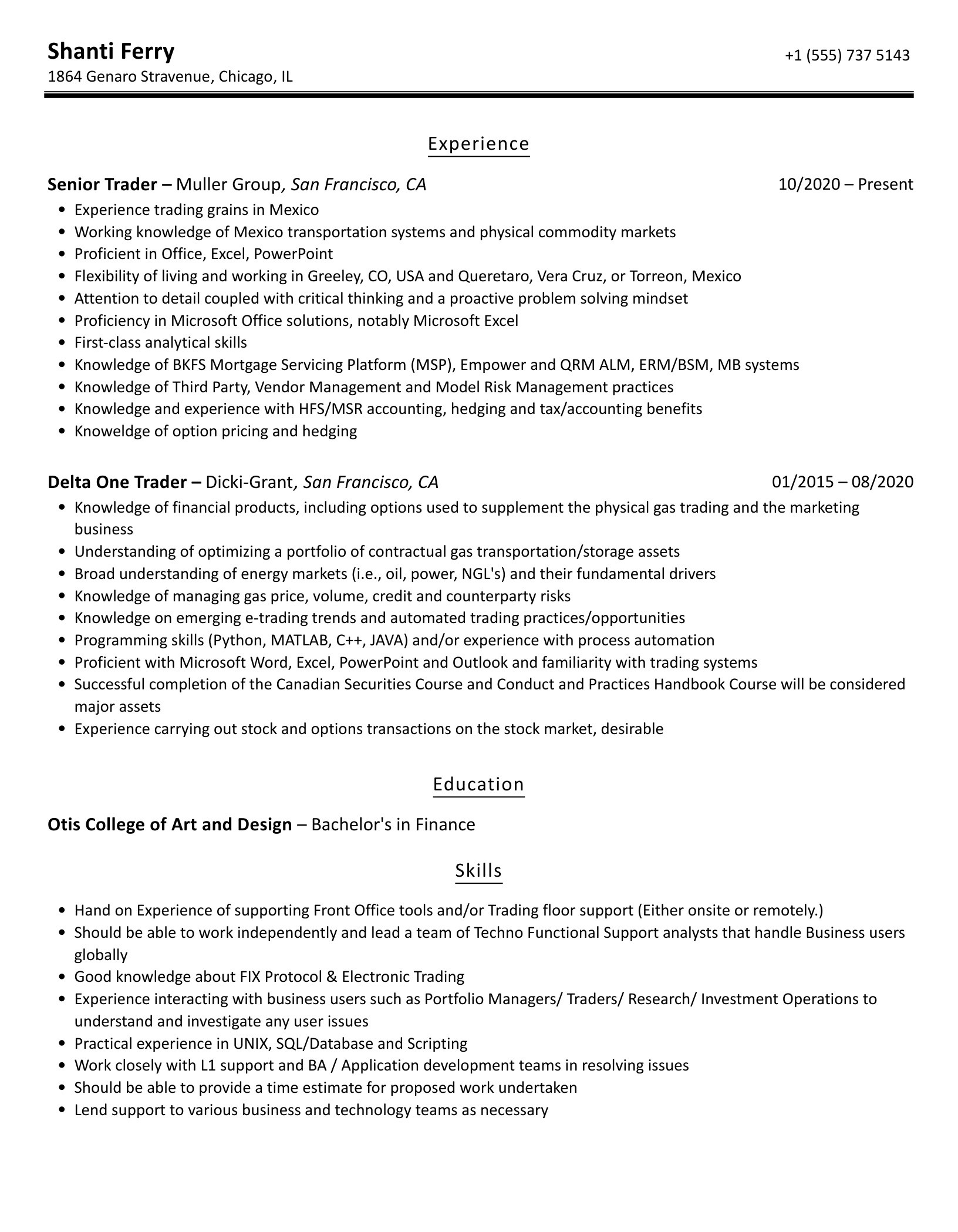

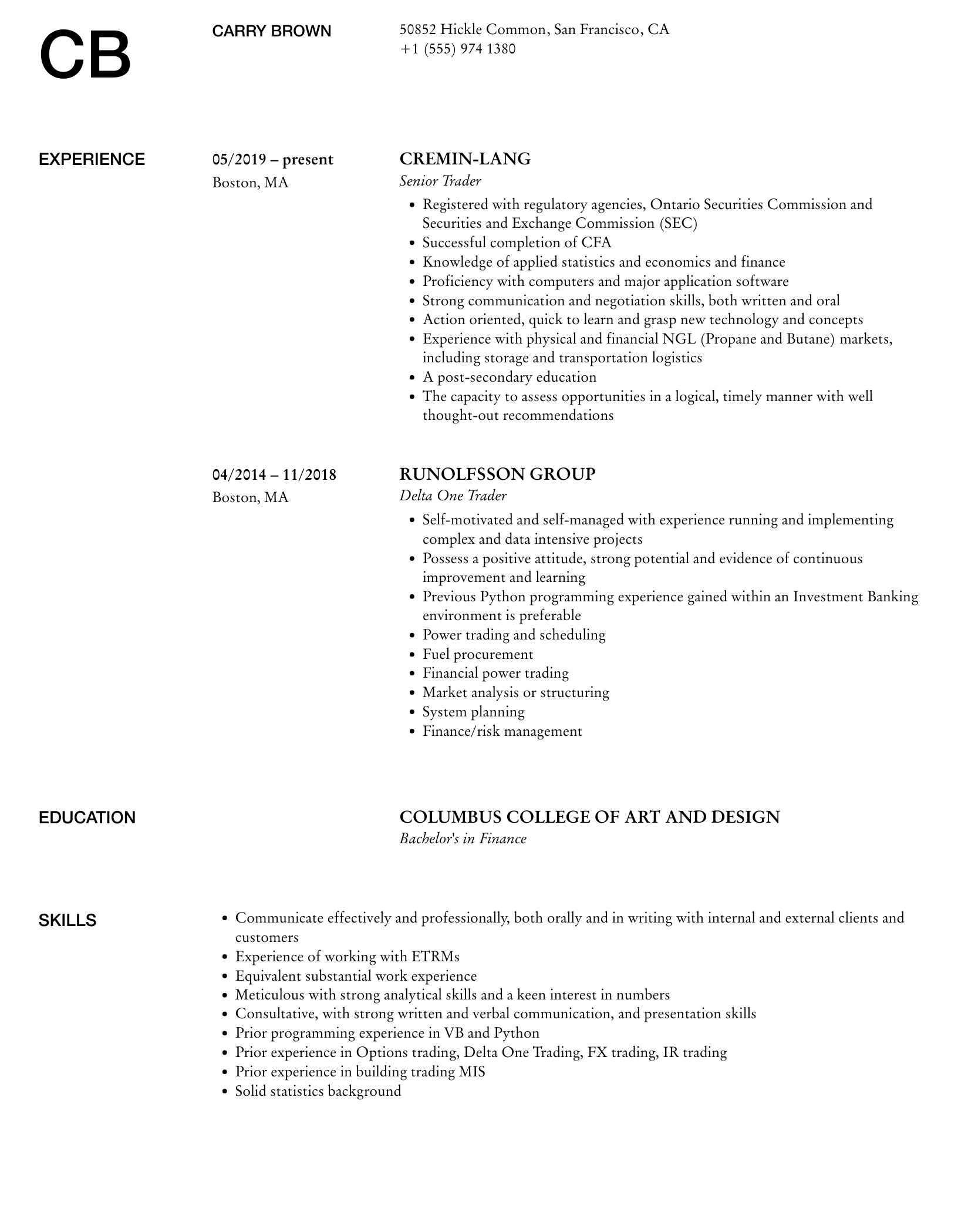

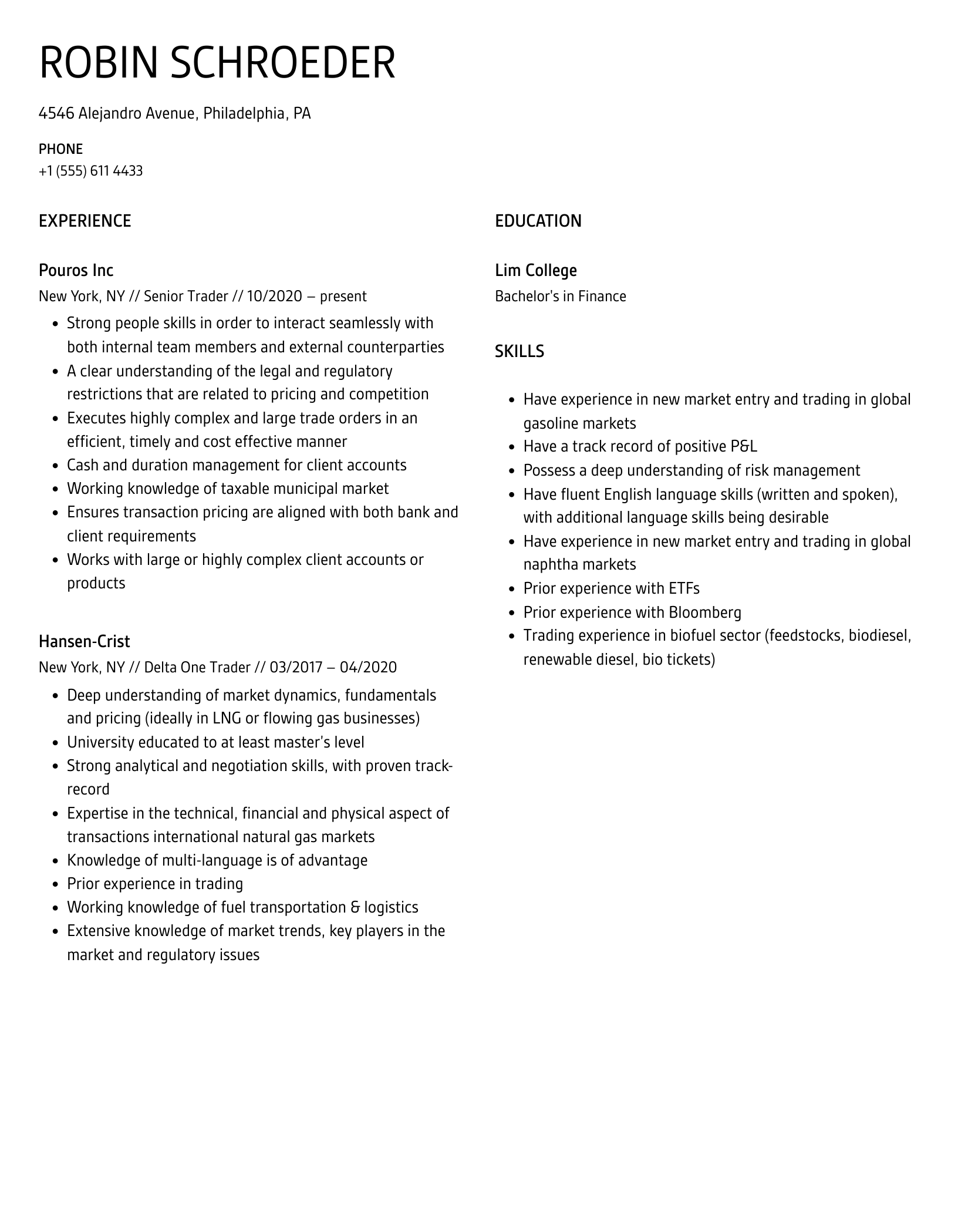

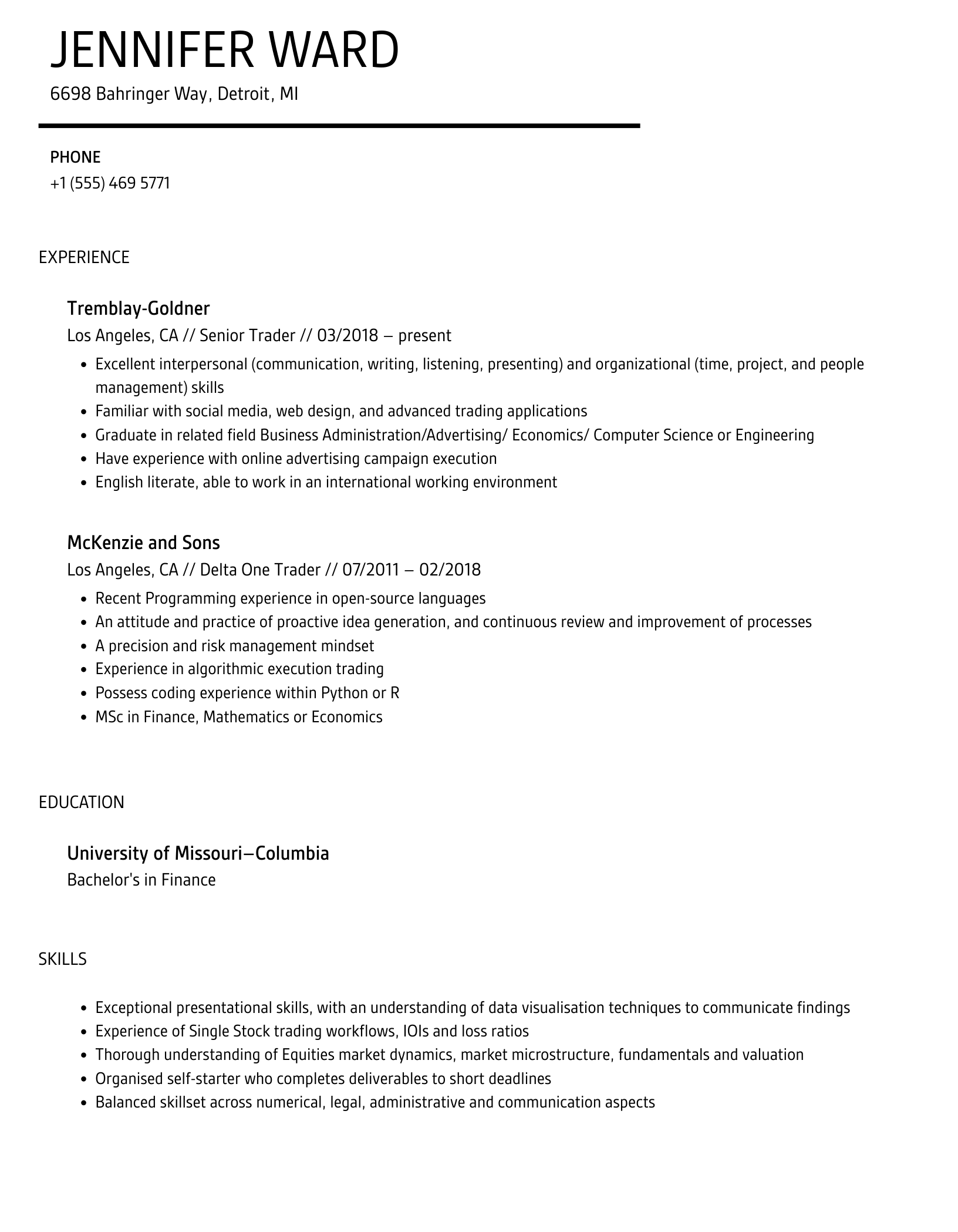

DL

D Leannon

Dayana

Leannon

3847 Shakira Viaduct

San Francisco

CA

+1 (555) 781 4799

3847 Shakira Viaduct

San Francisco

CA

Phone

p

+1 (555) 781 4799

Experience

Experience

San Francisco, CA

Trader

San Francisco, CA

Volkman and Sons

San Francisco, CA

Trader

- Assist in improving front office processes including execution process, risk management & monitoring framework, provide market colors and commentary

- Manage communication and relationship to deploy PRM (Price Risk Management) & SCM (Supply Chain Management) solutions for target customers

- Assist and execute risk management strategies for the Waterborne International team

- Assist and help execute instructions from TMS Global Credit Committee Members

- Develop and manage relationships with broker/dealers

- Performance Development

