Corporate Tax Manager Resume Samples

4.8

(132 votes) for

Corporate Tax Manager Resume Samples

The Guide To Resume Tailoring

Guide the recruiter to the conclusion that you are the best candidate for the corporate tax manager job. It’s actually very simple. Tailor your resume by picking relevant responsibilities from the examples below and then add your accomplishments. This way, you can position yourself in the best way to get hired.

Craft your perfect resume by picking job responsibilities written by professional recruiters

Pick from the thousands of curated job responsibilities used by the leading companies

Tailor your resume & cover letter with wording that best fits for each job you apply

Resume Builder

Create a Resume in Minutes with Professional Resume Templates

CHOOSE THE BEST TEMPLATE

- Choose from 15 Leading Templates. No need to think about design details.

USE PRE-WRITTEN BULLET POINTS

- Select from thousands of pre-written bullet points.

SAVE YOUR DOCUMENTS IN PDF FILES

- Instantly download in PDF format or share a custom link.

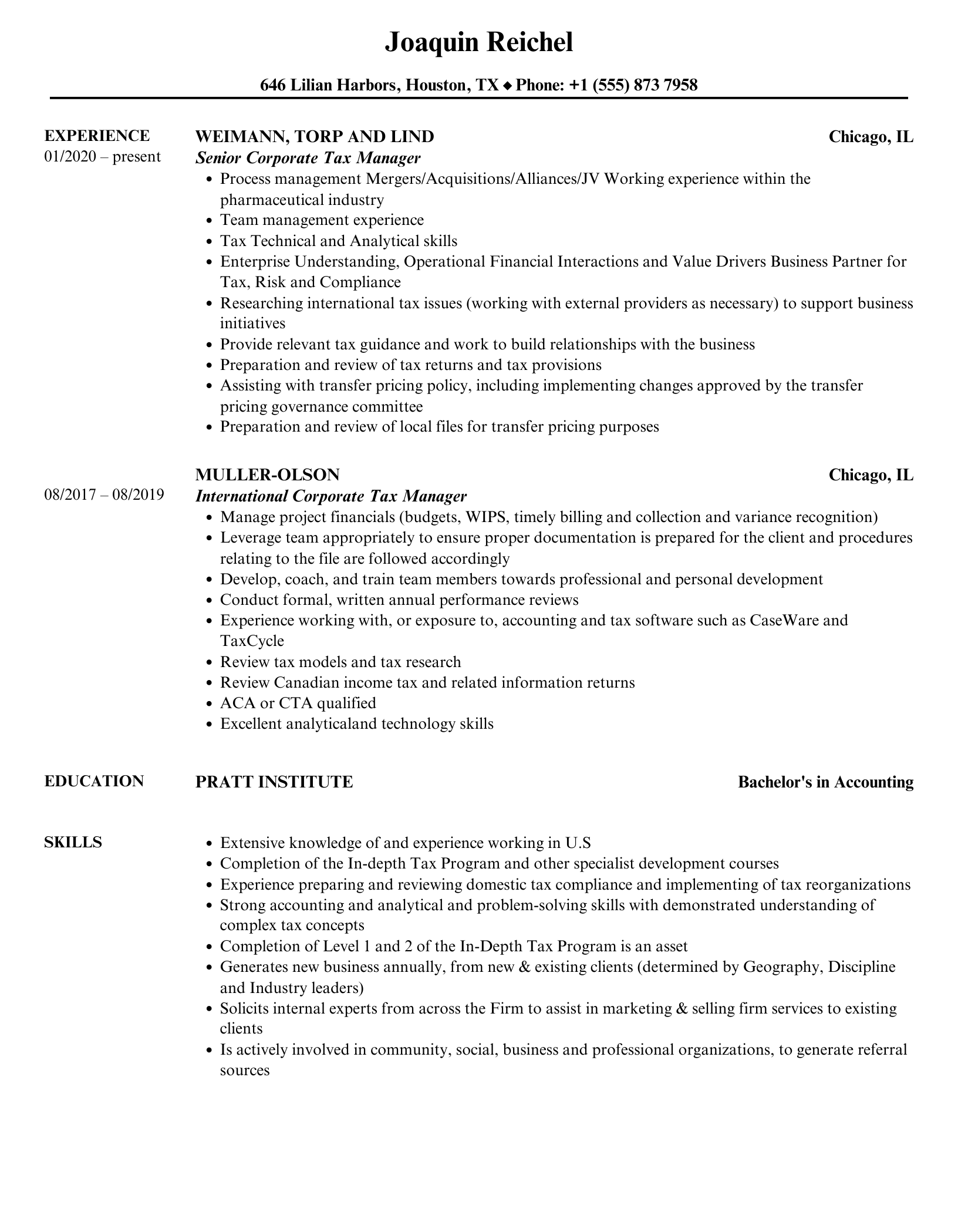

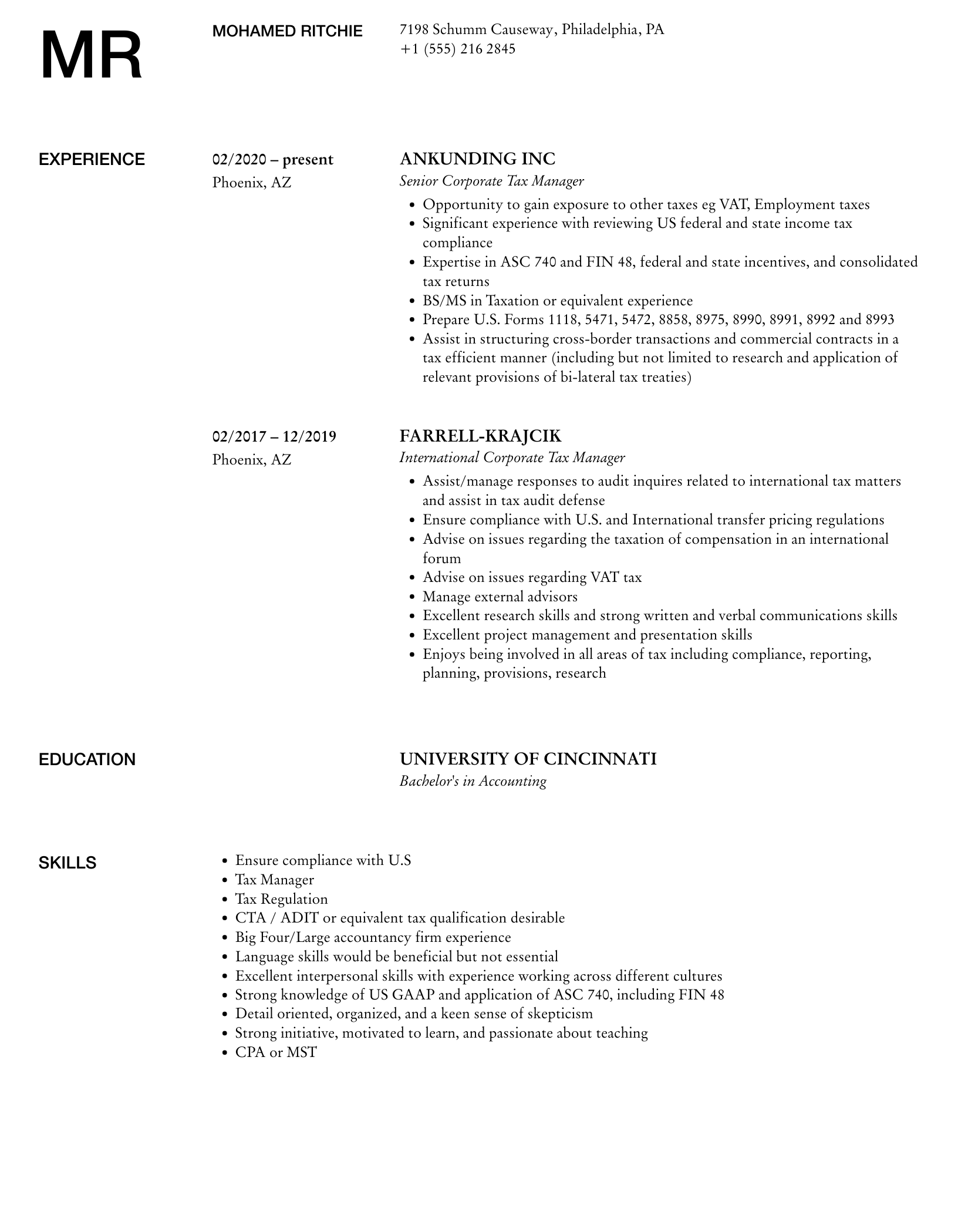

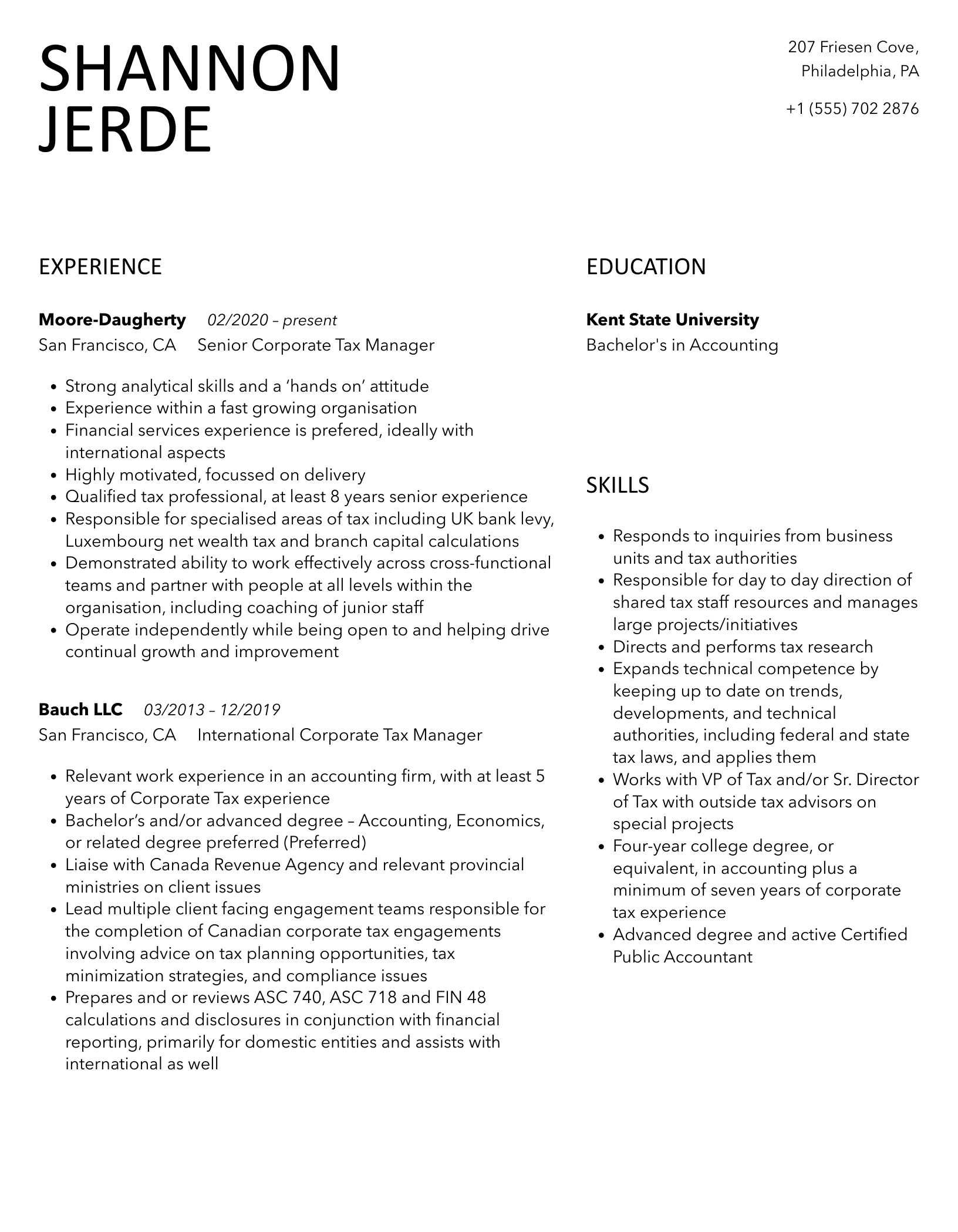

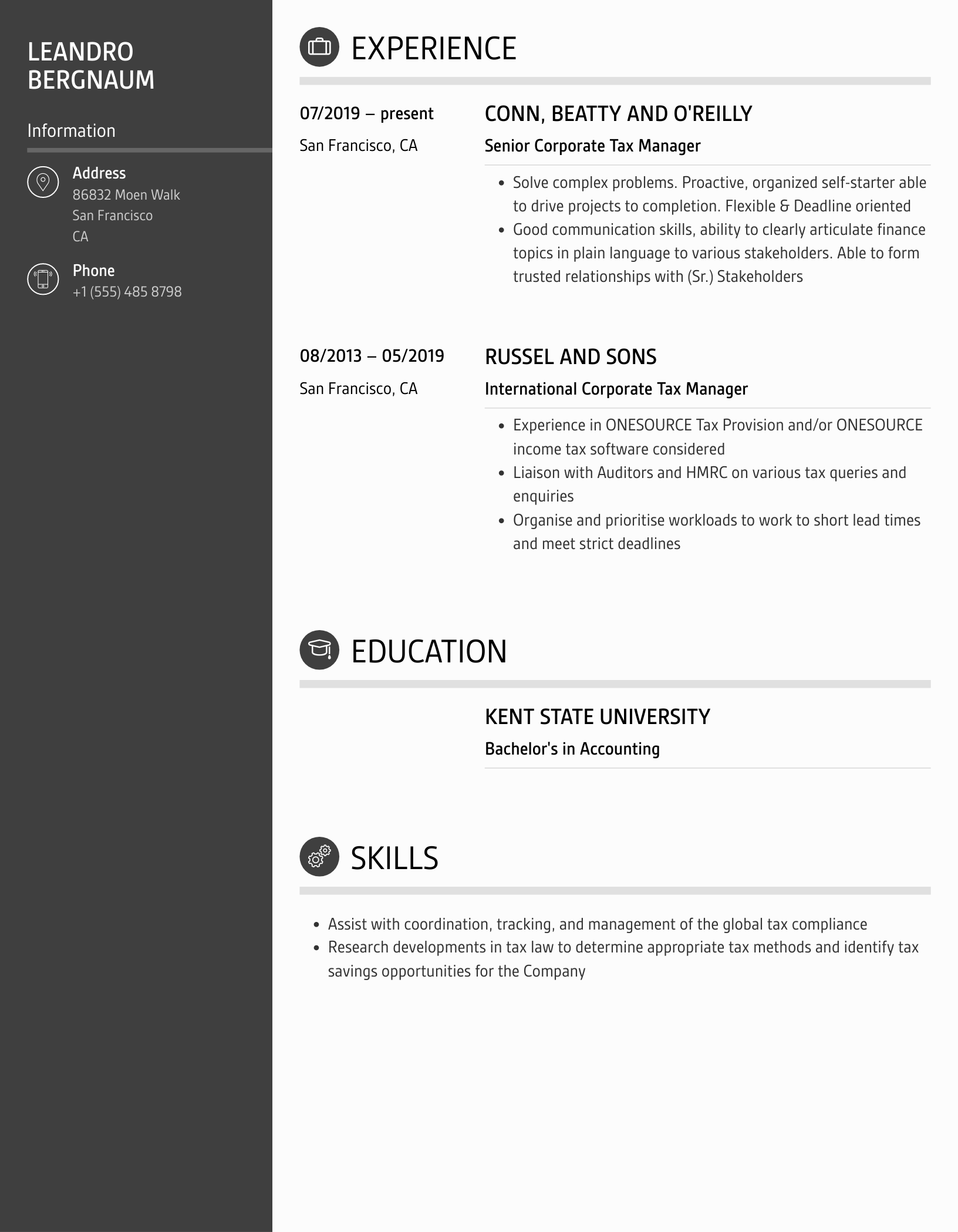

JF

J Frami

Joy

Frami

2361 Kutch Ridge

Los Angeles

CA

+1 (555) 434 3135

2361 Kutch Ridge

Los Angeles

CA

Phone

p

+1 (555) 434 3135

Experience

Experience

Phoenix, AZ

Corporate Tax Manager

Phoenix, AZ

Abernathy, Kerluke and Simonis

Phoenix, AZ

Corporate Tax Manager

- Manages the tax accounting and tax compliance processes

