Corporate Actions Analyst Resume Samples

4.5

(136 votes) for

Corporate Actions Analyst Resume Samples

The Guide To Resume Tailoring

Guide the recruiter to the conclusion that you are the best candidate for the corporate actions analyst job. It’s actually very simple. Tailor your resume by picking relevant responsibilities from the examples below and then add your accomplishments. This way, you can position yourself in the best way to get hired.

Craft your perfect resume by picking job responsibilities written by professional recruiters

Pick from the thousands of curated job responsibilities used by the leading companies

Tailor your resume & cover letter with wording that best fits for each job you apply

Resume Builder

Create a Resume in Minutes with Professional Resume Templates

CHOOSE THE BEST TEMPLATE

- Choose from 15 Leading Templates. No need to think about design details.

USE PRE-WRITTEN BULLET POINTS

- Select from thousands of pre-written bullet points.

SAVE YOUR DOCUMENTS IN PDF FILES

- Instantly download in PDF format or share a custom link.

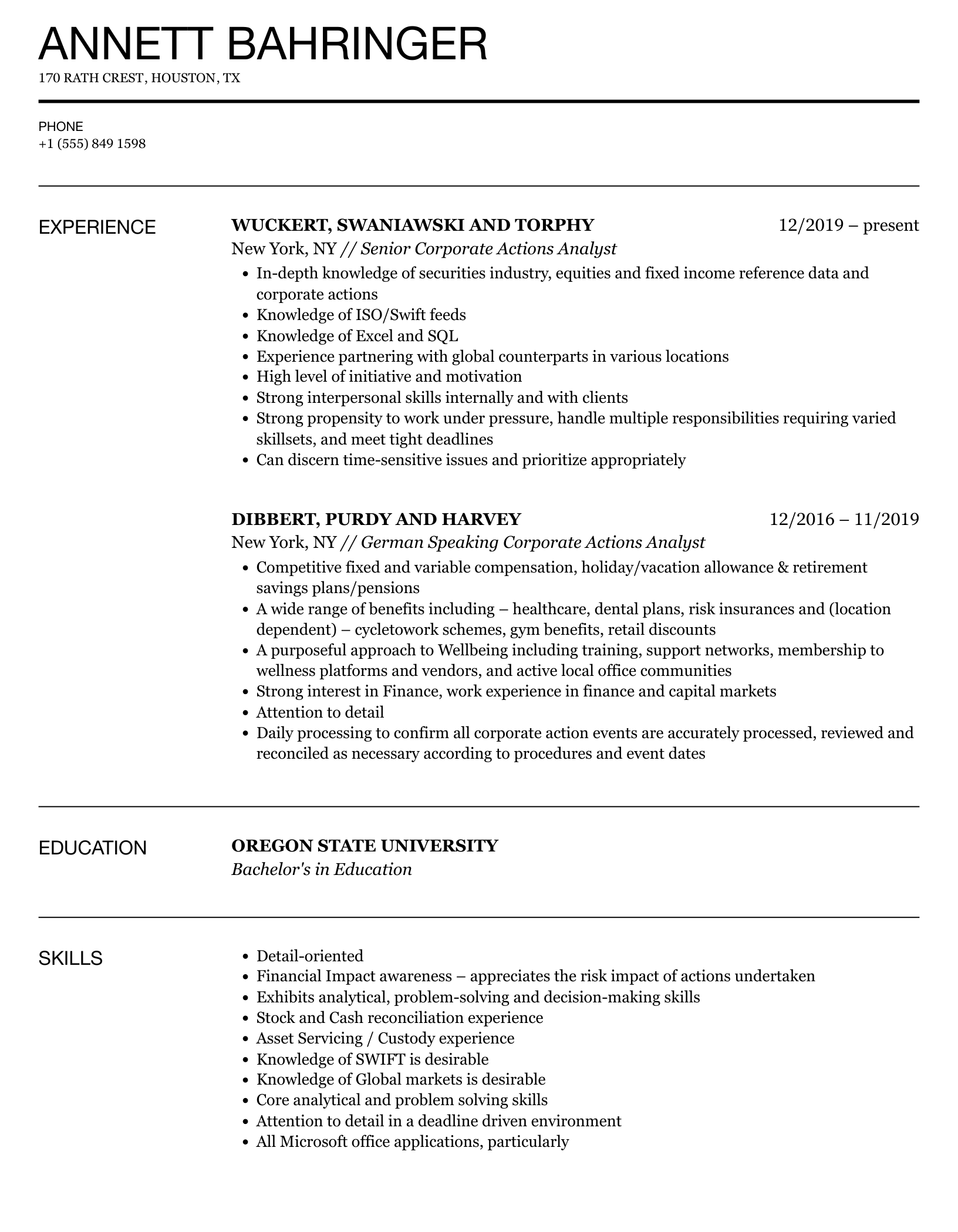

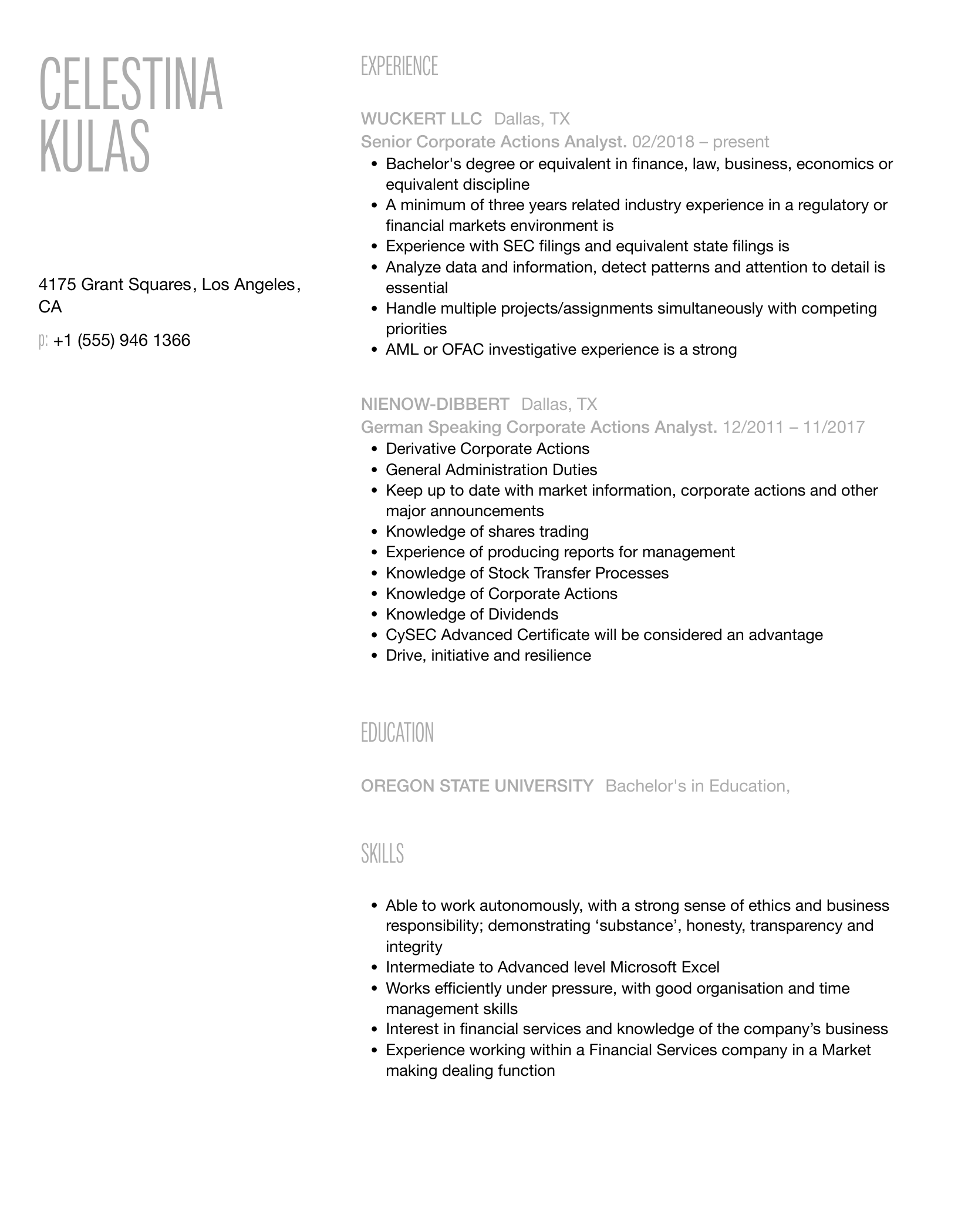

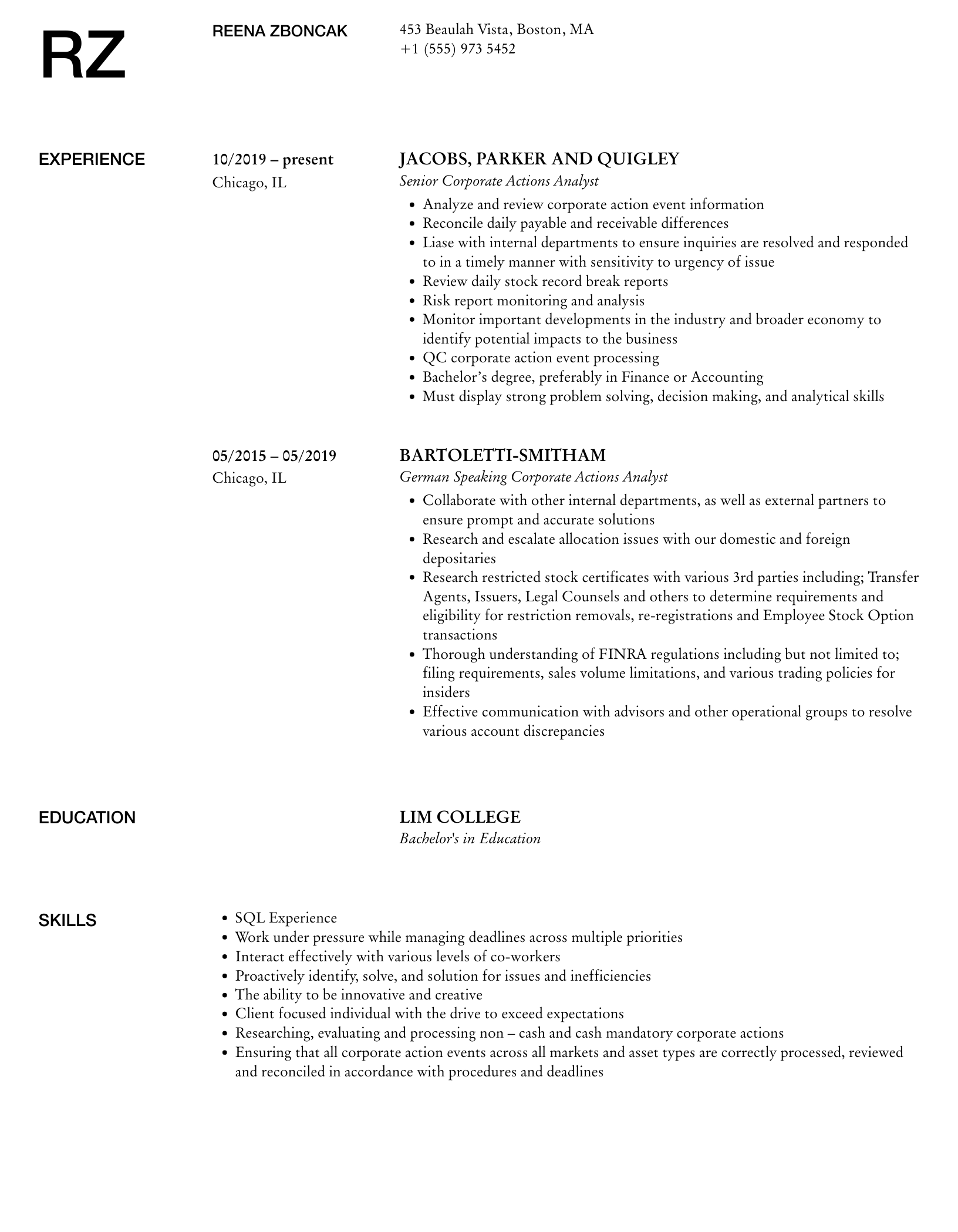

IK

I Kreiger

Isobel

Kreiger

4530 Farrell Ferry

Los Angeles

CA

+1 (555) 345 3700

4530 Farrell Ferry

Los Angeles

CA

Phone

p

+1 (555) 345 3700

Experience

Experience

Philadelphia, PA

Corporate Actions Analyst

Philadelphia, PA

O'Reilly-Rempel

Philadelphia, PA

Corporate Actions Analyst

- Provide support to Manager on the performance and development of processing staff within the team

- Overseeing and developing members of the team to ensure they work effectively together providing daily support and guidance to team members

- Providing feedback on custodian and vendor performance to the management team

- BlackRock provides an extensive Talent Management program with defined annual objective setting and a twice yearly review process

- General office duties/ Provide support to managers of the desk

- Provide support to the management team on ad-hoc projects, and provision of cover for holiday / absence periods under support and guidance

- Ensure all corporate action events are captured, and validated, working with 80+ global custodians & 10+ service providers

Philadelphia, PA

German Speaking Corporate Actions Analyst

Philadelphia, PA

Cassin, Reichert and Brekke

Philadelphia, PA

German Speaking Corporate Actions Analyst

- Escalate processing errors and potential risks to line manager upon discovery

- Innovative thought process to help develop processes

- Work well under pressure and meet strict deadlines

- Process high volumes of work with excellent accuracy and attention to detail

- Assist with Team/ Department Projects"

- Where relevant provide detail of exceptions and resolution date to Team Leader

- Provide Support to other Processors on the Team and Department

present

New York, NY

Senior Corporate Actions Analyst

New York, NY

Windler, Sauer and Stehr

present

New York, NY

Senior Corporate Actions Analyst

present

- Identifying and implementing process improvements to benefit internal stakeholders and our clients

- Assessing corporate action processes across the wealth platform to ensure compliance to tax and regulatory frameworks

- Monitor the workload of the staff ensuring responsibilities are completed in a timely and accurate manner. Recommend changes if necessary

- Completed or currently completing qualifications in CA/CPA would be highly considered

- Review custodian reconciliations prepared by the Portfolio Administration personnel to ensure that all corporate actions have been properly recorded and settled