- Identify risks, analyze procedures, and work with managers to resolve procedural gaps

New York, NY

Delta One Trader

New York, NY

Connelly Group

New York, NY

Delta One Trader

- Providing D1 hedging for exotic desk on the Select Dividend Indices and developing our trading capacity on similar indices

- Liaising with technology to develop index algo product and working to incorporate client feedback

- Product development, in particular pricing model, for complex collateral swaps

- Management of the PEA Inventory

- Management of the Inventory of the desk

- Risk management of the book

- Developing of our US long dated forward trading offering on the D1 platform

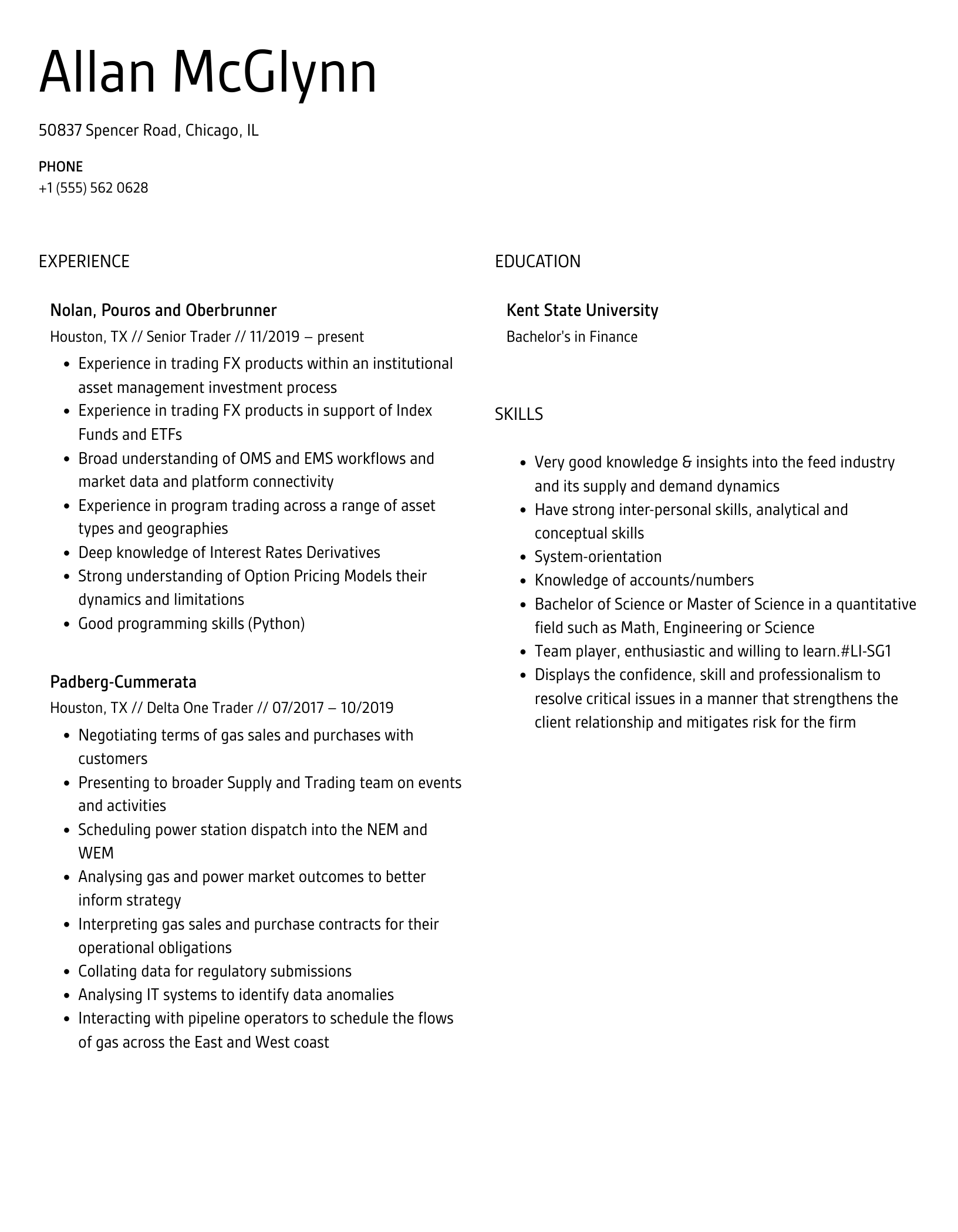

present

Houston, TX

Senior Trader

Houston, TX

Hammes, Maggio and Rippin

present

Houston, TX

Senior Trader

present

- Providing market color and insight to others within the asset management group

- Independently develop individual security and thematic investment opportunities for presentation to portfolio managers