- Manages, develop, train and mentor the tax team

- Reviews the quarterly and annual tax provision under ASC 740 (FAS 109)

- Reviews separate and consolidated tax returns for various subsidiaries of the firm

- Reviews credits, unremitted earnings, and stock based compensation under ASC 718 (FAS 123R)

- Reviews documentations for footnote disclosures for 10-K/10Q reporting

- Analyzes and reconciles tax accounts for unusual transactions or irregularities

Philadelphia, PA

International Corporate Tax Manager

Philadelphia, PA

Marks Inc

Philadelphia, PA

International Corporate Tax Manager

- Technical, personal and administrative development of seniors and assistants

- Undertake reviews to manage EY’s Permanent Establishment risks

- Risk management assessment and communication with senior managers and directors

- Managing work in progress and billiing

- Build and maintain relationships with clients, winning work proactively and contributing to winning new clients

- To manage Global Tax policy adherence across the 93 members firms in EMEIA

- Enthusiastic and flexible attitude to work

present

Houston, TX

Senior Corporate Tax Manager

Houston, TX

Mann, Brown and O'Connell

present

Houston, TX

Senior Corporate Tax Manager

present

- Formulate performance improvement plans and make termination decisions as necessary

- Undertake complex compliance work and oversee compliance work dealt with by more junior members of the department

- Manage the preparation of the consolidated federal income tax returns and related work paper and statements for accuracy and completeness