- Arrange acceptance, payment and settlement of placing and underwriting participations

- Lodge Class Action claims and ensuring effective delivery and clearance of all settlement distributions

Education

Education

Bachelor’s Degree in Business

Bachelor’s Degree in Business

Ball State University

Bachelor’s Degree in Business

Skills

Skills

- System Knowledge - ability to quickly learn new processing systems

- Strong knowledge of math and proven ability to perform mathematical equations

- Excellent knowledge of BNY Mellon systems and processes

- Have strong interpersonal skills, ability to communicate at all levels

- Demonstrate good time management, ability to prioritise tasks and to meet deadlines

- Excellent communication skills and ability to present to an audience

- Strong investigation and reconciliations ability

- Process high volumes of work with excellent accuracy and attention to detail

- Good attention to detail

- Possess strong interpersonal skills with an ability to communicate constructively at all levels

10 Corporate Actions Analyst resume templates

Read our complete resume writing guides

1

Corporate Actions Analyst Resume Examples & Samples

- Research, monitor, and process corporate action information in our Trading and Portfolio Accounting systems

- Maintain corporate action information in our databases. Ensure information is entered and distributed in an accurate and timely manner. Ensure all updates are made in each appropriate system

- Analyze market activities such as price movements to validate corporate action events affecting securities in our investment portfolio’s

- Ensure complete and detailed supporting documents are on file for our internal and external auditors

- Ensure all inquiries relating to corporate actions are addressed within our service level agreement

- Assist in any special projects as requested

- Requires sound knowledge of the financial markets, investment securities and accounting concepts. Requires strong customer focus to work with more senior level personnel from management, Portfolio Management, Trading, Fund Accounting, Portfolio Administration and Fund Tax

- Bachelor’s degree in business related major or equivalent experience

- One to three years of work experience in the investment industry is desired but not required

- Proficient in MS Office applications

- Work well in a daily deadline oriented environment

- Very good command of English both spoken and written - the role is entirely English speaking

2

Corporate Actions Analyst Resume Examples & Samples

- Research, evaluate, and process corporate action information from various external sources on a daily basis or as received

- Maintain corporate action information databases and ensure information is entered and distributed in a timely and accurate manner. Ensure all updates are made in each appropriate system

- Prepare, process and disseminate capital change information to users in a timely and accurate manner. Set up all CA security masters for all securities generated by a capital change and coordinate price movements with Pricing department. Provide user support for all capital change related questions

- Research and evaluate late corporate action information from various external sources. Contact external sources when needed

- Education Requirement – Bachelor’s in commerce and accounting domain necessary

- Experience Requirement – relevant experience in the securities market

- Background in finance desirable

- Experience in related line of business desirable (trade settlements, corporate actions, securities processing)