- Responsible for continuously improving the performance of the work procedures and systems of products

- Maintain strong relationships with the street and work to maintain and improve Genworth’s standing with outside participants

- Work within Trading, Credit Research and other teams to define themes and structure for quarterly sector performance reviews for senior leadership

- Executes firm and customers’ trades in accordance with established trading strategies and may contribute to the formulation of trading strategies

- Manage and execute orders

Education

Education

Bachelor’s Degree in Finance

Bachelor’s Degree in Finance

Virginia Commonwealth University

Bachelor’s Degree in Finance

Skills

Skills

- Ability to make quick decisions, us prioritization skills and to concentrate on detailed information

- Highly motivated with a strong willingness to learn and take on new challenges, develop knowledge and skills and apply these to new transactions and scenarios

- Ability to work accurately with strong attention to detail

- A quick learner with strong financial and analytical skills and outstanding attention to detail

- Strong team player and ability to integrate

- Knowledge of Swap/option/future pricing knowledge

- Strong organizational skills and detail oriented

- Strong knowledge of TCA

- Ability to multi-task and to work well under pressure, strong problem-solving and decision-making skills

- Ability to use good judgment in line with First Command’s policies and procedures when managing relationships

15 Trader resume templates

Read our complete resume writing guides

1

Trader Resume Examples & Samples

- Post-secondary degree or diploma – preferable business or finance related

- 3-5 years of buy or sell-side trading experience

- Strong Canadian-centric financial market knowledge

- Excellent interpersonal and communication skills both verbally and electronically

- Exercises a high degree of focus and attention to detail

- Strong investigative, research, and analytical aptitude

- High aptitude for computer systems and programs including MS Excel, Word and Outlook

- CSI’s Canadian Securities Course and or Trader Training Course an asset

2

GWM Fixed Income Derivatives Trader Resume Examples & Samples

- Have 3-7 years of Fixed Income trading/sales experience in either credit or interest rate derivatives

- Strong Math/Quant skills

- Strong Client and presentation skills

3

Power Trader Resume Examples & Samples

- Implementing power trading strategies

- Support the build out of deal origination/trading with customers

- Support the other power traders in strategy development and trade ideas

- System and tool development/support as required

4

Senior Trader Resume Examples & Samples

- Your responsibilities include, but are not limited to the following

- Building the Delta-1 product in the US. The product includes but is not limited to ETN’s, notes, and swaps

- Pricing, trading, and risk managing all Delta-1 deals in the USA

- Help to drive strategy in the Delta-1 business in collaboration with management, sales and structuring teams

- Participate in all aspects of product development including operations, legal and compliance

- Assist in various Single Stock Option Trading tasks (pricing, trading etc) as part of our overall trading coverage team

- Escalate operational risk loss events, control deficiencies and risks that you identify to your line manager and the relevant risk and control functionspromptly

5

Trader Resume Examples & Samples

- Develop internal CMBS model and infrastructure for portfolio analytics and to manage CMBS assets on a scalable basis

- Help develop granular CMBS models that capture the impact of regional markets, property types and other macroeconomic attributes

- Constantly monitor the markets for industry specific market color and pricing information

- Develop risk metrics to adequately capture the risk profile of the CMBS portfolio

- Ensure risk controls and pricing strategies are consistent internally and are appropriate from a market perspective

- Manage pipeline of new CMBS assets for funding; ensure that CMBS and other structured products are valued appropriately

- Adequately support team leader in managing new processes and developing new initiatives

- Occasional teach-ins to educate other members of Central Funding and risk management about product characteristics, risk analytics and modelling frameworks

- Support other facets of the business, including non-agency RMBS, ABS, and CLOs

6

Whole Loan Assistant Trader FI Resume Examples & Samples

- Assists and maximizes time of the Head Loan Trader

- Analyses of client loan excel files

- Prepares pitch book PowerPoint presentations, internal sales presentations, and speeches

- Interacts professionally with internal and possibly external clients and sales associates to provide professional customer service upholding the Service 1st philosophy

- Adheres to policies as dictated by management

- Performs activities requiring knowledge of technical, specialized or professional skills

- Provides information and assistance to loan applicants, and interacts with CPA’s, financial advisors and other parties to the transaction when necessary

- Fundamental trading strategies and market characteristics within assigned securities type or sector

- Fundamental concepts, practices, and procedures of Fixed Income

- Expert in Data Analysis

- Critical thinking, problem solving, creativity

- Organizational skills, including a high level of accuracy and attention to detail

- Effective oral and written communications sufficient to convey details on various mortgage loan products and processes

- Fundamental math and analytics sufficient for quantitative and analytical analysis

- Fundamental marketing skills and sales ability

- Using technical/professional knowledge, interpersonal and sales skills to obtain customers’ commitment to ideas, services, or products

- Conduct analysis including basic math, competency with decimals and fractions

- Research and analyze financial statements, complex tax return analysis, interprets findings and prepares reports of financial position and credit worthiness

- Interface with attorneys and understand at a high level the legal concepts of mortgage purchase and sale documents

- Bachelor’s Degree (B.A.) and a minimum of five (5) years of residential mortgage and consumer processing experience

7

Icg-senior Trader Resume Examples & Samples

- The senior trader is expected to work closely with sales team to make prices for the customers and clear customer flows

- The trader is expected to understand the markets and risks he/she takes positions in and accordingly develop and execute on appropriate views with the final objective of generating revenue for the bank

- The trader is expected to know and manage the risk he/she takes within limits and must understand how these transactions are properly booked and recorded into the banks financial and risk systems

- Trader with a minimum of 5 years trading experience

- Must have a keen understanding and appreciation of financial market risk, controls, and compliance

- Must have appropriate training and/or experience in various financial market instruments including but not limited to foreign exchange, interest rates, and derivatives

- Must have an aptitude for risk taking

8

Agency Securities Lending Trader Resume Examples & Samples

- Participate in daily trading activities to maximize our Clients’ portfolio performance

- Develop and maintain relationships with Borrowers to optimize utilization and spread

- Liaise with middle and back office with respect to the execution and settlement of loan and investment transactions, proactively working to resolve any issues

- Prepare market commentary for prospective and existing clients

- Facilitate research & product development for new trading markets & strategies

- Proficiency with Bloomberg

- Practical understanding of the BM&FBOVESPA’s Securities Lending System in Brazil is helpful

9

Trader Resume Examples & Samples

- An undergraduate degree in business or related field,

- At least 5 years of relevant experience in structured products, which should include familiarity with the CMBS market and the ability to structure and reverse engineer deals

- The ability to work cohesively in a dynamic team and fast paced environment

- Be detail-oriented

- Proficient in Word, Excel, Bloomberg, and Trepp

- Series 7, 63 and 55 required

10

Trader Resume Examples & Samples

- 5 years work experience in a similar bank environment

- Solid and profitable track record in a similar environment

- Strong analytical understanding of the FX, Fixed Income and Money Markets globally and in SA

- Strong economic and finance background

- Strong technical analysis background

- Disciplined

- Strong team player and ability to integrate

- Economics ,Business ,Financial or other analytical/quantitative fields e.g. mathematics, engineering, sciences degree

- Market making to the local FX sales team

- Daily commentary to the trading and sales desk

- Idea origination

- Join client and internal chat rooms (within policy guidelines)

- Daily position and p&l reconciliation

- Join client meetings Weekly Responsibilities

- Participation in the weekly markets calls

- Participation in weekly traders meeting

11

Equity Derivative Trader Resume Examples & Samples

- Responsible for making markets and trading within authorized limits

- Executes firm and customers’ trades in accordance with established trading strategies and may contribute to the formulation of trading strategies

- Maintains a thorough knowledge of the product area including market liquidity and volatility, pricing and trading strategies

- Provides technical and product support to junior staff

- Handles all trading situations and is confined only be risk limitations

- 5 plus years institutional trading experience with detailed knowledge of all aspects of the Structured Products business, including pricing and managing risk relating to Exotic Equity Derivatives

12

Bank Funding Trader Resume Examples & Samples

- BS/BA in Finance or Accounting 2 years financial market experience

- Experience with FX or Interest Rate risk/markets

- Quantitative Finance Background

- Advanced Excel expertise

- Experience with programming (C , R, Python, etc) Bloomberg API experience

13

Quant Trader Resume Examples & Samples

- Facilitate client order flow by providing liquidity, either through existing CRB inventory or utilizing the firm's capital

- Executes trades and orders, both on behalf of the firm and on behalf of clients, in order to generate revenue and support the needs of clients

- Generate revenue through the timely and accurate execution of trades/orders on a principal basis (generating P&L) or agency ("as agent") basis (generating commissions or sales credits), typically cash equities and ETFs, but also utilizing futures and options where appropriate