- Help people to develop through effectively supervising, coaching and mentoring staff

- Ensure delivery of quality work and take day to day leadership of delivery team

- Coordinate with outside providers for timely filing of all personal property tax return filings on a legal entity basis

- Identify federal and state tax planning opportunities, and develop and implement related strategies to optimize result

Education

Education

Bachelor’s Degree in Accounting

Bachelor’s Degree in Accounting

Johnson & Wales University

Bachelor’s Degree in Accounting

Skills

Skills

- Manages the tax accounting and tax compliance processes

- Manages, develop, train and mentor the tax team

- Reviews the quarterly and annual tax provision under ASC 740 (FAS 109)

- Reviews separate and consolidated tax returns for various subsidiaries of the firm

- Reviews credits, unremitted earnings, and stock based compensation under ASC 718 (FAS 123R)

- Performs tax provision preparation, tax payable summaries , and flux analysis,

- Reviews documentations for footnote disclosures for 10-K/10Q reporting

- Analyzes and reconciles tax accounts for unusual transactions or irregularities

- Identifies potential tax issues, performs research, and make recommendations to resolve tax issues

- Responds to Federal and State tax audits and notices

15 Corporate Tax Manager resume templates

Read our complete resume writing guides

1

Corporate Tax Manager Resume Examples & Samples

- Manages the tax accounting and tax compliance processes

- Manages, develop, train and mentor the tax team

- Reviews the quarterly and annual tax provision under ASC 740 (FAS 109)

- Reviews separate and consolidated tax returns for various subsidiaries of the firm

- Reviews credits, unremitted earnings, and stock based compensation under ASC 718 (FAS 123R)

- Researches Federal and State tax matters as needed

- Performs tax provision preparation, tax payable summaries , and flux analysis,

- Reviews documentations for footnote disclosures for 10-K/10Q reporting

- Analyzes and reconciles tax accounts for unusual transactions or irregularities

- Prepares information required by internal and external auditors

- Identifies potential tax issues, performs research, and make recommendations to resolve tax issues

- Responds to Federal and State tax audits and notices

- Tax accounting and reporting concepts, practices and procedures at an advanced level

- ASC 740 and ASC 718 regulations and IRS filing requirements

- Efficient utilization of RIA Checkpoint and ProSystem Tax Software

- Principles of banking, finance, and securities industry operations

- Operating standard office equipment and using required software application to produce correspondence, reports, electronic communication, spreadsheets, and databases

- Researching and interpreting IRS requirements

- Preparing for tax audits

- Communicating tax rules and regulations to others

- Reviewing and interpreting financial statements

- Compiling and analyzing information

- Read, comprehend and apply complex IRS rules, regulations and requirements

- Resolve tax issues

- Effectively lead and manage a team

- Bachelor's Degree in Accounting or Finance and a minimum of eight (8) years experience in financial services industry or public accounting firm

- State Tax experience required

2

International Corporate Tax Manager Resume Examples & Samples

- To take ownership of the tax management compliance tool that collates data for all entities across - EMEIA and ensures their tax filings are up to date. Work with the country to make sure compliance happens

- Working with the EMEIA tax Director to build a Global cross border tax advice tool to provide WHT - advice in conjunction with the EMEIA indirect tax Senior Manager/Director and acting as the Centre of - Excellence for cross border WHT advice generally

- Supporting the EMEIA tax Director on the impact that a new financial software will have on our internal tax requirements and working on the manual solutions needed

- Review of virtual business units

- Review and provide tax advice on regional reorganisation

- General WHT planning advice and review of WHT compliance

- US tax and Kuwait tax filings review of UK firm

- Self motivated team player. You will be responsible for managing more junior staff in the team and you may take on formal counselling responsibilities

- Personal Qualities

- Project management skills, plan and prioritise work, meet deadlines

- Ability to build strong client relationships (we pride ourselves on treating our internal customers as clients)

- Team player with the ability to build effective relationships at all levels

- Understand tax ramifications of commercial decisions

- Internal Client driven being strategically and commercially aware

- Preferably having performed a direct tax role in industry

- Significant experience in International business tax especially WHT and PE knowledge

3

Corporate Tax Manager Resume Examples & Samples

- Income tax compliance for US federal, state and foreign operations (either done by a third party or in-house), including annual tax return preparation and estimated tax payments

- Preparation of income tax provision and related balance sheet accounts (FAS 109) (either done by a third party or in-house), including estimated annual ETR and quarterly updates

- Assist in identification and assessment of each domestic and international subsidiaries’ certain and uncertain tax positions and recommend the appropriate treatment under U.S. GAAP (FIN 48)

- Point person for all income tax audits by US federal, state and foreign tax authorities and working with subject matter experts

- Partner with outside experts to make sure that we comply with income tax compliance obligations as we expand internationally in a manner that balances our business needs with tax saving opportunities

- Keep abreast of relevant domestic and international tax laws, sales/use, and property tax regulations to advise senior management of the tax ramifications of current and proposed activities. Focus on assisting in designing and maintaining an optimal global tax structure which supports the growth of our business, while minimizing our tax burden

- Drive process and efficiencies across tax and finance function to meet closing deadlines

- Cooperate with outside experts in major areas of tax planning

- Support the month-end closing process, which will include preparation of income tax journal entries

- Big 4 public accounting, including at least four years in the Tax department

- Total income tax professional experience – at least five years (experienced manager in Big 4 or four years Big 4 followed by at least three years in the tax department of a multi-national company)

- Specialized in corporate income taxes (planning, consulting and convert GAAP books to tax basis) – combined structure business

- Conversant with foreign income taxes, including US treatment of foreign sourced income, understands how to calculate tax provisions before filing taxes

- Auditing complex annual income tax provisions for multi-national US based corporations

- Understanding of state and other income taxes

4

Corporate Tax Manager Resume Examples & Samples

- CPA Firm experience servicing SEC reporting clients

- Experience with consolidated returns

- Strong FAS 109 skills

5

Corporate Tax Manager Resume Examples & Samples

- 6+ years of relevant experience

- Previous Tax experience (Compliance and Corporate)

- Experience with tax research databases such as BNA and RIA Proficient in all Tax Compliance process software

- Experience with Corporate Taxation, Consolidations, and Partnerships

6

International Corporate Tax Manager Resume Examples & Samples

- Ultimate responsibility for a large client portfolio

- Technical, personal and administrative development of seniors and assistants

- Final review and sign-out of tax returns

- Managing work in progress and billiing

- Risk management assessment and communication with senior managers and directors

- Participating in decision-making within the management group

- 5+ years of experience with comprehensive knowledge on US corporate and partnership tax

- Experience with Tax - Compliance; Corporate; International; Research & Planning; Trust/Estate; Partnership

7

Corporate Tax Manager Resume Examples & Samples

- Tax accounting/reporting experience, garnered through 6+ years in public accounting (preferably 'Big 4') or a combination of public/private industry

- Hands-on experience, preferably with all key aspects of corporate tax, from federal to state/local income tax as well as sales/use tax and related matters

- Strong knowledge and understanding related to GAAP (i.e., FIN 48, FAS 109, etc.)

- Proficiency in Microsoft Office programs, tax-preparation programs, and online tax research

8

Top-corporate Tax Manager Resume Examples & Samples

- Qualified ACA/CTA (or equivalent) with ideally at least 5 years PQE

- Strong academic history

- Relevant experience gained ideally from practice

- Tax advisory and transaction experience preferable, but not essential

- Self-motivated with excellent communication

- Organised with exceptional people and client relationship skills

- Pragmatic, but with strong risk awareness

- Experience of working as part of a team. Supervisory skills preferred but not essential

- A commitment to technical and personal development, with the drive and ambition to progress and fulfill your full potential

9

Corporate Tax Manager, Region Tax Resume Examples & Samples

- In this role, strong interpersonal and technical skills are a must

- You will take the lead on the majority of clients so a passion for client service is important

- You should be ACA or CTA qualified or equivalent

- You will have strong UK tax knowledge or equivalent knowledge gained overseas

- Experience of managing a portfolio of clients and leading client relationships

- An interested in being an all-round business adviser who enjoys working closely with clients to provide them with a pro-active service giving them innovative and commercial tax solutions

- Experiences in international tax, management shareholder issues or a familiarity with transaction processes

10

Corporate Tax Manager Resume Examples & Samples

- Direct supervision of tax staff

- Calculate the Company’s tax provision and effective tax rate

- Review supporting rate reconciliations and current liability analysis

- Preparation of the Company’s income tax footnote and related financial statement disclosures

- Assess tax planning strategies

- Prepare quarterly effective tax rate and deferred tax projections

- Assist in testing the design and operation of internal controls

- Work with outside tax consultants on completion of tax compliance

- Evaluate federal, state and local tax incentives

- Manage all federal and state income and franchise tax audits

11

Corporate Tax Manager Resume Examples & Samples

- Master’s degree in Accounting or related field preferred

- CPA with five to ten more years of experience in public accounting

- Experience working with small business, partnerships and corporate taxes preferred

- Technical knowledge sufficient to supervise Staff in a wide variety of industries and perform the essential duties and responsibilities of the position