- Good communication skills required – both oral and written

- Proficient in MS Office Applications

3

Voluntary Corporate Actions Analyst Resume Examples & Samples

- Understand / reduce the risk associated with Corporate Action events accross several Markets and Entities

- Interact with other financial institutions, various business units and other department members regarding liabilities and event details

- Research queries from external clients and other internal areas (i.e. Finance, Settlements, Confirmations, Risk, etc)

- Position requires extensive interaction with traders and support partners in Finance, Operations and Technology

- Project work is expected, including process enhancement initiatives and system testingQualifications

4

Corporate Actions Analyst Resume Examples & Samples

- Communication with Team Leaders and Global team managers to facilitate and support the global team structure

- Candidates should possess a good understanding of Financial Markets preferably with some experience within an Investment Management or Global Custody environment

- Experience within a Corporate Actions environment would be an advantage but is not essential for this role as training will be provided

- Strong analytical skills with an ability to identify problems and develop solutions

5

Corporate Actions Analyst Resume Examples & Samples

- Ensure all corporate action events are captured, and validated, working with 80+ global custodians & 10+ service providers

- Liaise with Portfolio Managers and Research Analysts and representatives from Legal, Compliance, among others to determine eligibility and share info and seek recommendation and instructions regarding events

- Liaise with External parties such as the issuing company, stock exchanges, depository companies, service providers, custodians, among others to determine and clarify terms of the corporate action event and determine its applicability for the holdings in the accounts managed by FTI

- Liaise with other FTS Departments including Security Maintenance (SM), Pricing, Reconciliations, NAV Analysis and Fund Tax to ensure appropriate processing into FTS systems

- Take full responsibility for adherence to all departmental procedures, policies, checkpoints and controls

- Liaise with internal departments to ensure queries are resolved / responded to within a timeframe and manner sensitive to the urgency of the event, thereby ensuring that internal / external client satisfaction is maintained

- Interact with other internal teams and the third parties/custodians as appropriate

- Escalate all material risk items and service issues to your Supervisors/Manager on a timely basis

- Communication with Global Supervisors and Global team managers to facilitate and support the global team structure

- Follow-up, escalate and get required information in a deadline driven environment

- Assess the situation, exercise good judgment about criticality and resolve problems encountered

- Work on multiple problems at the same time and to keep all appropriate personnel apprised of current activity and events. This would entail dealing with various external and internal contact persons, including at senior levels across Portfolio Management and companies and therefore requires good communication & service skills

- Organize work well so as to be on top of all issues in daily deadline-driven environment

- Be a self-starter and work with minimal supervision, post the initial training

- Sound knowledge of the financial markets and various security types

- Good verbal and written communication skills & Strong interpersonal skills with an ability to communicate constructively at all levels

- Well organized and focused in order to meet tight deadlines and client expectations

6

Securities Operations Corporate Actions Analyst Resume Examples & Samples

- Strong command in both written and verbal English and Cantonese, Putonghua optional

- Ability to apply firm's policieis and procedures to daily work

- Strong operations focus with good control sense

- Proficiency in Microsoft Office application; good Excel macro skill is a plus

- Innovative mindset to be part of an ever changing process improvement environment

7

Caip-voluntary Corporate Actions Analyst Resume Examples & Samples

- Ability to work under pressure to meet various deadlines during the day

- Knowledge of Microsoft Office suite (Word, Excel) mandatory

- Ability to understand the Corporate Action booking flows

- Candidate must be accurate and a fast worker, with good attention to detail

8

Caip Mandatory Corporate Actions Analyst Resume Examples & Samples

- Ability to work under pressure to meet deadlines

- The ability to handle problem solving

- Work in a team environment

- Good oral and communication skills

- Organization skills a must

- Ability to understand the trade flows for UBS Investment Bank business and Corporate Action booking flows

- Good front to back knowledge of equity flows and systems

- Good market knowledge of North American region

9

Black Rock Corporate Actions Analyst Resume Examples & Samples

- Ensure all necessary corporate action instructions are issued and acknowledged by custodians and counterparties

- On a daily basis ensure that all corporate action events across all markets and asset types (equities, fixed income and derivatives) are correctly processed, reviewed and reconciled as necessary in accordance with procedures and event deadlines

- Escalate all material risk items and service issues to your Team Leader/Manager on a timely basis

- Participate in local, regional and global initiatives/projects in conjunction with the Global Corporate Actions team

- Candidates should possess a good understanding of Financial Markets preferably with experience within an Investment Management or Global Custody environment

10

Corporate Actions Analyst Resume Examples & Samples

- Processing and Auditing Events - 60% of time

- Bachelor#s degree in Business, Finance, Accounting, or progress towards degree or equivalent work experience

- Minimum one (1) year securities processing and/or industry experience preferred

- Knowledge of DTC and/or Federal reserve systems are a plus

- Knowledge of cash/securities clearance processing preferred

- Possess excellent written and verbal communication skills

- Possess professional customer service skills

- Strong mathematical and organizational skills

- Ability to work in stressful environment and meet deadlines

- Ability to multi-task with high attention to detail

- Proficiency in MSExcel, MSWord

11

Position Services Corporate Actions Analyst Resume Examples & Samples

- Retrieve from either DTC?s corporate action projection utility (Reorg Inquiry for Participants System / RIPS function) or through our SWIFT interface for our custodian NA Custodian network (i.e.: RBC in Canada, Citibank in Mexico), all the anticipated mandatory corporate actions that are pending allocation for each day

- Retrieve, review and analyze the terms of the event and impact to our Client?s positions

- Review and analyze the Firm?s stock record for each impacted issue (cusip driven). Reconcile any differences (breaks) and initiate any required consolidations to ensure a seamless payment process (i.e.: recall bank loans)

- Create, maintain and record-keep for the event in accordance with the Department?s procedures; inclusive of, but not limited to, folder creation, processing authorizations, gathering of required supporting documentation, checklist maintenance, tax documentation (if applicable) and communications (internal and external)

- Monitor, throughout the day, DTC's payment utility to verify receipt of our client?s allocation resulting from the event

- Initiate, upon receipt of the pmt, a notification (via the Notification & Response System) to all impacted accounts outlining the terms of the event and the timing of the payment for that day. In addition, the processor will initiate, within the appropriate internal corporate action payment system, the payment to all impacted accounts on the Firm?s books and records

- Facilitate the mandatory event with the Firm?s contra-parties for all open transactions; inclusive of, but not limited to Broker to Broker Fails, Open Loans or Borrows, and Open Institutional Client trades

- Reconcile the Firm?s corporate action processing accounts to ensure all positions and balances are cleared or properly detailed for management review, inclusive of all internal processing account, custodian related sub-accounts, and omnibus

12

Corporate Actions Analyst Resume Examples & Samples

- End-to-end corporate action event life cycle across cash, non-cash and elective events for all equity and fixed income securities traded by the bank

- Processing client elections, entitlements and counterparty claims

- Interacting with external agents; custodians, clearers and depositories

- Responding to queries from middle-office, finance and other interested parties

13

Cib Voluntary Corporate Actions Analyst Associate Resume Examples & Samples

- Ability to perform at a high level in a fast paced, deadline driven environment

- Candidate must have excellent organization skills and self-motivated

- Good verbal and written communication skills & strong interpersonal skills with an ability to communicate constructively at all levels

14

Senior Corporate Actions Analyst Resume Examples & Samples

- Ensure a proper understanding of the event that has been achieved

- Oversee the general approach with regards to all front office communications

- Market research using third party vendors such as Bloomberg, IDC, IR, etc

- Support all escalated inquiries

- Consider all downstream impacts

- Maintain and mater the use of all work tools associated with our process

- Ensure all instruction deadlines are met

- Maintain a sound understanding of our accounting system and provide guidance on how to reflect the corporate action transitions in the portfolios

- Identify special handling needs early on in the life cycle and ensure that the proper communication and escalation takes place

- Lead various initiatives outside of the day to day core responsibilities

- Act as the conduit between the Corporate Action group and all global custodian banks to resolve all daily production issues

- Four year college degree in business-related field or equivalent experience

- Three to five years of financial experience in securities/investment business

- Sound knowledge of financial markets and various security types

- Excellent interpersonal and leadership skills

- Strong technical, analytical, and organizational skills

15

ETF Corporate Actions Analyst Resume Examples & Samples

- Collect, compile, analyze and verify corporate action information from multiple information and data sources prior to effective date

- Interact with Portfolio Managers to ensure all necessary corpoprate actions are received and acted upon

- Become an expert in the index methodologies and application at the fund level

- Anticipate index events and provide operational support to facilitate efficient trading around index events

- Investigate any discrepancies and resolve in a timely manner

- Must work closely with colleagues in other Invesco teams, 3rd party data providers, index calculators, custodial banks, operations support teams and portfolio managers