- Utilizing strong risk management skills, which are required for managing an increasingly large central risk book. This includes proactively keeping abreast of market developments and trading opportunities as well as having a strong underlying understanding of financial markets, instruments and strategies

- Adhere to regulations and internal policies, including, but not limited to, quality of execution (examples: "best execution", "fair and reasonable"), pricing, hedging, trading limits, trading mandates and compliance policies

- Manage broad range of risks, including but not limited to market risk, execution risk, operational risk, compliance risk, etc., evaluating available options and making decisions

- Developing software to assist with CRB efforts globally, both in terms of real-time risk management and post trade analysis and back-testing. This primarily is achieved using Java and KDB+

- Experience with one or more of

- Risk Program Trading

- Portfolio Risk Management & Optimization

- Automated Trading Strategies

- ETF Trading

- Some Programming Knowledge strongly preferred

- Knowledge of Statistical analysis tools helpful: R, Python

14

Trader Voice Engineer Resume Examples & Samples

- BT Netrix turrets

- IPC turrets Alliance and MX

- Cisco IP TDM

- Private wires- Verizon, att, IPC , BT, Orange & NTT

- Speakerbus

- Nice Voice Recorders

- Voice Print recording

- Dodd /Frank requirements

- BT Legacy TDM R16/17 Turret systems amd BT current/next gen R18 IP Turret systems

- ITP Line Networking

- Extensive knowledge of private Wire signaling types (E&M, ARD, MRD, PLAR), including T1/E1 signaling idle and seize bit patterns/conditioning

- Analog Bridging technology (HJA and Telaid) ? 2-wire to 4-wire circuit conversion, 3-way circuit configuration

- Analog/Digital Channelbank technology (Adtran, Newbridge)

- Identify opportunities to enhance, improve and use new ideas and technologies within the environment

- Analysis - Identify an issue and determine a solution

- Educate & Train - Coach peers and colleagues on new technologies and ideas

- Presentation Skills ? Prepare, construct and deliver formal and informal presentations to illustrate ideas, solutions and issues

15

Trader Resume Examples & Samples

- Experience in buy side trading, preferably across different asset classes

- Flexible approach to a fast paced working environment

- High degree of creativity and ability to “think outside the box”

- A good understanding of the asset management business

- Knowledge of DMA (Direct Market Access) and “algorithmic trading”

16

Associate Trader Resume Examples & Samples

- Trading – provide support to the Senior Traders in their market making capacity; including idea generation for clients, monitoring news/events and assessing their impact on prices, developing a deep market knowledge and staying on top of current needs of our clients

- Relationship Development – in conjunction with sales and senior traders, develop relationships with high yield investors through day to day discussions, attendance at events and individual client entertainment

- Credit Research – liaising with Leveraged Finance Distribution desk analysts, BMO Equity Analysts and other internal/external sources of information to help the desk form views on various credits that will be used to manage our inventory and provide relative value trading ideas to clients

- Administrative – Running the desks end of day processes. Maintaining models for comparing relative value amongst Canadian and US products

- Undergraduate degree in Mathematics, Commerce, Economics or Engineering is preferred. Enrollment or completion of the CFA program would be beneficial

- IIROC Registration as a Registered Representative is beneficial

- Strong client relationship building and management skills

- Strong communications skills, both verbal and written

- At least 3 years of experience working in a trading, investment banking or research environment. Exposure to credit analysis or trading financial products/derivatives would be beneficial

- Strong Excel and Bloomberg skills. Knowledge of MFL would be beneficial

17

Delta One Trader Resume Examples & Samples

- Manage funding and liquidity of Delta One activity in US

- Liaise with EF&D1 trading globally and Equity Derivatives trading locally as part of an integrated global business

- FINRA Series 7 and 63

18

CIB Global Credit Trading Secondary CDO Trader Analyst Resume Examples & Samples

- As part of an integrated global team, the successful candidate with be responsible for

- Utilizing excel spreadsheets and cashflow models to analyze trades and risk

- Working with middle office as well as front office to monitor risk and pnl

- Have extensive client contact and interaction both directly and through sales

- Communicate efficiently via email, Bloomberg, over the phone, and in meetings

- Strong proficiency in Microsoft excel

- A firm understanding of corporate finance and broader markets

- Willingness to be flexible and desire to work in a face-paced team oriented environment

- Ideally some trading experience either in flow or more esoteric less liquid products

19

Trader Resume Examples & Samples

- Preparation of ETF baskets for trading

- Daily reconciliation of future and stock breaks

- Travel to visit broker dealer counterparties as necessary

- Undergraduate Degree (BA/BS)

- Minimum of 5+ years of related work experience in financial services

20

CIB Global Credit Trading Secondary CDO Trader Analyst Resume Examples & Samples

- Put together price talk on client BWICs

- Work on creating on desk axe sheets and offer sheets to distribute to clients and sales

- Detailed review of documentation for deals we are bidding and offering

- Work with IT to help build out desk systems and speed up desk processes and analysis

21

Equity Derivatives Trader Resume Examples & Samples

- Manage risk and trade the EMEA Financials Sector

- Liaise with Sales, Research, tech, quant and compliance

- Drive business requirements for all facets of the franchise

- Interact with other citi trading groups such as Warrants, Exotics and other trading desks to maximize synergies

- Light Exotic Knowledge

- Proven risk management skills are critical

- Ability to understand, manage and evolve a market making business

- Strong quantitative, analytical and IT skills are prerequisites

- Must work well as part of team

- Interpersonal and communication skills essential for working with internal and external groups

22

Trader, Public Resume Examples & Samples

- Executes the purchases and sales of fixed income securities within the parameters set by Portfolio Managers and/or Senior Traders. Trading will be focused in High Yield Bonds, Leveraged Loans, Indexes, and/or CDS instruments as required

- Works alongside Portfolio Managers, Senior Traders, and Research Analysts with the goal of achieving best execution

- Analyze and timely provides details relating to primary bond/loan issuance. This includes a basic understanding of fundamental credit statistics, relative value, and deal specifics that include; capital structure, and market dynamics

- Keeps Head of Trading, members of Leveraged Finance Team, and senior leaders informed of market events, data, and flows

- Understands TIAA respective portfolio mandates/goals and has the ability to confidently present compelling relative value trades to members of the Leveraged Finance team

- Builds upon relationships with existing sell-side sales coverage, traders and syndicate desks

- 1-3 years of relevant work experience in trading, fixed income markets, and/or capital markets

- Knowledge of investment, credit, and quantitative analysis, trading characteristics, and factors that influence market prices and trends

- Ability to assess facts and make quick decisions in a fast pace environment

- Comfortable using various electronic platforms and has a knowledge or familiarity of applicable order management systems

- Working knowledge of Excel and/or other data/quantitative driven software

- Master's Degree or CFA are advantages

- Exposure to High Yield Bond and/or Leverage Loan trading is a plus

- Knowledge of Bloomberg functions a plus

23

Portfolio Trader Resume Examples & Samples

- High School Diploma or equivalent, Bachelors Degree preferred but not required

- 1-2 years operations or related experience, 1-2 years Managed Account processing or trading experience desired

- Ability to obtain Series 7 license during first year of employment, Series 7 & 66 desired

- Thorough understanding of regulations and policies of Advisory Accounts and the Investment Advisor Act

- Thorough understanding of Security APL, Vestmark Trading System and applicable BETA function

- Effective verbal and commuication skills

- Strong math and problem solving skills

- Must have a strong ability to organize and prioritize effectively

- Strong PC skills, significantly MS Excel, 10 -key calculator and various trading systems

24

CIB Investor Services Repo Trader Resume Examples & Samples

- Assist in the day-to-day repo finance trading across the Tri-Party/GC Repo funding books

- Liaise with various groups across the CIB including Sales & Marketing, Banking, CIB Treasury, FI/Equity Trading desks and Operations

- Coordinate marketing and distribution efforts of various desk products/programs including Tri-Party Repo and Collateralized Commercial Paper

- Prepare/model ad-hoc management reports

- Help with additional projects as needed

- Candidate should be able to interact with a wide range of internal/external groups (Sales Coverage, Clients, Senior Management, Technology, Trade Support, etc.)

- Since the candidate will be working in a trading environment, he/she should be highly organized, detail oriented and have effective time management

- Candidate should be highly proficient in core Microsoft applications, including Excel, PowerPoint and Word

- Candidate should have a general understanding of the secured lending markets and show an interest in the financial markets more broadly

- Candidate should have excellent verbal and written communication skills and should be able to message to a broader audience

25

Equity Derivative Trader Resume Examples & Samples

- Minimum 4 years of experience in Trading Asian Markets

- Asian language/s preferred

- Exotic Derivatives background and single stock experience preferred but not a prerequisite

- Highly quantitative, numerical and analytical

- Ability to work under extreme pressure

26

Group Treasury Junior Execution Trader Resume Examples & Samples

- B-degree in Business, Economics, Finance or Quantitative

- CFA/PRM/FRM advantageous

- Maximum 3 years banking experience. Treasury related role with knowledge of financial

27

Medium Horizen Trader / Investor Resume Examples & Samples

- Build out an intra-day research and backtesting platform

- Design innovative, systematic fixed income and currency–based investment strategies based on a rigorous, peer-reviewed research process

- Help manage these strategies, ensure their successful implementation, and proactively identify and mitigate out-of-model risks

- Contribute to broader research initiatives across additional asset classes within the global BlackRock Model-Based Fixed Income team

- Successful 5-7 year history of delivering consistent fixed-income and currency alpha via short-horizon quantitative trading strategies

- Significant experience working with intraday financial data and applying statistical learning methods to investment problems

- Formal training and empirical research experience in statistics or computer science, preferably at a PhD or masters level. Other quantitative backgrounds – such as economics, finance, mathematics, or other sciences - also considered with relevant experience