- Demonstration of independent thinking and strong decision-making skills

12

Corporate Tax Manager Resume Examples & Samples

- Learn about the aircraft leasing sector

- Reporting directly to Senior Management including Tax Partner

- Some practice background in Assurance or Tax would be favourable

13

Corporate Tax Manager Resume Examples & Samples

- Build relationships both within the firm and externally with clients, identifying opportunities to develop business

- Manage the successful delivery of tax projects, ensuring technical excellence and practical/business driven approach is taken

- AITI qualified with at least 2-3 years relevant corporate tax experience

- Strong working knowledge of corporate tax

- Excellent communication skills and relationship management skills

14

Corporate Tax Manager Resume Examples & Samples

- Tax accounting, tax compliance and tax research

- Income tax provision and tax account reconciliations

- Federal & state income and franchise tax returns and payments

- International subsidiaries – US and local tax reporting requirements

- Federal and state tax notices and tax audits

- Preparing research on various tax issue

- Bachelor's degree in Accounting. CPA preferred

- Minimum of 4 years corporate tax or public accounting experience

- Self-motivated, energetic and confident individual with solid communication and problem solving skills

- Strong attention to detail, flexible, and the ability to take ownership are essential

15

Big-corporate Tax Manager, Leeds Resume Examples & Samples

- Being the principal contact with clients on day to day tax matters

- Involvement on tax advisory and planning work on client portfolio

- Working with specialists to deliver expertise to the local market

- Responding appropriately to requests from clients for other KPMG services

- Supervising the work of junior members of staff, principally the preparation of tax computations and tax payment advice plus correspondence with

- Reviewing corporation tax computations

- Co-ordinating tax payments, loss relief, capital allowances, group relief and other claims

- Implementing the firm's advice in submitting returns and negotiating with HM Revenue & Customs

- Monitoring the tax compliance position using tax administration software

16

Big Corporate Tax Manager Resume Examples & Samples

- Providing tax advisory services to a variety of clients

- Managing the successful delivery of commercially viable and technically excellent advice to a variety of clients involving tax due diligence, structuring, international and other advisory - Reviewing corporation tax computations and managing the compliance process

- Undertaking tax audits for clients under UK GAAP, IFRS and US GAAP

- Helping to prepare proposals for new work, including researching target and client companies and on technical issues to identify new solutions

- Strong educational background (preferably 2:1 or higher University degree)

- ACA, CA, CTA, ACCA or equivalent qualified with strong UK corporate tax and accounting knowledge

- Experience of working with oil and gas companies

- Strong knowledge and understanding of UK corporation tax legislation

- Sustains a high level of drive

17

Big Corporate Tax Manager Resume Examples & Samples

- Ideally CTA / ACA / ACCA qualified (or equivalent)

- Experience of Property Tax

- Identifies and pursues business opportunities

- Continuously learns from experiences. Seeks out feedback and development

18

Corporate Tax Manager Resume Examples & Samples

- Identification and implementation of tax planning opportunities

- Maintaining excellent relationships with local finance teams and external advisers

- Structuring internal re-organisations and new set ups

- Qualified Accountant and AITI Chartered Tax Adviser (CTA) with an excellent academic background

- Currently working with a Big 4 practice or within a PLC/MNC environment with 2-3 years post qualification experience

- A commercially focused problem solver with a strong technical background and extensive experience advising international companies across a range of tax heads

- Excellent computer skills, Oracle experience an advantage but not necessary

19

Corporate Tax Manager Resume Examples & Samples

- Direct the preparation and use of all tax records and information as required for proper completion of municipal, state and federal tax returns

- Oversee the preparation of federal and state income and franchise tax returns and related estimated payments

- Supervise the work processes of the staff accountants within the tax department. Supervise, evaluate and counsel assigned associates

- Ensure the maintenance of proper records of all transactions of income, principal and related information to establish proper tax classification

- Recommend and oversee the implementation of adoptions and revisions to the existing tax accounting system and tax accounting methods

- Oversee the research and analysis of proposed and existing business transactions to determine the effect of taxes on the transactions and possible interaction with existing tax strategies

- Monitor tax legislation and relevant regulatory developments. Ensure that assigned associates are informed of current tax laws, regulations and rulings pertaining to municipal, state and federal income taxes

- Consult with and assist management throughout the company to assure that significant tax implications are considered as appropriate to the decision-making process. Advise management on the tax implications of ongoing and potential business activities and transactions

- Identify tax planning opportunities and develop/implement tax planning strategies to minimize the tax burden of BB&T

- Participate in the due-diligence process related to mergers and acquisitions, as appropriate

- Perform other responsibilities as assigned by management such as overseeing the operations of and maintaining accounting records of specialized subsidiaries

- Bachelor's degree in Accounting, Business or related field, or equivalent education and related training

- Six years of experience in accounting and taxes

- Demonstrated leadership skills with an emphasis on teamwork

- Ability to provide leadership and guidance to staff accountants as directed

- Managerial experience either in public accounting or with a large financial institution

20

Corporate Tax Manager Resume Examples & Samples

- 5-7 Years’ Experience

- Strong computer skills: proficiency in Tax software, Excel, FAS (and Access a plus)

- 1120S preparation, Multi State Company, 5500 Reporting, Cafeteria Plan

21

Senior Corporate Tax Manager Resume Examples & Samples

- Undertake complex compliance work and oversee compliance work dealt with by more junior members of the department

- Supervise the existing Corporate Tax Manager and Tax Senior and any tax trainees that may be seconded or recruited to the department

- Be required to provide technical advice to the audit department and provide technical back up to the Corporate Tax Partners

- Be required to assist in Corporate transactions (purchases/sales) i.e. clearances, due diligence, review of Sale & Purchase Agreements/Tax Deeds

- Be required to deal with the more complex areas of Corporate Tax i.e. Transfer Pricing, Loan Relationships and FOREX etc

- Assist the Corporate Tax Partners with advisory and consulting projects as required

- Be a qualified accountant (ACA/ACCA)

- Have passed the CTA exams

- Possess at least 5 years corporate tax experience

22

UKI Corporate Tax Manager Resume Examples & Samples

- Assisting in the provision of advice to clients on a range of advisory projects

- Building and managing client relationships and providing high levels of client service

- Mentoring and developing more junior members of the team

- 2-3 years PQE

23

Top-corporate Tax Manager Resume Examples & Samples

- Maintain an in depth, up to date, knowledge of taxation

- To actively seek opportunities for developing new clients and for selling new services to existing clients

- Experience of dealing direct with clients

- Educated to degree level, and/or CTA and/or ACA qualified or equivalent

- Demonstrable post qualified experience

- Comp Information

24

Corporate Tax Manager Resume Examples & Samples

- Analyze tax items for local tax compliance and US GAAP tax accounting resulting in identification of tax savings opportunities and effective tax rate minimization planning. Develop and document tax positions

- Corporate tax advisor to regional accounting teams responsible for local tax compliance

- Assist with international aspects of federal, state, and foreign income tax audits and related matters, including coordinating outside advisors in tax controversy and dispute resolution forums

- Identify, and assist with implementation of tax planning opportunities, drive process efficiencies, quality improvements, and risk minimization strategies related to foreign operations

- Be a strategic business partner, advising and supporting Fiserv domestic and international business teams in cross border tax related issues, policies and procedures. Assist with start-up of new international business operations and integration of acquisitions

- Monitor current and proposed, US and foreign, tax law changes to identify and assess impact on Fiserv

- Collaborate with Corporate Treasury function to design and implement tax efficient cash utilization across the global organization

- Manage transfer pricing planning, implementation, and documentation process, including maintenance of cost sharing structures, royalty and service benchmarks, and efficient intangible property planning

- Work with Fiserv’s Global Mobility team to minimize tax risk and set policy around Fiserv’s mobile workforce

- Manage special projects such as foreign country R&D benefits, including coordinating external advisors, tax research, and acquisition due diligence

- Assist with staff development within the tax function and across the global finance function

- Requires some business unit travel

- Minimum of five years of federal corporate income tax experience with progressive responsibility, and international exposure preferred

- Experience in accounting for income taxes of US multinational groups

- Experience at “Big 4” accounting firm preferred

- Strong knowledge of US federal tax laws, including those related to international or strong desire to expand knowledge in this area

- Strong Tax Accounting skills

- General accounting and financial skills

- Ability to work in a fast-paced environment and manage multiple projects and deadlines

- Experience in transfer pricing and related documentation preferred

- Ability to work independently with limited resources

- Strong, professional verbal and written communications skills

- Proactive and results oriented

- Intellectual curiosity, career oriented and motivated to grow professionally

- Proficiency in Microsoft Office (Word, Excel, Outlook, PowerPoint)

- Proficiency with financial accounting systems, preferably SAP

25

Corporate Tax Manager Resume Examples & Samples

- Responsible for the oversight & preparation of federal and state corporate tax returns with staff & outside consultants

- Maintain, reconcile and analyze tax balances on general ledger; update tax account analysis, ensure appropriate tax accounting, book required journal entries