- While this position is primarily focused on corporate actions, other investment supporting functions may be required as dictated by the business and the ETF Operations team

- Develop metric reporting and manage process. Look for continuouse improvement ideas

- 2-3 years directly related work experience in Financial Industry is preferred

- 1-2 years in Operations role with corporate action experience

- ETF experience is a plus

- Ability to multi-task in a fast paced team environment

- Detail and control-oriented

- Proficiency in Excel, Word and Powerpoint

- Ability to analyze complex and extensive securities-related documentation and summarize details

16

Position Services Corporate Actions Analyst Resume Examples & Samples

- Validate full range of international corporate actions, from simple events such as Cash Dividend and Returns of Capital, to more complex events like Mergers and Optional Exchanges

- Peform front to back processing of corporate action events, including set up, validation, payment and reconciliation

- Extensive interaction with various departments including international Position Services groups, Prime Brokerage and Controllers

- Field high volume of diverse inquiries from various consumers business units and stakeholders

- Interface with external corporate action data providers, counterparties, industry utilities and third party service providers

- Scrutinize day to day processes, technology platforms and workflows, and identify and implement opportunities for enhancement and improvement

- Participate in system testing and respond to ongoing demands for increased coverage and service

- Proficiency in navigating internet and web-based applications

- Interpret wide range of reference materials. Utilization of 3rd party information providers interfaces (e.g. Xcitek, Bloomberg, SWIFT, etc.), as well as those of Agents and Exchange

- Detail-oriented, maintains accurate and complete records

- Shows initiative, is self motivated and also works well with a team

17

Corporate Actions Analyst Resume Examples & Samples

- Responsible for assisting with the daily operation of the team, ensuring timeliness and accuracy of service

- Monitoring the clearance of all cash and stock exceptions

- Assist the Section Manager with the facilitation of the day-to-day workflow within the team to ensure effective workload taking into account the complexity and size of the event, via the Risk Review Process

- Overseeing and developing members of the team to ensure they work effectively together providing daily support and guidance to team members

- Ensure that departmental controls, checklists, policies and procedures are adhered to by team members

- Ensure all client responses are sought and acted upon in a timely manner

- Perform end of day checks to ensure that all Break queues, aging items and checklists have been reviewed and updated by the team

- Liaise with internal departments to ensure queries are resolved / responded to within a timeframe and manner sensitive to the urgency of the event and OLA specification, thereby ensuring that internal / external client satisfaction is maintained

- On a semi-annual basis work with team members to review and where necessary seek approval for updates from senior managers to procedures, urgent changes to processes or procedures should be documented and escalated immediately

- Provide effective team communication on changes impacting the team, including market changes, functional moves and procedural / service changes

- Provide input into department projects, system updates and testing. Additionally keep up to date with market and economic changes impacting corporate actions

- Investigate opportunities for self-development and improving knowledge of the business that you are servicing in order to improve skills and knowledge and deliver maximum service levels

- In the event that a situation arises where you are unsure how to proceed then you should immediately escalate to your manager for support and guidance and ensure that your team members escalate issue to you

- Provide support to the management team on ad-hoc projects, and provision of cover for holiday / absence periods under support and guidance

- Forward Planning

- Results Focus

- Drive for Excellence

- Developing Others

- Interpersonal Awareness

- Self-Performance Improvement

- Self Belief

- Good knowledge of corporate action processing

- Strong desire for excellence with a conscientious approach

- High level of risk awareness

- Developing people management skills

- Minimum education to GCSE level or equivalent – 5 passed (including Mathematics and English) – essential

- A-Levels/Degree - preferable

- Prepared to complete industry qualifications, as required – essential

18

Corporate Actions Analyst Resume Examples & Samples

- Assists in research and implementation of new investment types (specifically “hard-to-value” securities) to ensure appropriate valuation methodologies are available to support the global regulatory environment

- Maintains up-to-date technical knowledge of existing and new investment valuation issues in the global asset manager industry

- Researches and presents recommendations on fair valuation approaches for investments that do not have a reliable independent valuation source (“hard-to-value” securities)

- Performs periodic in-depth analysis of third party provided valuations, including the data points and assumptions used, to confirm the valuations are reasonable and appropriate relative to comparable market information

- Participates as needed with Pricing Analysts in the completion of the daily valuation process for various Invesco product lines

- According to established procedures, reviews and analyzes third party valuations received daily to ensure reliability

- Develops and supports relationships with third party agents and pricing vendors to ensure reliability of complex investment valuations

- Assists in the documentation and reporting of valuation issues and educational materials to various Invesco Valuation Committees and Fund Boards

- Answers queries from Invesco staff such as Fund Accountants, Compliance, Legal, internal and external auditors and Investments personnel

- Assists in developing and implementing internal control procedures as it relates to security valuation analysis and documentation adhering to regulatory and accounting standards

- This includes aiding the department and other Invesco units in understanding/implementing security valuation procedures and controls through various communication methods

- Normal office environment with little exposure to noise, dust and temperatures

- The ability to lift, carry or otherwise move objects of up to 10 pounds is also necessary

- Normally works a regular schedule of hours, however hours may vary depending upon the project or assignment

- Hours may include evenings and/or weekends and may include 24 hour a day on call support by pager and/or cell phone

- Clear evidence of analytical skills relevant to managing a variety complex valuation issues

- Valuation issues including but not limited to structured fixed income products, OTC derivatives, private equities and other alternative investments

- Must understand and be able to explain key financial concepts and how they contribute to the generation and analysis of valuations

- Valuations including but not limited to the “Greeks” for OTC derivatives, durations, yield and prepayment speeds for fixed income, and EBIDTA for private equities

- Must have the ability to research and communicate industry practices, risks and controls, and operational concerns related to the valuation of new and complex and hard-to-value investments

- Must be able to utilize computer equipment and software at a level of proficiency that supports analysis and valuation of complex securities

- Must have working knowledge of common market data services such as Bloomberg or Thomson Reuters

- Must have the ability to handle multiple tasks, prioritize work, meet deadlines and concentrate on detailed information

- Must have excellent communication skills with the ability to present information in a concise and informative manner

- The ability to contribute in a team environment is critical

19

Corporate Actions Analyst Resume Examples & Samples

- Ability to follow-up, escalate and get required information in a deadline driven environment

- Ability to assess situations, exercise good judgment about criticality and resolve problems encountered

- Ability to work on multiple problems at the same time and to keep all appropriate personnel apprised of current activity and events. This would entail dealing with various external and internal contact persons, including at senior levels across Portfolio Management and companies and therefore requires good communication & service skills

- Ability to organize work well so as to be on top of all issues in daily deadline-driven environment

- Ability to work with minimal supervision, post the initial training

20

Corporate Actions Analyst Resume Examples & Samples

- Responsible for assisting with the daily operation of the team, ensuring all OLAs are met relating to timeliness and accuracy of service

- Assist the Section Manager with the facilitation of the day-to-day workflow within the team to ensure effective workload taking into account the complexity and size of the query and the level of experience and expertise of the specialist

- Assists with the management of departmental client calls and visits as required

- Proactive management of all key client relationships and communication flow for the department ensuring regular updates are given to management from designated contacts regarding issues / themes

- Perform end of day checks to ensure that all queues, aging items and checklists have been reviewed and updated by the team

- Provide support to management with effective team communication on changes impacting the team, including market changes, functional moves and procedural / service changes

- Escalate to manager for support and guidance where necessary and ensure that team members escalate issues appropriately

21

Cib-voluntary Corporate Actions Analyst Resume Examples & Samples

- At least 2-5 years of Corporate Actions processing and event setup experience, preferably on the Broadridge ADP / BPS application

- Familiarity with Global markets a plus

- Assess and quickly resolve issues

- Multitasking and handling of multiple outstanding issues

- Well organized and detailed oriented

22

Corporate Actions Analyst Resume Examples & Samples

- The candidate will be responsible for processing of all Corporate Action and Income events within their designated section and will work closely with other Team Members and the Team Leader/ Section Manager of the group to address operational issues and work on other Strategic Initiatives

- The candidate will have a good understanding of Global Equity and Fixed Income markets, across Voluntary and Mandatory Events

- Responsible for ensuring that day to day processing requirements are complete and controls are adhered to

- Other responsibilities include event capture, pre/post reconciliation, Client enquiries and Client Instruction handling. Preparation of Management reports and Departmental initiatives, and interfacing with the different teams and the various Asset Servicing locations to ensure timely and accurate processing of all activities on a daily basis within the given timelines. The candidate would also be a key participant for other activities like operational risk and control forums