- The ability to work cooperatively and effectively in a small team with other researchers and portfolio managers

28

Global Credit & Special Situations Trader Resume Examples & Samples

- Experience with Credit Agreements or Derivative Documentation strongly preferred

- The candidate should have strong quantitative skills and an interest in contributing to an area that combines capital markets, derivatives and securitization disciplines

- 5+ years experience with structured finance, leveraged finance, or derivatives in a marketing, trading, or legal role

29

FID, FX Options Trader, ASO Resume Examples & Samples

- Pricing Vanilla and Flow exotics in a timely and competitive fashion

- Book and Risk Manage flow trading books

- Solutions: partnering with clients and solving bespoke hedging requirements

- Work with sales to bring new customers to Credit Suisse and be sales and customer focused/friendly

- Ability to leverage the franchise

30

Trader Resume Examples & Samples

- Effectively maintains various risk positions and manages position limits, providing liquidity to clients and markets in order to maximize total revenue of trading profit plus commission. Product area of support will be G10 FX Spot Trading

- Uses initiative and independent judgement to analyze, problem solve and proactively respond to client issues. Expected to make the necessary decisions to carry out own job responsibilities and meet primary goals and objectives. Evaluates and escalates complex issues and/or problems to manager

- Knowledge and Skill Requirements

- 4-5+ years institutional trading experience, detailed knowledge of all aspects of trading/compliance

- Product experience with G10 FX Spot Trading

- Excellent verbal and written communication skills, must have strong analytical skils

31

Interest Rates E-markets E-trader Resume Examples & Samples

- Managing market-risks of automated trading algorithms

- Operational oversight of automated trading algorithms

- Definition and validation of market-making algorithm advancements

- Knowledge of listed and OTC market structures

- Fixed-income (especially interest-rate) analytics – pricing, risk, relative value analysis

- Proclivity for hands-on Excel spreadsheet development

- Expertise with front-office trading systems and back-office trade workflows

- Proven experience trading a related product

- Degrees in statistics, math, finance, financial engineering, or a related field

32

FX & EM Local Markets Trader Resume Examples & Samples

- 2+ Years FX or Emerging Markets Trading

- Buy Side Preferred

- Must come from a top school

33

Associate / VP-structured Credit Trader Resume Examples & Samples

- Working with our sales and structuring teams to create new products suited to our client needs

- Driving risk approval and due diligence processes for new trades

- Executing trades and hedges

- Assisting in the day-to-day management of the Structured Credit Trading Business processes

- Assisting in managing risks on the book

- Helping build out our modelling and IT infrastructure by guiding quants and developers

- Independent thinker

34

Trader Resume Examples & Samples

- Effectively maintains various risk positions and manages position limits, providing liquidity to clients and markets in order to maximize total revenue of trading profit

- 5+ years of Fixed Income trading experience

- FINRA series 7 and 63 registrations

- Knowledge base to include plain vanilla derivatives and Original Index Swaps (OIS)

35

Macquarie Securities Group Etf Risk Trader Resume Examples & Samples

- Understanding and seeking to capitalise on Macquarie's unique attributes and edge

- Identifying and capitalising upon high return-on-capital ETF & related trading opportunities in Global financial markets, with particular focus on North American Markets

- Developing a successful business creating client product, relationships & trading equities, FX, forwards, futures, swaps & management of funding, collateral & SBL activities

- Developing and coordinating relationships with asset managers, issuers & investor platforms to grow the commission & fee revenue opportunities directly & with the various sales & distribution teams

- Prudent management of risks, transparent communication with and escalation to management

- Engaging with support functions to enhance trading tools and develop sustainable business structures

- Working as part of a global trading desk, ensuring clear communication, management of positions & a co-ordinated approach to managing opportunities & risks between Hong Kong, London & New York

- Working closely with other businesses to identify and extract synergies

- Developing and coordinating relationships with service providers (such as custodians and brokers) to ensure we receive commercial service and value for money

- Developing the respect and trust of stakeholders

- A minimum of 2 years of experience in ETF Market Making, pricing & trading related activities in Asian markets and managing a large balance sheet

- A track record of consistent profitability, high return on capital, high return on balance sheet and sound risk management

- A thorough understanding of financial markets, particularly equity markets and related instruments such as stocks, depository receipts, ETFs, futures, swaps and forwards

- Detailed understanding of interest rate and FX products such as loans and deposits, FX and interest rate forwards and swaps. Particularly NDFs

- Demonstrate attention to detail and possess a high level of numeracy and strong quantitative skills

- Demonstrate the ability to work as part of a team, and ability to interact with clients & sales teams

- Strong computer programming skills are advantageous

36

Trader Resume Examples & Samples

- Strong understanding of enhanced trading platforms and mutual funds

- Strong MS Office skills required and Beta, Morningstar, Siebel, BranchNet experience preferred

- Series 7 & 63 REQUIRED/Series 24 preferred

- Ability to work independently and in a fast paced/deadline driven environment

- Strong Knowledge of trading regulations and requirements

- Specific knowledge of fundamental and technical trading strategies under a variety of market conditions required

37

Trader Fixed Income Resume Examples & Samples

- Works with fixed income team members to educate financial advisors on the features and benefits of fixed income securities

- Able to manage incoming advisor calls on a daily basis

- Executes trades on behalf of our clients

- Possesses ability to make independent pricing decisions that are compliant, fair and reasonable, and the best execution within industry standards

- Portfolio review and construction, build bond ladders per instruction of LPL Financial Advisors on behalf of their clients

- Provides sales coaching to advisors, either individually or as a group (e.g., WebEx, conference calls, etc.)

- Proactively seeks opportunities through continuously cultivating relationships to search for values in the market

- Monitor market news and conditions to support advisors and their clients, including familiarity with and conformance to all applicable industry and corporate rules, regulations, policies and procedures while continuously looking for opportunities to increase revenue and productivity

- Bachelor’s degree strongly preferred or equivalent work experience commensurate with level

- Minimum of 3-5 years of traditional trading experience required (focus in retail municipal bond trading and sales)

- Must have a very strong knowledge of municipal bonds

- Series 7 & 63 required, Series 52 needed within 90 days

- Skilled at working in a fast-paced, pressure driven environment

- MS Office – Required

- Bloomberg – Required

- BETA – Preferred

- TMC - Preferred

38

Senior High Yield Credit Trader Resume Examples & Samples

- Intimate knowledge of the HY Energy sector, risk management, process and systems

- Proficient in Bloomberg, Murex, Star, Excel

- Minimum 5-10 years of work experience in High Yield trading

- Fluent in English; Spanish a plus

- Series 7, 63, (24 & 55 optional)

- Solid analytical and financial background

- Experience identifying and leveraging internal resources, building and working with cross-bank, cross-sell teams to meet client objectives

39

Emerging Markets Foreign Exchange Trader Resume Examples & Samples

- Potential candidates should have10 years and above experience in FX trading

- Excellent communication skills are highly appreciated given the involvement with local teams across various sales teams. Bilingual in Spanish is a plus

- Incumbent experience and Flow trading is paramount

- Knowledge of fixed income and derivatives are required to manage FX forwards, Futures and Non-deliverable forwards

- Risk and P&L Management skills are paramount in achieving the expected results

40

Exotics Trader Resume Examples & Samples

- Delivering comprehensive solutions to client’s complex requirements

- Knowledge of equity trading and market issues

- An in depth knowledge of esoteric exotic options product pricing and management

- Delivering a high level of customer service

- Ensuring compliance with all relevant regulations and internal policy

- Managing firms risk proactively

- Significant work experience within Equities

- Good knowledge of equity market and the financial sector

- Thorough understanding of the mathematics behind complex option products

- Motivation and enthusiasm

- Risk management skill

41

NEW Graduate Trader Role Resume Examples & Samples

- Financial services experience (trade execution and treasury/cash management

- Preferable)

- Ability to perform under pressure and within tight deadlines with accuracy

- Numeracy, accuracy and attention to detail essential

- Good communication skills, both oral & written

- Good negotiator and personable individual

- Detailed knowledge of asset classes - Equities, FX, Bonds, Cash and

- ETF/Mutual Funds

- Knowledge of trade execution or previous cash management experience an

- Excel VBA an advantage

42

Associate Principal Trader Resume Examples & Samples

- Assists with the execution of orders, relates bids and offers within established limits for in-house inventories

- Assists with keeping inventories balanced and up-to-date within approved guidelines

- Assists traders with administrative functions: inventory control, pricing and security set up

- Assist in dissemination of information to the sales/sales trading force on a timely basis

- Answer telephones for quotes, orders and information

- Complies with all existing security regulations

- Fundamental concepts, practices, and procedures of equity principal trading

- Company's working structure, policies, mission, and strategies

- Fundamental math and analytics sufficient for quantitative analysis

- Performing basic research

- Identifying relationships, draw logical conclusions, and interpret results

- Operating standard office equipment and using required software including email, graphics, presentation, spreadsheet, database, and project management software

- Project a positive, professional image with both internal and external business contacts

- Read, interpret, analyze and apply information from industry data

- Organize, manage, and track multiple detailed tasks and assignments with critical deadlines in a fast-paced work environment

- Use appropriate interpersonal styles and communicate effectively, both verbally and in writing, with all organizational levels

- Work independently as well as collaboratively within a team environment

- Bachelor's Degree in Finance, Accounting, Business or related field

43

Trader Resume Examples & Samples

- Check daily FX official rate from central bank, calculate the floor and ceiling rates based on the allowed band

- Work closely with Corporate Sales and Structuring (CSS) team to quote competitive pricing that optimizes client flows and bank profitability

- Support Risk Treasury team with views on FX markets, advice on limits with counterparties, squaring internal cash flow and other tasks when required