- Responsible for the preparation of interim and annual financial tax provisions in accordance with ASC 740

- Provide continuous process improvement support to ensure tax process flows efficiently and effectively. Work with various subsidiaries finance groups and other internal resources to maintain existing data flow and provide ways to improve data flow

- Assist VP Tax and Sr. Tax Manager on an as needed basis on special projects, planning, research and analysis

- Maintain professional and technical knowledge via continuing education and technical reading

- Maintain tax calendar, including monitoring of due dates; new filings, out-dated filings, and sign-offs. Ensure upcoming filings are assigned to staff or other individual and completed in a timely manner

- Assist in managing and coordinating tax audits

- 5+ years tax experience in a multinational or multistate corporate environment

- Strong knowledge of ASC 740

- CPA and/or MST a plus

- Strong knowledge of US consolidated and state tax rules and regulations

26

Corporate Tax Manager Resume Examples & Samples

- 5+ years of current or recent CPA Firm experience servicing SEC reporting clients

- Polished and professional

- Knowledge of Go System

27

Uki-senior Corporate Tax Manager Resume Examples & Samples

- Responsibility for proactive management of both compliance and advisory tax projects for clients and delivering exceptional client service

- Building and managing client relationships and developing new client relationships through business development pursuits

- Developing relationships within the firm to build a strong network

- Demonstrate technical excellence and a practical / business driven approach

- High level of technical competence

- Excellent communicator, both written and oral

28

Uki-corporate Tax Manager Resume Examples & Samples

- Build and manage client relationships and provide exceptional client service

- Actively contribute to business development opportunities by proactively managing existing clients and contribute to winning new clients

- Develop relationships within the firm to build a strong network

- Delegation of work to junior staff and overseeing its successful execution

- AITI qualified with 2-3 years’ relevant post qualification Corporate Tax experience

- Some practice background in other tax heads would be favourable

- Ability to identify areas of risk and carry out an effective review

29

Corporate Tax Manager Resume Examples & Samples

- Participate in acquisition post close processes, as appropriate

- Bachelor’s degree in Accounting, Business or related field, or equivalent education and related training

- Master’s degree in Accounting

30

Corporate Tax Manager Resume Examples & Samples

- Successfully manage delivery of relevant tax projects ensuring the highest level of technical excellence and client service standards whilst maintaining a commercial and practical approach

- Provide business tax services including audit support, tax reporting, compliance tax planning and transaction support

- Build and maintain tax relationships with clients and provide consistent first class levels of client service

- Build relationships internally within the firm and externally with clients

- Actively seek opportunities to expand market share through management and servicing of existing clients and new client wins

- AITI qualified and a minimum of 2 - 3 years' relevant Corporate tax experience

- Excellent technical and working knowledge of Corporate tax

- Assurance or tax practice experience an advantage

- Commercial astute and strategic

- Proven ability to adapt

31

Corporate Tax Manager Resume Examples & Samples

- Preparation of tax returns for Ireland, UK and a number of EMEA jurisdictions

- Responsible for submission of returns and payments on a timely basis

- Providing tax support across EMEA for ad-hoc queries

- Completion of tax accounting for various countries

- Assist head of tax with ad-hoc projects as required

32

Corporate Tax Manager Resume Examples & Samples

- Strong communication (written and oral) skills and the ability to interface with cross-functional groups within the company

- Demonstrated ability to drive projects to successful conclusions

- Strong work ethic and be self-motivated and proactive

- Dedication to providing high quality work

- Strong organizational skills with superior attention to detail

- Demonstrated ability to work in a fast-paced and dynamic work environment

- Manage income tax provision preparation by outside advisors

- Review and analyze issues related to Federal and state tax returns prepared by outside advisors

- Conduct tax research, draw conclusions, and prepare technical memorandums to support tax positions

- Drive process improvements around all tax processes especially internal controls over financial reporting for tax

- Assist with the identification of tax planning opportunities and tax risks and implementation of solutions

- Assist with tax authority notices and/or audits as needed

- Other ad hoc projects as assigned

- Minimum of 5 years of relevant experience in public accounting or multinational corporate tax department. A combination of both experiences is highly desirable

- Minimum of Bachelor's degree, with an emphasis in accounting, finance, economics or a related field. An advanced degree in tax or law is preferred

- Detailed knowledge of ASC 740 is required including experience with stock-based compensation, transfer pricing and international tax issues

- Experience with the design, implementation, and operation of processes to ensure integrity of reported numbers and of data across various sub-systems

- Personal experience using the Airbnb platform is preferred

33

Corporate Tax Manager Resume Examples & Samples

- Coach and stimulate more junior profiles in view of the right achievements and personal development and provide more senior executives with inputs in order to properly proceed to the performance review of counselees

- Organize the team in order to increase the efficiency of processes, roles and responsibilities within the team

- Bachelor or master’s degree in law or economics potentially with a supplementary degree in fiscal matters

- At least 5 years of relevant experience in national corporate tax compliance matters, within a consultancy or corporate environment

- Good knowledge of Dutch and English

34

Corporate Tax Manager Resume Examples & Samples

- Experience in reviewing Corporate federal and states returns (including S Corporations and Consolidated entities), Operating partnerships and LLCs

- Familiarity with ASC 740 and ability to prepare and review current and deferred tax provisions

- Bachelor's degree in Accounting; advanced taxation degree is a plus

- Background in public accounting required; Big 4 or National Firm experience preferred; CPA is a plus

- Minimum 3-5 years of hands-on experience with tax compliance/provision and review

- Strong computer skills including Microsoft Office Suite, as well as advanced proficiency with Excel, Word, RIA, CCH, BNA, GoSystem and other research tools

- Excellent written and presentation skills coupled with strong interpersonal and team-building capabilities across different functional areas and cultures

35

Corporate Tax Manager Resume Examples & Samples

- Manage, direct, and monitor multiple client services teams on client engagements, and manage activity to budget

- Plan, execute, direct and complete assigned client tax projects in a wide variety of industries

- Provide innovative tax planning, consulting and tax compliance expertise to assigned clients

- Manage, develop, train and mentor other tax staff on tax projects, and assess their performance for both their client engagement and year-end performance reviews

- Conduct primary and secondary review of complicated or complex income tax returns, including Corporate, S-Corp., partnership and individual tax clients

- Maintain an active communication with all clients to manage their expectations during the engagement, ensure their satisfaction is being met at all times, make sure client deadlines are being met and lead applicable change efforts effectively

- Consult, work with and service assigned tax clients to make recommendations on both business and process improvements, and to serve as a business advisor to the clients

- Work closely with Grant Thornton tax partners and tax staff on client management, practice development and related business development activities

- Bachelor's degree in Accounting or a Business-related field is required

- An active CPA license is required

- Advanced education (e.g MST, LLM in Taxation, or J.D.) is a preferred

- 5-8 years of progressive federal tax consulting and/or tax compliance experience in a public accounting firm or a professional services firm is required. A combination of both corporate and public accounting experience is a plus

- Experience in preparation and review of Corporate, S-Corp. and/or Partnership tax returns is required

- Excellent analytical, technical, and tax accounting/technology skills are expected

- Proficiency in US GAAP, tax compliance, corporate consolidated returns, consolidated federal tax returns, partnership returns and combined state tax returns is expected

- Exceptional client service and communication skills, with a demonstrated ability to develop and maintain outstanding client relationships, is expected

- Strong leadership, business development, training, coaching and mentoring skills are required

- Excellent written, interpersonal and presentation skills required

- Computer software experience, including knowledge of various tax software packages and technologies, is expected

- Ability to work additional hours as needed and travel to various client sites as required, is expected

36

Corporate Tax Manager Resume Examples & Samples

- Interact closely with assigned tax clients to provide innovative tax planning, consulting and compliance expertise while managing the client assignments to budget

- Plan, direct, execute and complete assigned client tax projects in a wide variety of industries

- Conduct primary and secondary review of complicated or complex income tax returns completed by tax staff, including Corporate, C-Corp., S-Corp., partnerships, joint ventures, eligible non-corporate entities and individual clients

- Direct and monitor the state tax compliance and composite filings activities

- Maintain active communication with clients to manage expectations, ensure satisfaction, make sure deadlines are met and lead change efforts effectively

- Consult, work with and service clients to make recommendations on business and process improvements, and serve as a business advisor to the clients

- A Bachelor's degree in Accounting or related field is required

- CPA is required. A Masters in Taxation, LLM in Taxation, or JD is preferred but not required

- Five or more years of current federal tax consulting and/or compliance experience in a professional services/public accounting firm, or a combination of both corporate and public accounting experience required

- Experience in review and completion of applicable tax forms for Corporate, C-Corp., S-Corp., Partnerships, Joint Ventures and non-corporate entity tax returns is required

- Excellent analytical, technical and tax accounting/technology skills, with proficiency in US GAAP, state tax compliance, corporate consolidated tax returns, consolidated federal tax returns, partnership tax returns, joint venture and non-corporate entity tax returns and combined state tax returns

- Strong leadership, business development, recruiting, training, coaching and mentoring skills