- The candidate will be self motivated with a continuous focus on Global Strategy Development, be able to drive change keeping in mind the organisations key objectives of Control, Capacity, Cost, Client and Completeness

- Ensure the timely resolution of all Cash and Stock Breaks

- Provide Support to other Processors on the Team and Department

- Complete User Acceptance/ Regression Testing on enhancements to system

- Participate in Contingency Testing

- Extensive years of experience working within an asset servicing role

- Ability to multi-task

23

Corporate Actions Analyst Resume Examples & Samples

- Bachelor’s degree in economy, finance or business related major

- Minimum 2 years of office work experience

- Fundamental knowledge of the financial markets

- Fluent English (verbal and written)

- Ability to perform multiple tasks within set deadlines

- Proactive attitude

- Self – reliance and self – discipline at work

- Comfortable working in a global environment

24

Corporate Actions Analyst Resume Examples & Samples

- The candidate will have an understanding of Global Equity and Fixed Income markets, across Voluntary and Mandatory Events

- Other responsibilities include event capture, pre/post reconciliation, Client enquirers and Client Instruction handling

- Preparation of Management reports and Departmental initiatives, and interfacing with the different teams and the various Asset Servicing locations to ensure timely and accurate processing of all activities on a daily basis within the given timelines. The candidate would also be a key participant for other activities like operational risk and control forums

- The candidate will be self-motivated with a continuous focus on Global Strategy Development, be able to drive change keeping in mind the organisations key objectives of Control, Capacity, Cost, Client and Completeness

- Assist with Team/ Department Projects

- One to two years of experience working within an asset servicing role

- Exceptional candidates who do not meet these criteria may be considered for the role

- Provided they have the necessary skills and experience

- Bachelor's degree in Business or related discipline

- Valuing Diversity: Demonstrates an appreciation of a diverse workforce. Appreciates differences in style or perspective and uses differences to add value to decisions and organisational success

25

Corporate Actions Analyst Resume Examples & Samples

- Degree or equivalent qualification preferred but not necessary

- Strong technical knowledge of Corporate Actions processing

- Demonstrated track record of managing risk across all aspects of Asset Services

- Experience with stock borrowing and lending within a corporate event

- Prime Brokerage and Securities lending experience

- Candidate should be proficient in front to back processing of corporate actions, be able to risk manage events and process the event from event capture to final reconciliation. Candidate should be able to recognise risk and escalate where necessary to senior management

- Demonstrate good time management, ability to prioritise tasks and to meet deadlines

- Have strong interpersonal skills, ability to communicate at all levels

- Are comfortable with the demands of working in a pressurised environment

- Detailed level of understanding of Corporate Actions both voluntary and mandatory

- Control - exhibits an appreciation of the risk impact of actions undertaken. Strong risk management focus

- Displays a high attention to detail

- System Knowledge - ability to quickly learn new processing systems

- Prioritisation - ability to prioritise heavy workloads and work efficiently under pressure and stressful situations

- Analytical - Excellent reconciliation skills

- Ability to anticipate problems and potential risk

- Identifies weaknesses in processes and takes ownership for change

- Experience processing corporate actions at an Investment Bank

- Efficient time and risk management skills

26

Corporate Actions Analyst Resume Examples & Samples

- Record corporate actions in applicable systems, including appropriate self-review of information recorded

- Provide Investment personnel voluntary corporate actions information and send responses to specific custodians or other interested parties in a timely and accurate manner

- Maintain documentation and support for all corporate action information

- Answer queries from third party accountants, Data Management personnel, external/internal auditors, Investments personnel and other Invesco business units

- Review custodian reconciliations prepared by the Portfolio Admininstration personnal to ensure that all corporate actions have been properly recorded and settled

- Complete special projects as required

- Assist other Invesco operations and Data Manangement teams when necessary

- Contribute to the improvement of the daily group process

- Broad understanding of all corporate action procedures

- Develop relationship with custodians, vendors and other Invesco business units to provide support with complex corporate actions

- Serve as a mentor to tier I Analysts and provide support and cover to Senior Analyst

- Maintain the timely and accurate accrual of dividends at ex-date and ensure accurate settlement of dividends on pay date

- Lodge Class Action claims and ensure effective delivery and clearance of all settlement distributions

- Process, Repos, and Factored Bonds

- Arrange acceptance, payment and settlement of placing and underwriting participations

- Proven experience in an Investment Management or accounting industry

- IAQ certificate or equivalent combination of education, training and experience to fulfill the job criteria

- Must have a thorough understanding of accounting and financial principles as it applies to corporate actions and daily pricing issues, monthly reconciliations, and tax related issues

- Must posses strong analytical skills in order to solves issues of moderate complexity, be proficient in reviewing detailed financial data and show initiative in problem solving and follow up

- Must be proficient in the use of computer equipment and software, specifically spreadsheet applications and mutual fund accounting systems

- The ability to cooperate in a team environment is critical

27

Corporate Actions Analyst Resume Examples & Samples

- The end-to-end corporate action event life cycle across non-cash and elective events for all equity securities traded by the bank for AU and NZ markets

- Processing adjustments to derivative products over Corporate Action events

- Processing trading desk and client elections, entitlements and counterparty claims

- Interacting and responding to queries from traders, middle-office, finance and custodians

- Provide CA expertise to internal stakeholders

28

Corporate Actions Analyst Resume Examples & Samples

- Responsible for processing all forms of corporate events like balancing and reconciliations related to mergers, conversions and redemptions

- Responsible for identifying and resolving problems within established guidelines

- Running and creating formal reports

- Working towards becoming proficient in all areas of the job

- Knowledgeable of the core aspects of the job

- Works effectively as a team member but also independently

29

Corporate Actions Analyst Resume Examples & Samples

- Review custodian reconciliations prepared by the Portfolio Administration personnel to ensure that all corporate actions have been properly recorded and settled

- Have a broad understanding of all corporate action procedures

- Assist in the completion of Board of Director reports and other financial data requests when necessary

- Assist in the review of pricing variance and exception reports when necessary

- Process Repos, and Factored Bonds

- Previous accounting or Corporate Action experience preferred in an Investment Management Company or similar environment

- A willingness to study for the IAQ (UK)

- Interpersonal skills necessary to interact effectively with a variety of individuals are required. Must have a fundamental understanding of accounting and financial principles as it applies to corporate actions and daily pricing issues, monthly reconciliations, and tax related issues. Must have analytical skills to solve fundamental corporate action and pricing issues as well as the ability to review detailed financial data

- Must have the ability to organize work to meet deadlines

- Must be able to utilize computer equipment and software, specifically spreadsheet applications and mutual fund accounting systems

30

Corporate Actions Analyst Resume Examples & Samples

- The incumbent needs to be numerically and computer literate due to the numerous system applications

- Must have eye for detail

- Must have good excel, Word and PowerPoint skills

- Good communication and client service skills

- Educated to A-Level standard minimum

31

German Speaking Corporate Actions Analyst Resume Examples & Samples

- Where relevant provide detail of exceptions and resolution date to Team Leader

- Ensure MIS is recorded on a weekly basis

- Ensure all daily DCFC checklists are completed

- Assist with Team/ Department Projects"

- Fluent German

- Extensive years of experience working within financial services

- Income and Corporate Actions or Asset Servicing past experience is a benefit

- Innovative thought process to help develop processes

32

Corporate Actions Analyst Resume Examples & Samples

- Receive incoming notifications from agent and data vendor(s),

- Cleanse data ,analysing impact of events and processing 'approach' required,

- Set up and process events on the accounting system(s)

- Monitor for full, timely and appropriate return of Fund Manager Instructions and initiate instructions out to agents

- Ensure completion of all processing through to share availability

- Maintain static data (custodian contacts etc)

- Maintain data for collation and provision of MIS

- Actively participate in team discussions that lead to quality, resource and target orientated improvements

- Incident/regulatory breach reporting

- Has relevant experience in Investment Operations, particularly Corporate Action related activities

- Has understanding of wide range of Corporate Action event types across major markets and across all instrument types

- Has extensive knowledge of the EMEA and APAC markets and processing methods

- Is Corporate Actions swift literate

33

Senior Corporate Actions Analyst Resume Examples & Samples

- According to established procedures, lead and guide staff in collecting, compiling, analyzing and verifying corporate actions information from multiple information and data sources

- Assist training the analysts in all aspects of the groups’ responsibilities. This includes aiding the department in understanding and implementing new corporate action procedures

- Provide Investment personnel voluntary corporate actions responses to specific custodians or other interested parties in a timely and accurate manner

- Review Analyst I & II corporate action data for accuracy, reasonableness, and documentation throughout all key stages of each an event