- Work closely with other businesses from front office to operations to ensure smooth running and proper management of the FX book, including verifying and squaring intraday and o/n GCG positions; Working with FinCon to verify and authorize positions via Control Adjustments; advising FX prices to other teams such Expense, FinCon, HR, Teller, etc

- University graduate with at least two years relevant banking experience in trading/capital markets

- Confident, innovative, motivated, and result-oriented

- Solid knowledge of fixed income/foreign exchange/derivative markets is an advantage

- Fluency in both Vietnamese and English required

44

Trader Fixed Income Resume Examples & Samples

- Must be able to demonstrate the ability to work accurately under pressure

- Work closely with the investment team to implement investment decisions in and efficient and accurate manner

- Must have a good understanding of the full trade cycle

- Must demonstrate a methodical, disciplined approach to their work as well as self-motivation to develop product knowledge

- IMC or equivalent is required for this role

45

Associate Trader, Public Fixed Income Resume Examples & Samples

- Assist Senior Traders with trade execution and processing with strong attention to details

- Work across investment teams on a daily basis, communicating with multiple Portfolio Managers, Research analysts & Sr. Traders

- Keep the Head of Trading informed of market events, data and trade-related issues

- Understand TIAA investment goals, divergent portfolio mandates and is able to present relative value ideas to portfolio managers

- Able to develop back up skills across both Agency MBS & Non-Agency structured securities space

- Contribute market color and spread data to investment discussions. Understand how flows in one asset class may impact spreads in a related asset class

- Track spreads and other market data for portfolio managers and research. Point out relationships across markets and potential trades that arise from those relationships

- Interact internally with portfolio managers and research team to vet offerings and direct offerings to the appropriate portfolio manager and analyst

- Develop relationships with TIAA research analysts to help develop an understanding about structures and underlying collateral

- Answer dealer phone lines and build upon relationships with existing Wall Street sales coverage

- Work independently and is able to manage multiple tasks on the trading desk simultaneously

- 2-5 years of relevant work experience in financial markets

- Experience in one or more of the following areas: Mortgage-Backed Securities, Asset-Backed Securities, Commercial Mortgage-Backed Securities is preferred

- Basic knowledge of applicable market(s); Exhibits good judgment in the field

- Comfortable using Bloomberg functions, various electronic trading platforms such as TradeWeb and MarketAxxes, and has knowledge or familiarity of an applicable order management system like Bloomberg AIM

- Basic understanding of trading norms and conventions of applicable market(s)

- Ability to assess facts and make quick decisions in a trading environment

46

Trader, Fixed Income Resume Examples & Samples

- 2-5 years experience trading in the taxable-exempt marketplace

- BA/BS degree required, CFA or Master’s degree a plus

- In depth knowledge and expertise of Bloomberg and MS Office

- Established sell-side market relationships

- Creative thinker willing to bring ideas and hone process

- Self motivated team player with solid communication skills

47

Delta Trader Resume Examples & Samples

- Generate and grow US Delta One related revenues in HBEU "US ring fenced book"

- Support EF&D1 Sales in US and globally , provide pricing , trade ideas and market color to assist in the growth of our client franchise across financial institutions, hedge funds etc

- Assess market environment and develop trading capacities

- 2+ years Index trading experience

- Able to understand and manage complex and diverse derivative instruments

48

Msg Execution Trader Resume Examples & Samples

- Providing clients with real-time trading advisory sales services, market intelligence, trading ideas and the tactical execution of stock orders

- ETO and OTC Derivatives Execution - execution of client derivative orders covering both exchange trade options and over the counter options

- Warrant Market Making - making markets in equity, index and currency warrants and management of the banks delta hedges

- Ownership of key clients and have a consistent track record with your clients

- Searching for new client opportunities and generate new business ideas and sell concepts that meet client needs

- Thinking commercially, acting professionally and being accountable

49

Trader Resume Examples & Samples

- Receive buy-side orders and facilitate execution

- Remain apprised of industry trends and cycles and provide feedback to clients

- Solicit business through value added dialogue with Buy-side trading clients

- Value added input includes

- Dissemination of research information to clients

- Marketing order flow

- Attend and coordinate selective client engagements to solicit RBC products and services

- Work with research, sales, market making, and investment banking to raise firm exposure to our client base

- Regularly visit clients to build relationships

50

High Yield Trader Resume Examples & Samples

- Trade High Yield Bonds and Leveraged Loan products

- Manage risk in accordance with RBC desk policy

- Work closely with the Sales Force and Research Department

- Maintain and grow existing accounts and identify new key accounts

- BA/BS

- Must have series 7 & 63

51

Trader Resume Examples & Samples

- Attend and coordinate selective client engagements to solicit RBC

- Products and services

- Work with research, sales, market making, and investment banking to

52

Cpb Trader Resume Examples & Samples

- At least 5 years buy side trading experience, preferably across different asset classes

- Experience in trading USD Asian Bonds is a requirement

- Strong interpersonal skills and the ability to work with colleagues and counterparties in different locations

- A quick learner with strong financial and analytical skills and outstanding attention to detail

- Highly motivated with the ability to work independently

- Able to monitor and review TCA (Trade Cost Analysis) for equities

53

Trader Resume Examples & Samples

- Trade Entries

- Reconcile positions

- P&L calculation

- Run MBS Analytics to support traders

- Analyze mortgage bonds and actively trade them

54

Risk Exposure Management Trader Resume Examples & Samples

- Managing and structuring the credit and funding risk in the Credit Book and the second order non-credit risk in the Market Risk Book for the entire Portfolio of counterparties and UBS entities

- And structuring and execution of RWA and LRD optimisation solutions, including close-out hedging option strategies. Ownership of strategic projects to enhance the optimality of UBS RWAs, LRD, balance sheet and funding

- Ensuring that appropriate regulatory numbers are prepared at the appropriate quality

- Work with the rest of the Global REM team to ensure full coverage of the client portfolio

- Client interaction when required to support the franchise and REM specific activity

55

Cdi / mcm Senior Trader D Bf Resume Examples & Samples

- Buy and sell orders for taxable and tax-exempt securities taking into consideration relevant factors such as size of the order

- Maintain up to date knowledge of related regulations (FINRA, MSRB, SEC)

- Responsible for managing risk, P&L and an inventory of securities

- Interact with internal underwriting and public finance groups

- Bachelor’s degree or in lieu of a bachelor’s degree equivalent in work experience

- Minimum five years relevant experience in Taxable, Municipal and fixed income securities

- Series 7 and 63 required

- Working knowledge of Bloomberg and industry information and trading systems

- Series 53 and 24 preferred

- General knowledge of personal computers and software utilized by department

- Knowledge of financial, economic and market conditions

56

Trader Resume Examples & Samples

- Responsible for trading equities

- Generate revenues and drive market share

- Develop & deepen client relationships through superior content / tech sector knowledge

- Leverage existing research analyst expertise

- Liaise with sales to provide insight into sector fundamentals

- Series 7, 55 and 63 Licensed

- BA, MA or MS or equivalent with an in-depth understanding of Equity Capital Markets

- Proficient in Microsoft Office tools

- Institutional equity client relationships

- Sector trading experience

- LI - AC

57

Trader Resume Examples & Samples

- Analyze market data landscape to negotiate and execute trades within time constraints

- Monitor domestic and international markets for news and events (political events, economic data releases, company specific news) that may affect the markets in which we have investments

- Develop and maintain strong working relationships with brokerage coverage

- Build solid relationships and communicate regularly with Portfolio Managers, Research Analysts and other business units that interact with trading

- Build proficiency with market data sources (Bloomberg, Reuters) and Microsoft Office products (Excel, PowerPoint, Word)

- Bachelor’s degree required; Finance or Economics concentration preferred

- MBA or CFA is a positive

- Minimum 2 years of equity and/or fixed income trading experience preferred

- Strong understanding of financial markets

- Strong analytical, interpersonal, communication and organizational skills

58

Trader / Associate Trader Resume Examples & Samples

- Trading: Execute/negotiate foreign exchange transactions (spots, forwards, options)

- Systems Development: Work with internal and external developers to design, develop and test tools to automate manual functions and improve risk controls

- Bachelor's degree in Finance, Economics or Mathematics. MBA/CFA or progress toward desired

- 2-5 years of relevant foreign exchange experience

- Proven client service abilities

- Analytical, detail-oriented and very precise with numbers with a strong attention to detail

59

Trader Resume Examples & Samples

- Effectively maintains various risk positions and manages position limits, providing liquidity to clients and markets. Accounts for Senior Trader are of a more complex nature and larger in size. Trading limits are also higher as well as overall accountability and proprietary risk

- Provides consistent pricing service to sales force and target clients. Provides market information to sales staff as well as guidance on transaction opportunities and market timing

- 5 plus years institutional trading experience, detailed knowledge of all aspects of Emerging Market credit trading area

- FINRA series 7 and 63 required

60

Rates Trader Resume Examples & Samples

- Price derivatives to the Sales team

- Manage risk of the derivatives portfolios

- Price derivatives using systems

- Execute transactions with market counterparties

- Manage risk of portfolios

- Register transactions in systems

- Good understanding of risks involved in each derivative

- Familiarity with market conventions

- Expertise using Front Office systems

- Regulation awareness

- Operational risk minimization

- Derivatives pricing

- Regulatory knowledge

- Murex, STAR, Bloomberg, Tradeweb, Markitwire and MS Excel

- Fluent in English; Proficient in Spanish (preferred)

- Manages team of 2 or 3 people

61

Equities Derivatives Trader, Associate / VP Resume Examples & Samples

- Price Vanilla and Light Exotics options for both Institutional and Private Wealth sales desks

- Work closely with Sales / Research to generate trading ideas and solutions for clients