- Excellent written, interpersonal and presentation skills

- Advanced computer experience including knowledge of various tax softwares and technologies required

37

Corporate Tax Manager Resume Examples & Samples

- Team management and supervisory experience

- Strong computer skills including proficiency in Microsoft Office Suite, Fast-Tax software, and CCH

- Five to seven years of progressive tax compliance and/or tax consulting experience; experience in public accounting is a plus

38

Corporate Tax Manager Resume Examples & Samples

- Lead and manage a team of 2-5 individuals to prepare and review of the quarterly and year-end income tax provision calculations

- Manage and assist the external resources in the preparation of US income tax returns, tax extensions and tax estimates

- Ensure accuracy and timely filing of tax returns and extensions and proper payment of applicable fees and taxes in all jurisdictions

- Evaluate tax positions and use excellent professional judgment to conclude issues which provide the best result with the least amount of risk

- Build and maintain appropriate documentation of US income tax work papers

- Research and provide support for issues related to US income tax positions and filings

- Research tax implications of new business initiatives

- Maintain and improve tax forecasting model

- Assist with R&D study, Sec. 199 deduction study, and other tax incentives projects and filings

- Build relationships with other departments to obtain accurate and complete information for the US tax provisions and tax returns and tax forecasts

- Monitor and ensure compliance with key SOX controls related to US income tax and stay current with changes in US income tax law and US GAAP

- Develop and implement procedures and processes to improve the tax function

- Train and develop junior staff

- Minimum of 10 years of income tax experience, with strong knowledge of corporate tax provision and compliance issues related to multinational publicly traded companies

- Combination of Big 4 experience and industry highly preferred

- Ability to research, analyze and understand complex issues

- Commitment to self-improvement and process improvement

39

Corporate Tax Manager Resume Examples & Samples

- Working closely with Freddie Mac business areas to provide timely, value added support in the application and understanding of tax accounting methods for related business transactions and the execution of tax accounting or tax compliance processes

- Preparing or supporting GAAP accounting and disclosure related to federal income taxes

- Providing execution or tax technical expertise to support the Tax Department’s analysis of transactions and/or the selection of appropriate tax accounting methods

- Leading or providing tax technical support in the filing of federal income tax, partnership, or information returns

- Working closely with IRS examining agents, advocating and defending tax positions, responding to inquiries, and coordinating activities with the examining agents, Tax Department, and/or Freddie Mac business area personnel

- 7+ years of federal tax compliance experience, including experience as a tax manager

- Knowledge of Excel and tax software such as OneSource or CorpTax

- Excellent communication skills, self-motivated, and a team player

- Demonstrated ability to identify and implement process efficiencies and improvements

- Knowledge of the secondary mortgage market and accounting for related items such as mortgages, mortgage securities, debt, or derivatives

- CPA and/or Master’s degree in tax

40

Corporate Tax Manager Resume Examples & Samples

- Build and maintain tax relationships with clients and provide exceptional client service. A key expectation will be well project managed service with high quality deliverables that demonstrates that value has been provided to the client

- Experienced corporate tax manager with UK corporate tax experience for this role

- Up to date knowledge of changes in the tax environment (BEPS, CBCR etc)

- Proven track record for business development on existing clients and ‘cold’ targets

- Experience of managing and coaching others

- Excellent relationship management skills

- Team player; ability to integrate with new teams quickly and build effective relationships at all levels

- Ability to identify areas of risk, carry out an effective review and consult appropriately within the firm

41

Big-corporate Tax Manager Resume Examples & Samples

- Manage full tax services to a client portfolio

- Build relationships within the firm to support the identification of opportunities and provide deep specialist assistance to clients

- A significant contribution to winning new work by proactively managing existing clients and targeting / building relationships in the business community to win projects on new clients

- Responsible for providing coaching and support to more junior of team to support them on client work and through personal development

- Experience of advising on both compliance and advisory work, experience of issues including CFCs, loss relief, reorganisations, patent box, BEPs and international tax issues

- Proven track record for business development on existing clients and 'cold' targets

- Attention to detail with a commitment to high quality delivery

42

Corporate Tax Manager Resume Examples & Samples

- Lead the preparation of the UK Corporation Tax Returns for group companies, meeting all compliance filing and payment deadlines

- Pro-actively liaise with the US tax team to identify and explain UK tax issues and the impact on the group’s world-wide tax position (e.g. WWDC, interest deductibility)

- Lead preparation of tax disclosures for UK financial statements (including consolidated tax numbers, where required)

- Assist with HMRC enquiries, working with external advisors to manage the HMRC relationship and resolution of open enquiries

- Provide assistance and support with Sarbanes-Oxley compliance

- Periodic review of compliance and reporting processes and controls, with a view to continuous improvement. Assist with SAO sign-off process

- Support the Head of Tax with project work and business integrations

- Support the Head of Tax with policy matters and interact as necessary with other corporate functions

- Oversee development of the Tax Analyst and offer wider support to the team

- Occasional working in London offices, when required

43

Corporate Tax Manager Resume Examples & Samples

- Minimum 5 years of experience in a public accounting firm or related experience

- Excellent written and verbal communication and interpersonal skills

- Must be highly motivated and experienced in managing multiple client engagements

44

Corporate Tax Manager Resume Examples & Samples

- Desire to review & prepare Tax returns (involved role)

- Experienced accounting for income taxes reporting

- Experienced with audits of Federal, State, and Local filings

- Oversight of Sales/Use and Property taxes

- Responsible for transfer pricing and/or coordination of Advance Pricing Agreements

- Assist in M&A and strategic tax planning

- Bachelor in Accounting required

45

Corporate Tax Manager Resume Examples & Samples

- Manage monthly ASC 740 compliance and reporting; including identification and reporting of unrecognized tax benefits associated with uncertain tax positions

- Supervise and review federal and state income tax returns and quarterly estimated tax payments making efficient use of OneSource Income Tax software package

- Assist with federal and state/local income tax audits

- Perform thorough and accurate tax research relative to substantive federal, state and local tax issues on assigned projects. Gather relevant facts, determine applicable law and regulations, locate and 'digest' relevant judicial precedent, administrative pronouncements, and commentary. Appropriately analyze and reach logical and well documented conclusions

- Process financial and accounting data as well as other factual information in order to identify and bring forward substantive tax issues and determine the appropriate treatment of items. Identify potential planning opportunities and/or advocacy positions

- Discuss research, analysis, and conclusions with senior management and outside experts including attorneys and CPA's

- Review of sales/use tax returns, real estate and personal property tax returns/payments, and business license filings

- Training of Corporate Tax Department team on tax treatment of transactions and compliance procedures

- Demonstrates ability to self start and the willingness to learn new skills

- Possesses a thorough understanding of income tax accounting (ASC 740)

- Significant tax compliance and review experience of consolidated C-Corporations

- Proficient with OneSource tax compliance software, (also called GoSystems or Fast Tax)

- Tax provision software experience

- Ability to monitor, analyze and interpret complex federal and state tax laws

- Familiarity with taxation of Financial Institutions

- PeopleSoft general ledger experience

46

Corporate Tax Manager Resume Examples & Samples

- Qualified ACA (and CTA a plus)

- At least 5 years tax compliance and accounting experience

- Big 4 tax experience is a preference

- Experience of working in a multinational and media sector a plus

47

Fs-gcr Corporate Tax Manager Resume Examples & Samples

- Provide business tax services including audit support, tax reporting, compliance, tax planning and transaction support

- Strong working knowledge of Corporation Tax

- Relationship management skills with ability to manage client expectations

48

Senior Corporate Tax Manager Resume Examples & Samples

- Direct the income tax compliance function and tax returns process for multiple entities including C Corps and single-member LLCs

- Manage the ASC 740 (FAS 109) tax provision process, accounting and related financial statement disclosures as part of the quarterly and annual close. Ensure items that impact the Company's effective tax rate are incorporated into the ongoing effective tax rate analysis

- Analyze and document ASC 740-10 FIN 48 reserves

- Review R&D credits calculation and analysis, unremitted earnings, and stock based compensation under ASC 718 (FAS 123R)

- Assure tax accounts are fully compliant with GAAP and Sarbanes-Oxley requirements

- Manage the preparation of the consolidated federal income tax returns and related work paper and statements for accuracy and completeness

- Manage the preparation of the calculations of quarterly federal and state estimated corporate income taxes and annual extensions

- Prepare documentation for footnote disclosures for 10-K/10-Q reporting

- Perform research of relevant tax laws, regulations and rulings to determine proper tax treatment of issues

- Manage all U.S. federal and state corporate income tax audits including all communication between the Company and the tax auditors

- Assist with financial planning in determining tax expense and tax related cash flows in the budgeting and forecasting process

- Assist the Finance Department in evaluating significant transactions in which the company enters into or contemplates

- Collaborate with the internal departments, company partners and external advisors to evaluate proposed transactions and investments, with focus on tax implications

- Manage external consultants to ensure they deliver quality on time and to budget

- Manage a team of employees to meet departmental goals via appropriate allocation of workload and effective resource management