- Collect, compile, analyze and verify corporate action information from multiple information and data sources

- Record corporate actions in applicable systems, including appropriate self-review of information recorded. Maintain documentation and support for all corporate action information

- Answer queries from third party accountants, external auditors, Investment personnel and other Invesco business units

- Complete special projects as required. Continually monitor the daily group process and recommend enhancements when necessary. Assist other Analysts with their daily tasks when needed

- Broad understanding of all corporate action procedures and looking to implement change when necessary

- Serve as a mentor to other tier I and tier II Analysts with any issues or questions

- Monitor the workload of the staff ensuring responsibilities are completed in a timely and accurate manner. Recommend changes if necessary

- Assist in the completion of Board of Director reports and other financial data requests as requested

- Lodge Class Action claims and ensuring effective delivery and clearance of all settlement distributions

- Proven securities/investment industry experience, two of which are in the mutual fund industry, is required. Supervisory experience is preferred

- A solid understanding of the financial markets, corporate actions, and general accounting skills

- Must possess strong analytical skills in order to solves issues of moderate complexity, be proficient in reviewing detailed financial data and show initiative in problem solving and follow up

- Must have the ability to organize and prioritize responsibilities to meet deadlines

- A Bachelor’s degree in Accounting or Finance is required or an equivalent combination of education, training and experience that would provide the knowledge, skills and ability required

- IAQ certificate or equivalent combination of education, training and experience to fulfill the job criteria (UK)

34

Corporate Actions Analyst Resume Examples & Samples

- Outstanding written and communication skills essential

- Prior experience working within a financial institution with an understanding of custody functions and financial market operations is desirable

- Strong analytical and problem solving skills with a high attention to detail

- Demonstrated attributes to support a large team to manage business requirements

- Tertiary qualified in Finance/Accounting/Business would be highly considered

35

Voluntary Corporate Actions Analyst Resume Examples & Samples

- Interpreting complex voluntary re-organization offers. Presenting details of offerings to the client base (incl. Prime Broker and Trading Account Representatives) in an accurate, condensed, timely, and professional manner

- Sending liabilities to the relative parties

- Interface with Securities Lending and Repo desks

- Accountable for reconciling events in entirety and subsequent differences

- Ensure all relevant documentation and recordkeeping is maintained within event files

- Responding to verbal and non-verbal inquiries

- Occasional testing system upgrades

- Technical/Business Skills and Knowledge

36

Corporate Actions Analyst Resume Examples & Samples

- Researching, evaluating, and disseminating corporate action information from various external sources on a daily basis or as received

- Tracking responses/instructions received from clients, custody investment advisors and submitting to sub-custodian in a timely manner

- Maintaining corporate action information databases and ensuring information is entered and distributed appropriately to client service teams, custody advisors and clients in a timely and accurate manner

- Ensuring all updates including client contact information are made in each appropriate system

- Processing corporate actions based on the terms of the action and according to US tax consequence as required

- Ensuring set-up of all CA security masters for all securities generated by a capital change and coordinating price movements with Pricing Department

- Providing support and responding to inquiries for all capital change related questions from both internal and external clients

- Serving as backup for Senior Corporate Actions Analyst and assisting on special projects as requested

- Bachelor’s degree in a business-related major or equivalent training

- 1 to 3 years of work experience in the financial industry, with an emphasis on corporate action processing

- High level of proficiency with MS Office applications

- Well-developed verbal and written communication skills

- Strong organization skills and high degree of detail orientation

- Proven ability to work within a team and within a daily, deadline-oriented environment

- Working knowledge of office equipment (printers, copiers, faxes, multi-line phones, etc.)

- A keen sense of ownership, responsibility and accountability

- Demonstrated experience in solving routine problems of limited scope and complexity following established policies and procedures

- Ability to maintain a professional image

37

Corporate Actions Analyst Resume Examples & Samples

- Manage and complete all corporate actions instructions and enquiries received within all agreed and referenced deadlines

- Provide a detailed working knowledge and understanding of all functions within the desk to clients, not limited to

- Offering documentation review experience (specifically knowledge of ICMA/ISDA)

- Corporate Actions knowledge

- Strong knowledge of Excel/ Word is necessary

- Capital Markets middle office or back office/ Agency and Trust /Corporate Trust Operations experience

- PC proficient

- Excel, Word, Outlook

- Quick and accurate numerical keying skills

- Leaving Cert educated or equivalent

38

Corporate Actions Analyst Resume Examples & Samples

- Responsibilities include the following

- Processing of Free Receives & Delivers

- Maturity process and collection of receivables

- Processing transactions related to Private Placements

- Processing of Open Orders and Distributions

- Processing of Reversals and Re-processing of trades as per client request

- Backdating the transactions to past date with due authorizations

- Understanding Cost Basis Reporting concerns and processing the necessary adjustments

- Assist in any special projects as requested and assist other staff as necessary

- Processing all requests in the GMB and completing them with daily deadlines related to Free Receives & Delivers, Private placements, Reversals & Backdates

- Processing of Incoming free Receives in client accounts with cost details & delivering out assets to other custodian (Domestic & Global assets)

- Following up with CSA for cost details during Free Receives and validating the cost details prior to recording the asset

- Reconciling assets and cash breaks with custodian records and in case of discrepancies, need to work with TACC and to understand the outstanding items and making necessary adjustments for closure

- Transfer of securities between the client accounts as authorized

- Maturity processing and collection of receivables with custodian records

- Processing of Interest payments which are associated with Maturity

- Private Placement security – book keeping of records in client records

- Processing Open Orders and distributions for Pool investment securities

- Updating Daily NAV rates of different Funds in Global plus application

- Research, evaluate and disseminate Cost Basis Reporting concerns and processing the adjustments of Amortization, Date of Death, and cost adjustments

- Reversing the transactions which need a correction

- Event reversals should be done when events require modifications

- Re-posting of trades/transactions with amendments is required to pair off the reversal transaction in client accounts

- Understanding Cost Basis Reporting concerns and processing the adjustments of Amortization

- Cost adjustments as per Client requests

- Revision of processing codes and explanation text

- Date of Death validation: Through analysis is needed prior to DOD validation is done; post that necessary adjustments should be processed

- Amortization Reconciliation: On a monthly basis, amortization adjustments should be performed for Bonds securities and ensure amortization values are accurate in all client accounts

- Serve as backup for Senior Analyst

- Customer support

- Education Requirement – MBA (Finance) and accounting domain necessary

- 2 – 3 years’ experience requirement – relevant experience in the securities services

- Ability to work independently and as a member of a team which includes the ability to be flexible and adaptable, and take initiative on one’s own

- Innovative thinking

- Strong communication skills required – both oral and written

- Ability to analyze complex situations and generate brief conclusions

- Ability to manage multiple priorities and tasks

- Ability to learn new technology and systems, and adapt to a rapid pace of change

- An educational assistance program to financially help employees seeking continuing education

- Medical, Life and Personal Accident Insurance benefit for employees. Medical insurance also cover employee’s dependents (spouses, children and dependent parents)

- Personal loan assistance

39

Senior Corporate Actions Analyst Resume Examples & Samples

- Strong knowledge of tax and portfolio reporting with 2 years of experience working in market operations

- Experience working as part of a team to manage business requirements

- Outstanding written and communication skills

- Proven leadership and personnel management skills

- Excellent time management skills to meet multiple business deadlines in a fast pace environment

- Completed or currently completing qualifications in CA/CPA would be highly considered

40

Junior Corporate Actions Analyst Resume Examples & Samples

- Outstanding written and communication skills is essential

- Prior experience working within a financial institution with an understanding of market operations is desirable

- Ability to support a large team to manage business requirements

- Strong problem solving skills with a high attention to detail

- Ability to manage high volume of tasks in a fast pace environment

- Tertiary qualifications in Finance/Accounting/Commerce would be highly considered

41

Corporate Actions Analyst Resume Examples & Samples

- Ability to interpret complex event terms, global market regulations and practices

- Ability to discuss event terms with counterparties, custodians and Financial Advisors on a daily basis

- Reconciliation and balancing of multi currency ledger and client accounts on a daily basis

- Accurate input of elections received to custodians in the marketplace

- Provide responses to service related inquiries via telephone and email channels

- Ability to execute events along with ad hoc requests at the same time

- College degree or related work experience

- Presentable, confident and client focused

- Client facing experience or ability to conduct discussions with Clients in a confident manner

- Excellent communication skills and ability to present to an audience

- Ability to work under pressure and in a team environment

- Ability to liaise with all levels of the firm and people with differing experiences and backgrounds