- Develop and maintain relationships with Core Trading desk / Core Sales desk and Core Sales Trading desk

- Assist in maintaining all inputs to pricing models, including Dividend / Volatility / Funding curves

- Assist in maintaining and develop Single Stock market making engine

- Assist in the development and evaluation of new trading approaches, programs, and other systems*LI-JG1

- A Bachelor’s degree or equivalent

- At least three years of Equity derivatives trading experience with some specific exposure to retail products

- Ability to effectively use systems and technology; working knowledge of Windows based applications a plus

- Strong organizational skills, including the ability to coordinate, prioritize, and manage multiple activities

- Ability to work in a fast-paced work environment with an entrepreneurial approach to new challenges

- Highly detail-oriented self-starter with the ability to maintain a high standard of accuracy while under minimal supervision

62

Cib Global Credit Credit Correlation Trader Associate Resume Examples & Samples

- Work closely with Sales force to market new products

- On-going monitoring / management of existing trade inventory

- Quantitative analysis of various form of regulatory capital

- Pricing of credit derivatives portfolio transactions

- Trade credit derivatives correlation products ( tranches, baskets…) based in EMEA

- Bachelors degree in Economics, Maths or a scientific subject

- Good commercial instinct

63

Trader Resume Examples & Samples

- Manage pension fund portfolios of short term securities to maximize yields and preserve capital

- Monitor and manage cash positions and liquidity requirements in various portfolios of the pension fund and invest excess cash balances in short term securities

- Monitor foreign currency exposures and implement currency hedges and execute spot transactions to meet foreign exchange cash requirements

- Assist in the management of portfolios, notably with regard to implementation of rebalancing policies

- Build and maintain financial models to assist in the management of money market, foreign currency exposures, and passive bond portfolios

- Coordinate the issuance of Canadian and U.S. dollar commercial paper for Bell Canada

- Manage relationships and evaluate credit risk of counterparties

- Stay abreast of developments in fixed income and money markets and inform the Investment Team of relevant trends and issues

- Work with the back office to ensure quality of data and reports

- Conduct related analyses and participate to ad hoc projects as required

- Bachelor degree with a concentration in finance or a related field

- Two to ten years of related work experience, including trading money market and foreign exchange instruments

- Bond portfolio management or derivative trading experience are assets

- Completed CFA Level 1 or Canadian Investment Manager designation

- Detail-oriented, committed to accuracy and strong organizational skills

- Ability to handle multiple ongoing tasks and manage short deadlines

- Commitment to continuous improvement of skills and knowledge base

- Mature, flexible, highly motivated professional team player with strong communication skills

64

Electronic Trader Resume Examples & Samples

- Understand direction of electronic business and integration with broader cash business

- Provide first class trading, sales trading and sales coverage to the firm’s client base

- Understand the electronic product and how it could be enhanced and better sold

- Identify gaps in wallet and clients. Sell and on board new clients with a view to growing the franchise

- Understand how the various businesses within Citi operate and how can we leverage to sell to clients (SFS etc)

- Taking an involvement in the development and enhancement of the product by interacting with quant, product and tech teams

- Understand and help to grow the liquidity franchise by selling to adequate counterparties and monitoring their flow

- Understand the internal liquidity strategy by interacting with all relevant stakeholders to assist with growth

- The successful candidate should interact well between product, technology, EE trading and sales-trading and sales, mkt making, sales trading, client

- Navigate Regulation – MiFID II - Tradable IOIs, Restrictions on dark pools. Working on interpretation of market structure and regulatory changes to ensure the systems are optimising the best opportunities and /or we are best prepared for change. Explain and talk to clients on these issues

- Detailed knowledge of electronic trading

- Understanding of the engine – the MTFs, dark pools, market makers, high frequency that it interacts with working closely

- Credibility with sales traders and traders and management. Ability to work across these groups in high and low touch

- Knowledge of client requirements and ability to communicate with them

- Knowledge of Regulation

- The successful candidate will be required to be able to think on own two feet in pressure situations

- Needs to demonstrate an ability to interact professionally with very demanding clients

- Needs to be an excellent team player within a diverse group of individuals

- This is an FCA regulated position, as such the successful candidate will need the appropriate licences

65

Cbna Icg Local Markets Treasury Trader Resume Examples & Samples

- Minimum of 3 to 5 years experience in a similar role

- Must have a keen understanding and appreciation of financial market risk, controls and compliance

- Must have appropriate training and/or experience in various financial market instruments including but not limited to foreign exchange, interest rates and derivatives

- Must have an aptitude for general business management AND risk taking

- Knowledge and appreciation of other bank products

- Excellent communication, interpersonal, analytical and project management skills required

- Requires the ability to make decisions on the spot and to develop innovative solutions to complex problems

66

Senior Trader Resume Examples & Samples

- Bring together simultaneous buy & sell orders in cooperation with sales desk. Maintains complete and detailed records to verify orders as they are executed

- Provides management direction to foster effective selection, development and reward of subordinates (if applicable) while contributing to initiatives in support of the Company's Diversity programs

- 5 plus years institutional trading experience, detailed knowledge of all aspects of business’ trading area

- Excellent verbal and written communication skills, with very strong analytical skills

67

Global Markets Credit Markets Credit Trader Resume Examples & Samples

- CNH/HKD/SGD Credit Trader, based in either Hong Kong or Singapore

- Familiar with a mix of Sovereign, Investment Grade and/or High Yield credits

- Disciplined risk taking skills with a proven track record, and a good understanding of macro markets

- Ideally VP level, with 3-4 years hands-on relevant experience trading those asset classes

- Fluent in English and Mandarin. Highly articulate and client friendly (client contacts are an advantage)

68

Securities Lending Trader Resume Examples & Samples

- MBA and or financial background

- Strong analytical ability, analysis of intraday stock and market patterns

- Strong communication skills highly desirable

69

Trader Resume Examples & Samples

- Execute the firm's day-to-day funding and liquidity requirements

- Assist and help execute instructions from TMS Global Credit Committee Members

- Manage and provide highest service to our internal and external clients

70

Affluent Trader Resume Examples & Samples

- Economista, Administrador de Empresas, Financista, Ingeniero Industrial

- Experiencia de 1 año como Trader

- Certificado como Operador ante la AMV

- Buenas relaciones interpersonales

- Inglés hablado y escrito

71

International Securities Lending Trader Resume Examples & Samples

- Identify and present trading opportunities to capitalize on special situations

- Prepare market commentary for prospective and existing hedge funds

- Leverage relationships to access supply for delta one trading

- Experience in International Markets

- Understanding of hedge fund client trading strategies

- Highly proficient with Excel modelling & macro development

- Ability to price and interpret special situations/arbitrage trades including Rights, Tenders, Scrips, and yield enhancement is helpful

72

CIB Swaps Trader Resume Examples & Samples

- Heading up the Swaps desk covering

- Driving revenues forward through finding new sources of inventory, efficient collateral management and driving client demand

- Managing the expenses of the business, both direct and B/S related

- Driving product development including Real Time inventory systems and Electronic Trading

- Involvement in Asia Pacific initiatives as required

- Member of the Asia Pac Equity Finance Management Team

- A minimum of six years' experience in an Equity Finance related business, ideally in Asia Pacific

- Knowledgeable in all Equity Finance related products

- Ability to communicate well with internal counterparts in Sales

- Proven ability to drive forward client relationships

- Be able to work away from Head office while remaining connected

- Proven ability to drive forward constant improvement across all areas of the business

73

Yen Swap Trader Associate to VP Resume Examples & Samples

- Senior Yen Swap Customer Flow Trader for market makings

- Minimum 3 year Yen Swap Trader experience with Investment Bank based in Japan

- Yen Swap Trader experience in Global Investment Bank based in Japan

74

Trader Resume Examples & Samples

- Prepare deal term sheets, manage transaction timelines/deliverables

- Prepare pitch books for the presentation in order to get mandates of the domestic/foreign currency bond

- Build and maintain good relationships with the clients, such as municipal bond issuers, agencies and mega banks

- Liaise with Salesforce in order to share investor’s demands

- Prepare internal and external marketing materials for transactions and products

- Manage the deal execution process by working with the salesforce and internal/external legal counsel, if needed

75

Trader Equities Resume Examples & Samples

- Some business-related college courses required; prefer Associate’s Degree in business-related field

- 1-3 years brokerage industry experience; prefer 1 year of retail brokerage trading experience

- Series 7 and Series 63

- Knowledge of laws and regulations governing the investment industry

76

Trader Resume Examples & Samples

- Market making Dax and eurostoxx options for clients

- Manage risk across all major indices. Identify RV opportunities across the index vol space

- Engage with clients and highlight trade ideas that are suitable for clients trading mandates

- Increase our presence in DAX and FTSE by being more active in the market

- Take an active role in mentoring and training junior members of the team

- Index Derivatives market making

- Cross-Asset Volatility experience

- Index Options Flow trading experience

- Light Exotic Knowledge (Varswaps/Barriers)

77

VP, Mortgage Options Trader Resume Examples & Samples

- Trade options on mortgage TBA contracts,

- Use interest rate instruments and TBAs to hedge market risk,

- Monitor and manage risk exposure metrics,

- Interact with clients to facilitate client flows,

- Work with internal resources to develop the business

- 5+ years of experience in a global financial institution

- 5+ years of experience in a Front Office, client facing capacity

78

Portfolio Trader Resume Examples & Samples

- Accept client orders via FIX, spreadsheet, or legacy protocol utilizing Fidessa BEAM platform

- Analyze basket constituents for liquidity concerns and choose appropriate trading strategies for the various components of baskets

- Continually monitor performance of portfolios and adjust strategies to optimize performance while maintaining order integrity

- Communicate effectively with Sales, Traders and clients substantive index events impacting the market