- Interview, select, train, and develop new employees

- Evaluate employee work and productivity and monitor for process adherence and compliance

- Drive other projects as required or as business needs change

- Minimum 10 years of tax experience in a public accounting firm and/or corporate tax department, with 8 years of solid experience of ASC 740 (FAS 109)

- CPA/MST preferred

- Experience in federal state taxation of corporations, acquisitions and consolidations

- Exposure to partnership tax issues is helpful

- Strong tax technical and accounting skills, ability to communicate technical issues clearly and work effectively with all levels of leadership

49

Corporate Tax Manager Resume Examples & Samples

- 5-7 years in Corporate Tax

- Master's in Tax and/or CPA preferred

- Familiar with tax compliance systems

- Proficiency in basic Microsoft Suite (Excel, Word, etc)

- Fast paced and detail oriented

- Ability to prioritize and simultaneously handle deadlines, ad hoc requests, and regular deliverables

50

Assistant Corporate Tax Manager Resume Examples & Samples

- Responsible for the entire delivery of the project, including control of billings and keeping the client/Partner informed of budget overruns and staff management

- To review work produced by more junior members of staff and aid in their development

- Identify risk and technical matters, as well as selling opportunities, to the Partner/Manager

51

Corporate Tax Manager Resume Examples & Samples

- Work closely with the Assistant Corporation Tax Manager, and Group Head of Tax to gain efficiencies and drive best performance within the Corporation Tax department

- Lead a small team, (3, including 2 based remotely), and co-ordinate staff and work-related issues, particularly with regard to planning and organising work schedules, assessing performance and development

- Build relationships and interact with internal and external customers to provide excellent planning, consulting and expertise

- Review and undertake audit of tax packs prepared by business units, through to completion of CT returns for submission to HMRC

- Identify and mitigate tax risks and actively contribute to the SAO return procedures for the Group

- Identify and drive opportunities for process improvements

- Manage tax provision and corporate tax compliance process

- Preparation and responsibility for interim and year-end tax reporting under IFRS, tax papers, and to advise on tax notes for inclusion in statutory accounts

- Responsibility for worldwide debt cap calculations, preparation and submission of Joint Amended Returns, Group Payment On Account calculation

- Review and update Transfer Pricing documentation, and involvement in year-end Transfer Pricing calculation for appropriate business units throughout the group

- Assist in year-end consolidation process and review output

- Manage the transition from COINS to Oracle/Hyperion

- Assist in the automation of Hyperion tax reports and tax consolidation process

- Process R&D credit claims

- Manage and coordinate corporate tax audits

- Provide Management information regarding the satellite corporate tax compliance team’s performance and targets

- Directly responsible for supervising the relevant elements of corporate Tax Process function

- Assists Head of Group Tax with line management responsibilities including performance review and appraisal

- Proven working experience as tax manager, either in-house or practice

- Excellent knowledge of consolidated of tax accounting and tax compliance, particularly for large and complex groups, and ability to understand and work through complex tax positions in relation to Corporation Tax, Knowledge of tax software (Thomson OneSource), MS Office and Oracle/ Hyperion would be beneficial

- Good at meeting deadlines, solving problems with strong analytical skills with detail orientation

- Involvement in ERP change projects or Tax Technology implementation project would be useful

- Strong leadership and personnel management skills

- Experience supervising teams, including supervising remotely, and working effectively with Record to Report functions or other core financial processes in a Shared Service Centre environment of a complex business

52

Corporate Tax Manager Resume Examples & Samples

- Prepare and/or review of tax workpapers to support tax filings (tax trial balances, book/tax reconciliations, state apportionment schedules, etc.)

- Prepare quarterly projections and forecasts of taxable income

- Support Tax Team on responding to federal, state and local tax audits and inquiries related to tax filings

- Bachelor’s Degree in Accounting and knowledge of accounting principles required. CPA and/or Masters of Taxation are preferred

- Minimum of 6 years of experience in work environment dealing with taxation matters, public accounting experience preferred

- Strong technical skills, with some experience in international taxation

- Experience with performing tax research using tax libraries

- Intermediate proficiency in MS Office software. Experience in tax preparation software (OneSource) is a plus

53

Corporate TAX Manager, Prestigious Company Resume Examples & Samples

- Gather and collect federal and state tax information at the corporate level

- Planning and strategy for property tax and sales and use tax

- Schedule calculations/analysis and workpaper compilations

- Conduct research and understand opportunities to capitalize in the areas of tax

- Work with site locations as well as planning and tax centers

- 7+ years of tax accounting experience

- CPA and/or MST strongly preferred

- Experience and ability to perform the above responsibilities

54

Corporate Tax Manager Resume Examples & Samples

- Income Taxes Topic, ASC 740 Analysis

- Detailed review of monthly and quarterly tax provisions

- Identify new permanent and temporary differences

- Monitor and assess impact of potential tax incentives available to the Company

- Monitor state tax rate

- Monitor new tax legislation

- Adjust the deferred tax inventory as needed

- Review settlement of provision to return differences

- Quarterly maintenance of existing uncertain tax positions

- Identify and quantify new uncertain tax positions, if any

- Review journal entries to add, remove, or settle uncertain tax positions, as needed

- Prepare / review all tax disclosures for quarterly 10-Q and annual 10-K

- Prepare / review all tax disclosures for annual separate company audit reports

- Work with audit and tax outside service providers to answer questions and provide additional information

- Income Tax Compliance

- Review of income tax workpapers

- Review federal, state, and international income tax returns

- Oversee international tax compliance requirements, as needed

- Review estimated tax payments

- Review extension payments

- Review amended returns, if necessary

- Federal / State Income Tax Examinations and Notices

- Satisfy information requests

- Review initial / proposed assessments

- Determine favorable positions available to the Company

- Prepare responses to taxing authorities

- Identify and implement tax planning strategies

55

Corporate Tax Manager Resume Examples & Samples

- Responsible for timely preparation of the US income tax returns, including consolidated federal return (including foreign tax credit and reporting for non-US subsidiaries) and state returns

- Assist in the preparation of quarterly and annual global income tax provision for the company, including the global effective tax rate, taxes payable, reserves for uncertain tax positions and maintenance of accurate deferred income tax balances

- Calculates and remits quarterly estimated income tax payments

- Advises Tax Director regarding the impact of new tax legislation

- Responsible for administering and maintaining the CorpTax software

- Primary responsibility for managing US federal and state tax audits

- Maintains compliance with US transaction taxes

- Assists Tax Director in developing strategic initiatives to reduce the world wide effective tax rate

- Assists local country Controllers and outside tax preparers in ensuring the accuracy of foreign tax provisions, tax compliance and tax balances. Assists in developing strategic plans to optimize cross-border transfer pricing in order to minimize overall effective tax rate of the company

- Assist with various other tax matters as needed, including ongoing review of tax procedures in order to streamline processes and minimize risk

- Undergraduate degree in accounting. Master's Degree in Accounting or Taxation or MBA preferred

- Minimum 6 years’ experience in corporate taxation in a public accounting firm or corporate setting

56

Senior Corporate Tax Manager Resume Examples & Samples

- Ensure that the consolidated federal income tax return and state tax returns for adidas North America and its subsidiaries are timely prepared and filed, and incorporate all planning opportunities available to the Group to minimize its federal and state income tax liabilities

- Identify federal and state tax planning opportunities, and develop and implement related strategies to optimize result

- Address tax aspects of quarterly and year-end financial statement presentation, including assisting in the determination of the Group’s consolidated tax provision and effective tax rate, tax rate reconciliations, subsidiary tax provision calculations, and deferred tax analyses

- Maintain technical competency and keep abreast of developments and changes in U.S. federal and state tax laws, assessing their implications to adidas North America and its subsidiaries

- Effectively utilize and develop staff personnel

- Ability to build rapport with financial management personnel of business units and provide support to their operations

- Ability to work in a matrix organization comprised of all divisions of the adidas Group

- General understanding of the financial and tax frameworks and standards required for multinational operations

- Exceptional computer skills, including knowledge of SAP, CorpTax and Microsoft Office applications

- 7+ years audit/tax experience; CPA and/or JD; M.S.T. or L.L.M. strongly preferred

57

Tax-international & Corporate Tax Manager Resume Examples & Samples

- Delivering complex tax advice in relation to such matters as corporate restructures, acquisitions and divestments as well as tax losses, tax consolidation, CGT, debt/equity etc

- Coaching and motivating a team

- Overall project management and delivery of multiple client engagements - including identification of issues and opportunities, research and preparation of advice on complex tax matters

58

Corporate Tax Manager Resume Examples & Samples

- Tax SPOC for BICS, the international Carrier of the Proximus Group as well for the international subsidiaries of the Proximus Group

- As Group Structure Tax Expert, oversee initiatives involving multiple entities impacting the Group effective tax rate

- Lead M&A process for Tax: optimize acquisition and divestment structures and avoid/limit tax risks translated into transaction documents

- Follow-up of (inter)national corporate tax legislative changes and prepare information to top management on possible impact for the Group

- Negotiate favourable tax rulings to optimize the Group effective tax rate and avoid tax risks