- Self motivated and able to work unsupervised

- Manage own time and know when to escalate

- Previous experience within Corporate Actions

- Series 7 licensed

42

Corporate Actions Analyst Resume Examples & Samples

- Challenging, fun and supportive environment

- 25 days holiday (in addition to Bank Holidays) plus opportunity to purchase up to 5 extra days

- Highly competitive benefits package including pension and private medical cover

- City centre location

- Competitive discounts on travel and parking

- Discounts on a range of local retailers

- Opportunity for further academic training – including NVQ, IOC, Degree and soft skills

- Opportunity to join site wide networking groups

- Opportunity to participate in process improvement programmes (Lean, Six Sigma, Kaizen); we recognise and reward new ideas

43

Corporate Actions Analyst Resume Examples & Samples

- Verifying corporate action events and various vendor related reports

- Interpreting corporate action specific data, taxability, and cost allocation based on vendor provided information and pricing

- Providing ongoing support to the maintenance of the GainsKeeper security master file, this includes but is not limited to the reconciliation of fixed income securities

- Responsible for issue resolution with third party vendors, support of client specific applications and ad hoc projects

- Bachelor’s Degree in Business, Finance, Accounting, or related field preferred

- Experience working in the areas of operations or financial services

- A minimum of 2 years of experience working in a Corporate Actions or Data Analyst role including the following

- Analyzing vendor sources to determine key market data to include event type, rates, dates, terms, etc

- Interpreting applicable tax treatment and applying to the posting of the corporate event

- Knowledge of the fixed income securities and their attributes

- Experience processing Foreign & Domestic, Voluntary and Mandatory corporate actions

- Proficiency in all Microsoft Office products with a particular emphasis on Excel

- Bloomberg experience

- Understanding of current cost basis legislation in regards to corporate action and IRS reporting

- Team oriented individual with ability to work well with diverse groups

- Organized, detail oriented and extremely thorough, having the confidence and communication skills to ensure work processes are completed accurately and appropriately

- Demonstrated problem solving skills and ability to take initiative and critically analyze processes and procedures in a push toward constant improvement

44

Corporate Actions Analyst Resume Examples & Samples

- Act as single point of contact for selected top tier clients for Asset Servicing issues and attend regular client reviews and calls

- Liaise with respective contacts to ensure timely resolution of client issues

- Ensure necessary escalation and proper root cause analysis conducted for repetitive issues

- Educate clients to use the UBS portal to identify information where available, and where

45

Corporate Actions Analyst Resume Examples & Samples

- Utilizing the operational platforms specific to the job role

- Preparing and processing error-free transactions accurately and in a timely manner, according to instructions and according to SEI procedure

- Maintaining and updating data as needed and producing reports as required

46

Corporate Actions Analyst Resume Examples & Samples

- Escalate all material risk items and service issues to Team Leader/Manager on a timely basis

- Communication with Team Leaders and Global Managers to facilitate and support the global team structure

- Participate in local, regional and global initiatives/projects

- Candidates should possess an interest Financial Markets

- Possess a good understanding of the risk and demonstrate good discipline around control and escalation

47

Corporate Actions Analyst Resume Examples & Samples

- Ensuring all corporate actions are verified to multiple sources and processed in the Corporate Action system. This includes investigating discrepancies between inbound SWIFT MT564/8 messages and reviewing text leading to the production of a timely and accurate "Golden record" for the event

- Preparing voluntary corporate action notifications for distribution to the fund managers and trading desks

- Accruing Cash Dividends in the Accounting system through the use of Custodian MT564 SWIFT's and a Data Vendor feeding into the Corporate Action system and investigating any discrepancies

- Instructing Custodians on Optional events via MT565 messaging through BaNCS Corporate Action system and other ad-hoc means when required

- Completion of key daily ad-hoc tasks e.g. those denoted on Task Management Tool

- Support companywide project initiatives as required

48

Corporate Actions Analyst Resume Examples & Samples

- Business as usual: Ensure queries are logged and acknowledged/responded to within 24h, provide thorough investigation, especially in case of sensitive / risky items, and follow-up on pending queries with operations especially in case of aged items. On pending queries, intermediary updates should be provided to clients (internal and external) maximum every 48 hours

- Risk Management and escalation: Ensure that any risk is spotted, reacted to in a timely manner, and escalated to the Corporate Actions Inquiry Section Manager if required, providing a summary of the issue and the investigation done and work closely together with the Corporate Actions Inquiry Section Manager on resolution. In addition, ensure aged items are escalated, if required

- Communication and client management: Develop a good and sustainable relationship with internal and external parties (within all Corporate Actions processing sites and those external departments for which we regularly engage with and with our clients)

- Team evolution: Coaching the newcomers and provide regular feedback to the Corporate Actions Inquiry Section Manager In addition, share any important information with the team (event specific, system related, client related) to develop the team and increase its efficiency

- Problem Solving: Evaluates (sometimes complex) situations using multiple sources of information

- Job proficiency: A Corporate Actions Inquiry Analyst must demonstrate the necessary skills and knowledge of the corporate action business. He/she must demonstrate an understanding of his/her duties and responsibilities. Given the importance of the interactions/interpersonal skills required for the job, he/she must work across lines of business and with different parties internal and external, as required

- Personal organization: Given the need for accuracy, the Corporate Actions Inquiry Analyst must keep information organized and accessible. He/she must be able to prioritize work as required and manage his/her time effectively

- Work quality/attention to detail: Given the need for accuracy and risk control, the Corporate Actions Inquiry Analyst must use a systematic approach to achieve high-quality results with attention to detail and accuracy in order to meet the client and organization's needs whilst being able to juggle with multiple demands and requests simultaneously

- Initiative/sense of urgency: The ability to tackle problems and to take responsibility when dealing with difficult situations as well as the ability to prioritize based on business needs and client's specificity are key for a Corporate Actions Inquiry Analyst

49

Corporate Actions Analyst Resume Examples & Samples

- Oversee the processing of the mandatory corporate action events for all domestic and international accounts (ie dividends, splits, mergers, rights offerings, etc.), ensuring that all events are processed in a timely and accurate fashion. Review of all event records received in from our data vendors and associated processing with the portfolio accounting system

- Coordinate and process all voluntary corporate action events. Maintain oversight of the documentation process with the custodians for the elections, including announcement of the event and response of our elections based on the direction provided by the trading desk. This includes reading, analyzing, and understanding of the corporate action notices, as well as effectively communicating the event details to multiple parties

- Review all position, transaction, and cost basis discrepancies related to corporate action events, as presented by the accounting team from the daily reconciliation process. A thorough review of the event and the associated processing should be completed to minimize the difference between our internal records and that of the custodians

- Participate in projects as assigned, including class action processing. Research corporate action industry standards and compare existing vendors to those identified standards

- Bachelor’s degree required; concentration in accounting or finance preferred. Progress towards MBA strongly preferred

- 4 or more years of experience working with or at an investment management firm

- Preferably 2 or more years of experience as a Corporate Actions Analyst/Administrator

- Displays high attention to detail, accuracy and thoroughness. Commitment to meeting identified quality and efficiency standards

- Delivers clear, effective communication and takes responsibility for understanding others

50

Corporate Actions Analyst Resume Examples & Samples

- Min. 4-5 year's experience of a complex Funds Administration business, with direct involvement in the securities static data function

- Broader equity and bonds market knowledge and awareness

- Positive and "can do" attitude

- Blooomberg terminal knowledge

- High accuracy & attention to detail

- Analytical skills - understands and interprets trends and data to make improvements

- Orientation to customer, workflow and systems thinking

- Self-starter and take ownership

- Ability to network to get the job done

- Ability and willingness to reach out and learn new processes and skills

51

Corporate Actions Analyst Resume Examples & Samples

- To accurately manage all corporate events under your remit from event capture to event closure in a risk controlled manner

- Interpreting complex global voluntary corporate actions and accurately reflecting the information in the form of an event notification

- Ensure all events are reconciled and processed on the key processing dates

- To ensure all deadlines are met and all instructions passed on the clients and Agent Bank in timely manner

- To ensure file is fully reconciled after the event and that all risk breaks are explained and cleared

- Maintain risk within the levels set by the management team

- Maintain client query levels within the SLA

- Provide input to and support of projects and business initiatives

- Make recommendations and implement process improvements

- Understand and prepare cross system reconciliations on large, complex positions

- Monitor incoming queries to ensure they are answered accurately and on a timely basis

- Initiating and documenting procedure enhancements

- To provide a high level of service to our clients and trading books with regards corporate actions. To be willing to push boundaries with regards client service whilst operating in a risk controlled manner. To be a team player helping others where required and taking on workload where appropriate

- 2-3 years of experience processing corporate actions at an Investment Bank

- A team player with a high level of commitment and enthusiasm

- A strong understanding of the control environment and the associated risks

- Good analytical skills and the ability to develop effective solutions to support new business initiatives, market and regulatory changes