- Maintain continuous knowledge of current events, market developments, and market trends by obtaining information through world news reports, industry news reports and other relevant sources

- Seek to understand the various ways Guggenheim interacts with clients and actively look for synergies

- Understand the indexing methodologies of the various index providers

- Bachelors Degree in Business/Economics/Finance/Accounting preferred

- Expertise in basket trading is required

- Quantitative and analytic skills including advanced use of Excel and VBA Macros

- Knowledge of key indexes, e.g. S&P, Russell, MSCI, FTSE

- Ability to spot arising opportunities and assertiveness to seize them

- Demonstrated ability to use good judgment; maintain integrity at all times

- FINRA Series 7, Series 63 and Series 55

- Fidessa BEAM experience

79

Short Term Interest Rate Trader Resume Examples & Samples

- Running the EUR derivatives book, building on the existing franchise, meeting revenue targets

- Generating trade ideas across the G10 Stirt space

- Being a partner for technology, e-business platforms, pricing systems

- Help in the recruitment, training and mentoring of junior staff and new hires

80

Delta One Trader Resume Examples & Samples

- Strong analytical skills, including the ability to quickly spot trends and characteristics in high volume data

- Strong verbal communication skills

- Highly detail-oriented self-starter with the ability to maintain a high standard of accuracy

- Confidence to have constant dialogue with internal and external clients, as well as to communicate with senior management

- General knowledge of markets. Previous experience on an Equity Swap desk preferred but not required

81

Senior Emerging Market FX & Rates Trader Resume Examples & Samples

- Market making and servicing client requests for liquidity in selected currencies, specifically RMB

- Deliver information to the franchise and Sales teams on market developments and outlook

- Participation in infrastructure development (new risk / pricing models)

- Maintenance of external electronic trading platforms and internal live pricing

- Previous experience in EM FX Trading

- Specific experience in trading Chinese FX and Interest Rates products

- Awareness of how time zones trade differently for EM

- Experience of working in a top tier Investment Bank

- Experience of trading out of both London and Asia

82

Trader, Emerging Markets Resume Examples & Samples

- 2-5 years institutional trading experience, detailed knowledge of all aspects of trading compliance

- Excellent verbal and written communication skills must have strong analytical skills

- Ability to understand and manage complex and diverse instruments

83

Icg-local Market Treasury Trader Resume Examples & Samples

- To take interest rate risk prudently and profitably and to add quantifiable value to existing revenues

- To understand balance sheet and liquidity and capital management

- Understand the transfer pricing process and its implication on the earnings

- Work closely with other businesses from front office to operations to ensure smooth running and proper management of the FX book including verifying and squaring intraday positions

- Business major who shows an interest in the financial markets

- Confident, innovative, motivated and results-oriented

- Strong analytical skills, with an eye for detail and risk taking ability and passion required

- Knowledge of Fixed Income and FX market is required with 0-2 years of work experience

84

Junior Execution Trader Resume Examples & Samples

- Find and fix transaction errors T+0

- Identify and improve inefficient processes

- Responsible to own and monitor IPS and potentially WMI PnL books

- Daily signoff of finance reports for the owned books

- Single point of contact for inquires related to the FMC-Desk

- Testing the trades auto-generated by workflow rules in our main trade repository and risk management system (MOR)

- Collecting data and analysing against existing models, checking if control parameters are optimally set

- Assisting in new projects in a multi-team environment

- Contribute with ideas how to develop the desk further and make sure the desk is compliant with all legal and compliant requirements

- Running various daily processes and reports

- Efficiently documenting existing and new processes

- Actively support the improvement of the desk’s control processes and tool

- Proficiency with Excel is required and will support the development of desk-built applications

- Enthusiastic and excited to learn and expand into new areas

- Ability to work without supervision on more than one task at a time

- Rational and efficient in their planning and execution

- Willing to take over occasionally certain weekend work. (Business readiness testing)

85

Agency Trader Resume Examples & Samples

- Executes customer orders with other market making firms over the telephone

- Executes customer orders, using the Brass system, OMS system, and through other trading systems

- Gives financial advisors advice on larger orders, keeps them informed of pending orders

- Quotes domestic and foreign issues

- Monitors the progress of long-term orders (good until cancel orders)

- Looks for trade discrepancies and potential problems in customer orders (restricted stock, reverse splits, wrong quantity, etc.) to minimize risk to the financial advisor and firm prior to executing the trade

- Assesses market risk and works quickly and accurately to get customers the best possible price

- Cultivates relationships among other dealers

- Performs other duties and responsibilities as assigned

- High level customer service

- Operating standard office equipment and using required software applications, including the BRASS trading system, the OMS trading system, FINRA workstation, and Reuters

- Attend to detail while maintaining a big picture orientation

- Communicate effectively and professionally, both orally and in writing with internal and external clients and customers

86

Junior Structured Credit Trader Resume Examples & Samples

- You’ll be expected to gradually learn the trading of credit derivative products, under the close supervision of senior traders. Structured credit products will be hedged in a smart and efficient manner so as to keep risks under control and facilitate client business; you’ll learn to make sharp prices and to profitably manage the positions arising from Client Business flows

- Building upon your excel (and maybe VBA skills), you’ll participate in the development of tools enabling faster and more accurate pricing and risk reporting, two crucially important daily activities of traders

- Your skills will also be put to work on various business development projects, where you’ll be expected to act as an analyst on topics ranging from regulation to balance sheet optimization trades

- With the aim of distributing structured credit to ING clients worldwide in an operationally efficient manner, you will work closely with sales, structurers, quants, and developers. Hence you’ll be able to team up with all relevant front office stakeholders when required (e.g. Legal (Brussels and Amsterdam), Market Risk (Brussels, Amsterdam, and London), Back Office, Tax & Finance departments)

- As part of Structured Products Trading, you’ll be exposed to structured interest rates and inflation products via the offering of combination products joining the two asset classes with structured credit products; you’ll gain a broad understanding of the main characteristics of the other asset classes

- You will be evolving in a multi-asset team based in the Brussels dealing room of ING

87

Trader Resume Examples & Samples

- Effectively maintains various risk positions and manages position limits, providing liquidity to clients and markets in order to maximize total revenue of trading profit plus commission

- 2-5+ years institutional trading experience

- Typically series 7 and 63 registrations (may not have registrations in HBUS)

88

Senior Securities Finance Trader Resume Examples & Samples

- Driving business to proactively offer GSF axes out to clients and market participants

- Actively introduce and market to new customers ING’s financing and trading opportunities to gain more business in all products

- Marketing and trading equity stock lending and financing enquiries from sales people as well as directly from clients and counterparties

- Work on project initiatives as well as new opportunities/markets. Working with all the support areas e.g. tax, legal, operations, credit, compliance, business management and market risk for new and existing business

- Problem solving unmatched trades, helping deal with the daily duties covering internal shorts

- Assist in providing relationship management activities, including the identification of cross selling opportunities

89

Trader Equity Derivatives Resume Examples & Samples

- Bachelor's degree in finance, economics or mathematics (CFA designation or progression towards a CFA designation is desirable)

- Minimum of two years in equity derivatives research, trading and/or analytics environment

- Strong attention to detail within a fast paced trading environment

- Knowledge of global investment benchmarks

- Familiarity with equity derivatives pricing and risk models

- Excellent written, verbal and presentation skills as well as proven time management skills

- Ability to work independently, multi-task and a desire to learn and improve

- Other desirable traits: professional presence, ability to work in within a team framework, tenacity, intellectual curiosity

- Programming skills in VBA, .Net, C#, C/C++ are a positive

90

Associate Trader / Trader Resume Examples & Samples

- New client set-up: Work closely with internal resources (including operations, legal/compliance and portfolio managers) to establish new accounts

- Client service: Serve as primary contact for a subset of clients. Monitor and evaluate trading results. Report results to clients, answer client questions, and assist in the identification of additional business opportunities

- Transaction Cost Analysis: Work closely with other team members on FX TCA projects

- Knowledge of electronic execution platforms and trading systems

- Knowledge of trading costs and settlement practices

- Technology skills, including strong proficiency with excel and comfort with database applications

- Composure to perform well under pressure and make rapid decisions

- Flexible and ability to thrive in a fast-paced, unstructured environment

91

FX Forwards Trader Resume Examples & Samples

- Effectively maintains various risk positions and manages position limits, providing liquidity to clients and markets in order to maximize total revenue of trading profit plus commission. Product area of support will be FX Developed and EM Markets

- Provides consistent pricing and market making to sales force and target clients

- Ensures compliance monitoring is in place, including processes for management of operational risk, in accordance with HSBC and regulatory standards

- 5+ years institutional trading experience, detailed knowledge of all aspects of trading/compliance

- Product experience with FX Developed and EM Markets

- Bachelor's degree in Finance, Economics, or equivalent work-related experience

- Excellent verbal and written communication skills, must have strong analytical skills

92

Citibank Berhad KL Senior Rates Trader Resume Examples & Samples

- Bachelor's degree with 5-8 years of relevant experience in trading

- In-depth knowledge of what drives bond market flows, what drives short term and long term interest rate and what drives FX

- Teamwork within the trading team, generating trade ideas and share market views

- Teamwork with both onshore and offshore sales team to best serve Citibank’s clients

- Ability to handle pressure of the volatile market swings

- Discipline to work within the assigned stop loss and position limit

- Understand the whole settlement/operational process for client facing deals

93

Trader Resume Examples & Samples

- Academic Education

- Pre-advanced English, Spanish is a plus

- Desirable previous experience in the financial market

- Advanced knowledge Microsoft Office package

94

Eq-junior Facilitation Trader Resume Examples & Samples

- Generate revenue through the timely and accurate execution of trades/orders on a principal basis (generating P&L) or agency ("as agent") basis (generating commissions or sales credits), typically in one asset class or product