- Represent Proximus towards the ruling commission and tax authorities when required

- Promote a favourable corporate tax environment for the Group: analyse and propose legislative changes where necessary, represent Proximus in specific FEB/VBO working group, prepare answers to the press, etc

- Provide end-to-end tax guidance to the business covering risk assessment, business impact and optimization

- Co-create, motivate, guide, assess and coach (tax) specialists and advisors in order to achieve, through motivated and capable staff, operational efficiency

- Interact with internal as well as external stakeholders i.e. higher Proximus' management (treasury, M&A, Accounting, Legal, Group Public Affairs, Press Relations, ...), tax authorities, auditors, advisors and other professional organizations

59

Corporate Tax Manager Resume Examples & Samples

- At least 10 years of corporate tax experience

- Must have the ability to read, comprehend and apply complex tax law to the Company’s operations and transactions

- Strong analytical and time management skills

- Excellent understanding of tax compliance, controversy, and negotiations,

- Strong understanding of ASC 740,

- Experience in managing numerous external service providers

60

Corporate Tax Manager Resume Examples & Samples

- Lead the preparation of the UK Corporation Tax Returns for group companies within two key News UK divisions, meeting all compliance filing and payment deadlines

- Management of outsourced tax compliance engagement

- Prepare tax outlook, quarterly and annual reporting figures, and tax figures for inclusion in long-term cash flow forecasts. Liaise with external auditors as required

- Pro-actively liaise with the US tax team to identify and explain UK tax issues and the impact on the group’s world-wide tax position

- Preparation of tax disclosures for UK financial statements (including consolidated tax numbers, where required)

- International tax advice and project management for rapidly expanding business division, including entity setup, pricing strategies, liaising with UK and US businesses as required

- Support the Head of Tax with project work and business integration work-plan

- Working in London offices as required

- Graduate qualified tax professional with a recognised accounting and/or tax qualification and at least 3-5 years’ post-qualified experience, either in a blue chip corporate or a leading tax advisory firm

- Impeccable personal integrity, values and professionalism

- Excellent communication skills, able to converse with people at all levels and to present information clearly and concisely

- To actively seek input from internal and/or external stakeholders to better understand their needs; placing high value on stakeholder enthusiasm by exceeding their expectations

61

Corporate Tax Manager Resume Examples & Samples

- Commercial & cross border project advice - providing advice in respect of commercial and cross border trading activities and liaison with overseas tax departments or advisors as required

- Tax planning – Advice and management of tax matters in connection with corporate restructuring / re-organisation and other acquisition and post acquisition activities

- Completion of specialist tax research/reviews on particular technical issues as required and ad-hoc tax advice to own portfolio of group companies

- Development of junior members of the department in conjunction with senior tax managers

- Responsibility for corporate tax governance and risk management in respect of own portfolio of group companies

- Review of corporation tax returns, required claims & elections, IRFS reporting calculations and statutory account calculations / disclosures in respect of own portfolio of group companies (potential assistance with the preparation of more complex aspects of group issues). This will include liaison with contacts across the business and research on specific technical issues

- Involvement in the completion and analysis of group topics; e.g. group plans, thin capitalization, calculation of quarterly corporate tax installment payments to HMRC

- Provision of advice in respect of the pricing and documentation of cross border transactions and preparation of transfer pricing documentation for UK companies and divisions

- Accountancy or tax qualification (eg ACA, ATII) or equivalent

- Experience working in corporate tax for a for large commercial organisation/audit company

- Customer focus and excellent communication skills

- Experience of dealing with a group of companies and related tax affairs

- Proficient use of Office and corporate tax return software

62

Corporate Tax Manager Resume Examples & Samples

- Assist with the set-up and testing of the compliance process in OneSource Corporate Income Tax

- Preparation and review of federal, state and local income tax returns

- Preparation and review of federal, state and local estimated tax payments and extensions

- Preparation and review of the quarterly and annual U.S. GAAP income tax provision under ASC 740 including analysis and documentation related to Uncertain Tax Positions and related tax footnotes and disclosures in the Company’s SEC filings

- Participate in the completion of controls and documentation regarding SOX compliance including recommending and implementing changes to enhance internal controls over tax items

- Perform research, document and advise on tax matters related to tax legislation and various business transactions including mergers, acquisitions, divestitures, etc

- Participate in the development and implementation of tax strategies

- Work with external tax consultants and internal and external auditors

- Drive efforts to improve efficiency, accuracy and throughput of tax reporting and compliance processes

63

Corporate Tax Manager Resume Examples & Samples

- Establish the process to transition the provision process from outsourced model to in-house model

- Maintain ownership and expertise of the tax provision model/workbook

- Maintain the federal and state calendar and assignments of responsibilities

- Compute and review calculations of quarterly federal and state estimated income/franchise tax payments and annual extensions

- Prepare and continuously maintain all records to substantiate internal tax controls and processes are adequately followed

- Assist in the development of models as needed to forecast consequences of tax planning strategies, corporate M&A transactions, pending legislation and new business initiatives

- Manage property tax compliance reporting through an outside vendor

64

Corporate Tax Manager Opportunity Resume Examples & Samples

- Preparing the US Consolidated Federal Income Tax Return

- Assisting with the gathering of information from outside partners to review various returns

- Maintaining compliance responsibilities partner's tax returns

- Assisting with tax planning opportunities and tax risks to implement solutions

- A minimum of 3-5 years' experience in a tax role

- Experience developing and training staff

- Bachelor's Degree in Accounting, Finance or related field; MBA or CPA preferred

- Excellent written, oral, and presentation skills

65

European Corporate Tax Manager Resume Examples & Samples

- Corporate Tax Manager within a Big 4 firm with proven post-qualified experience

- Strong accounting background

- Highly proficient with spreadsheets, databases and tax provision application (Hyperion Tax Provision experience a plus)

- Ability to conduct complex analysis and present data in a meaningful Strong organizational skills and detail orientation

- Open minded, flexible, and willing to listen for other people’s opinions

- Financial Services experience

- Graduate with professional accountancy qualification with extensive post qualification experience in the financial services industry

66

Corporate Tax Manager Resume Examples & Samples

- Prepare U.S. GAAP and non-GAAP statutory tax provisions relating to the company’s non-U.S. operations

- Manage external advisers for outsourced tax compliance (both income and indirect), as well as ensuring timely and accurate offshore estimated tax payments

- Manage day-to-day activities of the company’s expatriate tax program, including: interaction and coordination with external advisers and employees

67

Corporate Tax Manager Resume Examples & Samples

- Bachelor's degree in Accounting, Finance, or a related major

- 8 or more years’ experience in tax accounting and planning (federal, state, and/or international taxation)

- Strong technical tax knowledge and GAAP tax accounting knowledge

- Tax technology knowledge and ability to lead projects

- Strong work ethic, with ability to work under deadlines and shift emphasis as required

- Excellent interpersonal communication and negotiation skills, both written and oral

- Ability to work with all levels of management, and understand primary financial drivers in the business

- Must be detail oriented with strong attention to details and accuracy of analysis and procedures

- Strong computer and technology skills, including Microsoft tools and other data analysis tools

- Excellent trouble shooting, problem resolution, and analysis skills

- Solid understanding of accounting and business processes

- MBT, MBA, or CPA

- Cooperative accounting experiences

- Prior experience driving process improvement and documenting processes

- Knowledge of JD Edwards's systems

- Knowledge of multiple integrated SAP/ERP systems

- Prior coaching and developing employees

- CorpTax tax provision and compliance software experience a plus

- Process management, organizational agility, and ability to identify tax opportunities and develop action plans

- Percentage of Travel: < 5%

68

Corporate Tax Manager Resume Examples & Samples

- Management of the Company's federal and state income tax returns, quarterly estimated tax calculations and extensions (currently 54 legal entities). In addition, manage the compliance process for international tax filings including addressing Business Unit tax queries with respect to foreign country tax implications of doing business abroad

- Complete company's tax provision and present properly in audited financial statements. Prepare financial reporting tax footnote and manage reconciliation of tax accounts for yearend close/audit. Manage support to the external auditors with respect to tax inquiries

- Assist Director in identifying and mitigating tax risks. Interpret new federal and state law changes, evaluate their impact on the group's businesses, institute compliance and document positions. In addition, evaluate and draft appropriate tax language in proposed customer contracts with short turnaround times. Assist with integration of new companies and with due diligence of prospective mergers and acquisitions

- Provide growth and learning opportunities to maximize staff performance and effectiveness. Perform special projects, prepare ad hoc tax analysis, attend meetings and address tax inquiries from all levels of staff including upper management. Consistently evaluate current processes and implement best practices

- Assist in managing federal and state income tax audits

- Extensive technical tax knowledge of federal and state tax returns for S Corporations & other pass-through entities, and multistate income/franchise/sales tax expertise

- Strong work paper techniques and attention to detail

- Visual acuity (e.g., needed to prepare and analyze data, to transcribe documents, to view a computer, to read, to inspect objects, to operate machinery)

- Ability to write complex documents in the [English] language