52

Lead Corporate Actions Analyst Resume Examples & Samples

- Results/task orientated with excellent attention to detail

- Good MS Office skills including Access, Excel and MS Powerpoint

- Computer literate and ability to grasp several in house systems quickly

- Self motivated to learn new tasks

- Ability to make rational, well informed decisions

- Adaptive to change

- Control and risk focussed

53

Corporate Actions Analyst Resume Examples & Samples

- Strong working knowledge of Corporate actions with exposure to interaction with custodians, market vendors like Bloomberg, Interactive Data, companies – understanding of impact on funds

- Basic knowledge of Accounting

- Strong knowledge of Mutual Funds Industry & securities trading procedures

- Strong understanding of pricing, quantity, cost and fund valuation implications due to corporate actions

- MBA with specialization in Finance

- Strong personal computer skills, including MS Office products and the internet

- Strong working/researching knowledge and skills on Bloomberg

- Excellent verbal, written, and interpersonal communication skills

- Excellent personal organization and time management skills

- Ability to follow written and verbal procedures

- Good mathematical skills

- Careful attention to detail

- To be an excellent team player

54

Corporate Actions Analyst Resume Examples & Samples

- Monitor, analyze and report on tax, securities and other regulatory issues relating to 871(m) and other withholding tax products

- Develop and maintain subject matter expertise in the tax laws relating to these products

- Analyze and summarize complex corporate filings and tax opinions

- Perform accurate mathematical calculations

- Conduct daily research on corporate actions and track events until completion

- Provide professional, knowledgeable and courteous contact with clients (large financial institutions, banks, brokerage houses, attorneys) on matters related to the products you support

- Prioritize and manage large number of files

- Meet daily deadlines for the withholding products you support

- Bachelor’s Degree in Business, Finance, Accounting or similar concentration

- A minimum of 2 years of experience working in a Tax, Legal, or Regulatory environment

- A minimum of 2 years of experience working with Tax Law and Debt Securities

- A minimum of 2 years of experience demonstrating a high degree of Math acumen and proficiency

- JD, CPA and/or LLM in Taxation

- Experience working in the Financial Services industry

- Significant Legal Writing experience

- SEC or other regulatory experience

- Strong research and analytical skills with excellent comprehension, outstanding verbal and written communication skills, and the ability to produce publishable work product

- Strong knowledge of math and proven ability to perform mathematical equations

- Ability to work independently, but with strong cross-functional team building skills

- Proficiency with MS Office products – Word, Excel, PowerPoint

- Ability to work well in a multi-tasking, deadline-driven environment

- Demonstrated ability to use smart judgment, be insightful, flexible and creative

55

Corporate Actions Analyst Resume Examples & Samples

- Responsible for the Processing of Corporate Actions from end to end where we maintain a stock lending and borrowing position

- To ensure that every new event received into Rooster is actioned on the same day and a file set up within Rooster and is accurately diarised

- Check all updates/new info to your Rooster file to ensure accurate information and query any conflicting data with our agent. Escalate to the CA supervisor as necessary

- To send details of all elective events to traders, exposure and BO teams on announcement date and at various stages through the life of the event as detailed on the checklists

- To agree all positions with custodians/counterparties to ensure there are no discrepancies and to work with settlements / reconciliations to resolve any discrepancies pre and post event

- To ensure all SLAB entitlements are booked in Alaris on pay date. Report any issues or late bookings to the supervisor

- To accurately submit instructions to custodian / counterparty upon receipt from traders / counterparties

- Review all stock breaks assigned to CA and provide an explanation / estimated date of clearance. Check any outstanding cash in KDE / Intellimatch daily and clear if necessary

- Where FX transactions are being done by the desk, ensure that these are logged and cleared as part of the file process and any resulting P+L as agreed with the desk and posted

- LI-GB2

56

Corporate Actions Analyst Resume Examples & Samples

- Responsible for the Processing of Corporate Actions from end to end where we maintain a stock lending position vs an underlying client position

- To manage static data; parameters to include client default, tax matrix, accounts, broker details

- To ensure all instructions on elective events are received before / on internal date specified

- To accurately submit instructions to custodian / counterparty upon receipt from clients

- To ensure confirmation of outgoing instructions is received prior to the external deadline

- To ensure all instructions and confirms are logged and checked in the general order book

- Ensure the action points on the checklists are always followed and advise supervisor immediately if this is not the case

- Maintain accurate files by completing a weekly review of open files to ensure they are relevant and diarised appropriately

- To reconcile cash accounts and monitor cash movements linked to a corporate action processing any necessary accounting entries

- To contribute to the monthly activity report, finance justification report and any other ad hoc reporting

57

Corporate Actions Analyst Resume Examples & Samples

- Ensure the timely resolution of all stock and cash exceptions

- Assist with team/dept. projects

- Ability to multi-task between job processes throughout the day

58

Corporate Actions Analyst Resume Examples & Samples

- Exceptions management – ensuring all breaks assigned to the team are cleared in line with specified thresholds

- Be responsible for ensuring all your team’s events are processed accurately within the event timelines

- Acting as an intermediary and escalation point between processing staff and Team Leader

- Acting as an example to other team members, creating an ethical and motivated team environment

- Coordinate testing and review Manager’s Control Assessment, Flow Charts and Procedures for the team

- Assist in and lead adhoc projects on behalf of the team

- Review and provide feedback on Service Level Agreement applicable to the team

- Liaise with Securities Finance Trading Desk on problem issues and new processes

- Conduct client RFP reviews with Securities Finance Product and assist with new client on-boarding

- Work with Securities Finance Product on new product development

- Experience within a custody operation and lending

- Strong Leader & Team Player

59

Corporate Actions Analyst FTC Montths Resume Examples & Samples

- The accurate and timely processing of all events assigned

- Ensure accurate MIS recorded on a weekly basis

- Monitor and action all daily diary messages

- Monitor and allocate all incoming Front End Instructions and advices

60

Corporate Actions Analyst Resume Examples & Samples

- Analysis of company documentation received directly from Issuers and their Registrars together with information published via the various Regulatory News services

- Ensure that all dividend details are extracted from company announcements and documents and using UnaVista ensure that relevant data is loaded and disseminated on the same day

- Notifying of Ex Markers for all Corporate Actions to Market Operations for input into the trading system in a timely manner

- Using UnaVista, draft Stock Situation Notices for issue to customers via the Corporate Events Diary to provide details of Corporate Actions and the dates associated with them

- Notices to be issued in a timely manner (as soon as practical after receipt of information) and to the required standards, ensuring that all relevant information has been correctly interpreted and included

- Loading of Corporate Actions into UnaVista using the Corporate Action screens for onward transmission to Customers via the Corporate Events Diary

- Production of ISO MT564 Messages in compliance with ISO standards

- As part of the Stock Situation Analysis team, be responsible for ensuring customer satisfaction with the Stock Situation products thereby taking joint ownership

- Liaison with other Exchange Departments and Euroclear UK & Ireland, as and when stock event and benefit issues arise

- Liaison with Corporate Advisers and Registrars to discuss Corporate Actions and agree timetables

- Educated to a graduate level or able to demonstrate relevant operational experience

- Previous knowledge of Corporate Actions and Settlements essential

- Knowledge of using databases

- Proficient in MS Office products

- Previous experience of working in Financial Services

61

Corporate Actions Analyst Resume Examples & Samples

- Basic processing and/or service activities specific to team function

- Reviewing, analyzing, and entering client information and transactions into multiple systems

- Setting up securities, general account level maintenance, and some level of client contact

- Respond to client inquiries in a timely, accurate and professional manner

- Working on special projects as needed

- Perform research & analysis of root cause conditions

- Implement solutions as assigned

- Interact effectively with multiple operational processing teams

- Maintaining the highest level of confidentiality, quality and privacy

- Manage a time-sensitive delivery schedule

- Participate in developing, maintaining and ensuring the associated Procedures and Controls around Income processing are carried out according to policies in order to satisfy all audits and minimize any and all risk

- Accountable for working towards agreed OLA’s to ensure delivery of services to the client in an accurate and timely manner

- Reconcile and clear suspense accounts and reconciliation breaks

- Proactively research, interpret, notify and process income events for Mutual Funds

- Proactively research, interpret, notify and process income events for Traditional Assets

- Provide coverage and support to various team members and may be called upon to assist with related activities within SWP US Operations Services

62

Corporate Actions Analyst Resume Examples & Samples

- Manage and complete all corporate actions instructions and enquiries received within all agreed and referenced deadlines for capital market transactions (mainly debt securities)