Due Diligence Analyst Resume Samples

4.6

(115 votes) for

Due Diligence Analyst Resume Samples

The Guide To Resume Tailoring

Guide the recruiter to the conclusion that you are the best candidate for the due diligence analyst job. It’s actually very simple. Tailor your resume by picking relevant responsibilities from the examples below and then add your accomplishments. This way, you can position yourself in the best way to get hired.

Craft your perfect resume by picking job responsibilities written by professional recruiters

Pick from the thousands of curated job responsibilities used by the leading companies

Tailor your resume & cover letter with wording that best fits for each job you apply

Resume Builder

Create a Resume in Minutes with Professional Resume Templates

CHOOSE THE BEST TEMPLATE

- Choose from 15 Leading Templates. No need to think about design details.

USE PRE-WRITTEN BULLET POINTS

- Select from thousands of pre-written bullet points.

SAVE YOUR DOCUMENTS IN PDF FILES

- Instantly download in PDF format or share a custom link.

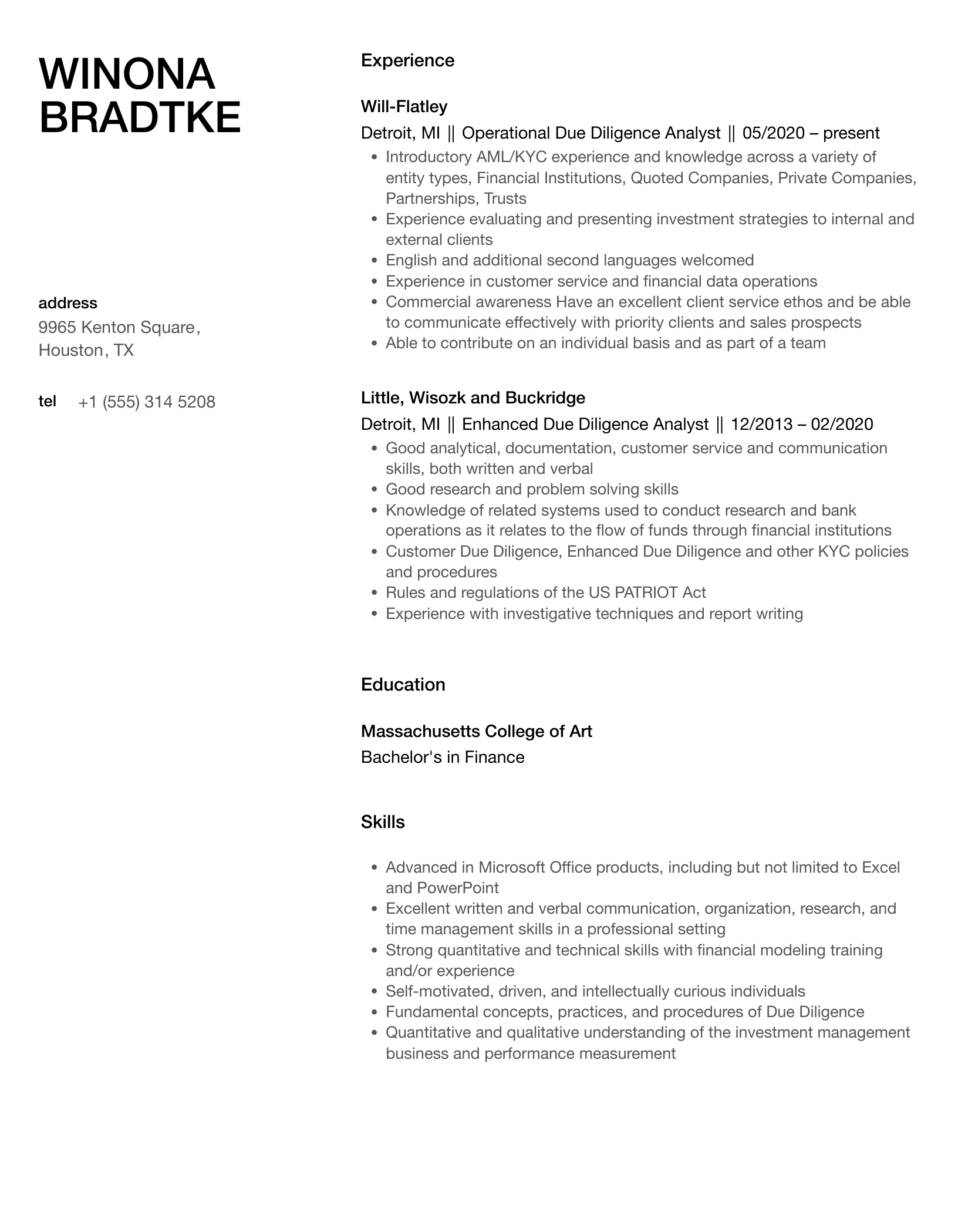

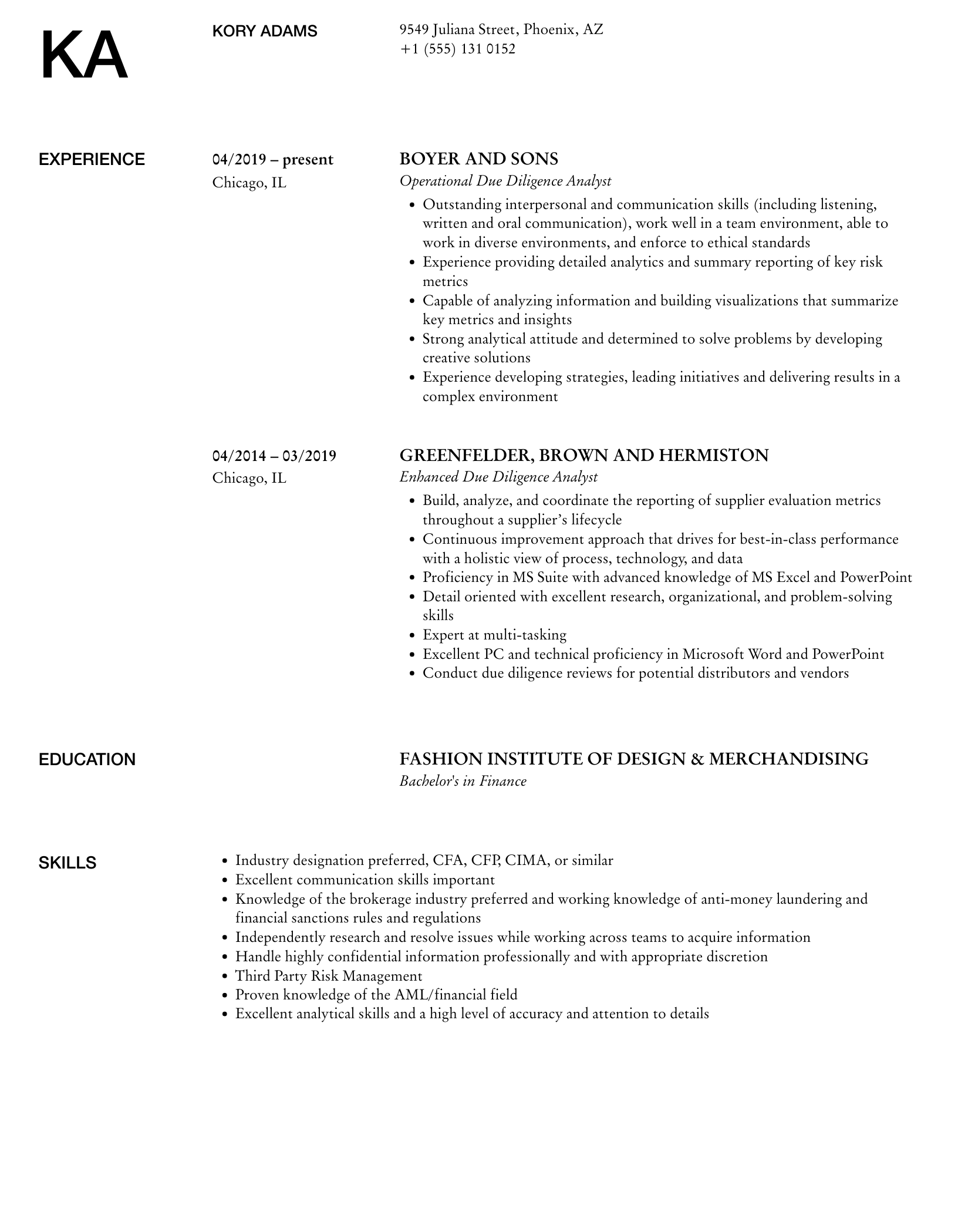

LB

L Brekke

Lina

Brekke

44726 Jocelyn Forges

San Francisco

CA

+1 (555) 725 0122

44726 Jocelyn Forges

San Francisco

CA

Phone

p

+1 (555) 725 0122

Experience

Experience

Philadelphia, PA

Due Diligence Analyst

Philadelphia, PA

Bogisich-Vandervort

Philadelphia, PA

Due Diligence Analyst

- Prepare and review fund governing document abstracts for underlying fund governing documents including a review of underlying fund liquidity provisions

- Assist in ensuring ongoing due diligence efforts and KYC are maintained while identifying substantive changes to customer profiles

- Assist in conducting AML Screening/CDD/EDD reviews on prospects and new/existing customers in accordance with the Bank’s policies and procedures

- Assists in maintaining and publishing various reoccurring reports in regards AMS products and investment topics

- Complete all job-related training in a timely manner and attend seminars or continuing education, as directed

- Perform AML Screening/CDD/EDD reviews on prospects and new/existing customers in accordance with the Bank's policies and procedures

- Communicate effectively with peers, front-line and management when requesting information or documentation and addressing concerns or findings

Los Angeles, CA

Enhanced Due Diligence Analyst

Los Angeles, CA

Spencer LLC

Los Angeles, CA

Enhanced Due Diligence Analyst

- Creates risk acceptance documentation to support the raising or downgrading of high-risk customers for management approval

- Establish working relationships with key business partners across all lines of business

- Provide support and guidance to bank’s operational areas and assist with implementation of KYC related programs for the bank

- Assist with internal audit and federal regulatory examinations

- BSA / AML Operations team members will work on wire monitoring reports, Searchspace alerts, and suspicious activity referrals

- Assist with special projects and data gathering for audit and/or regulatory purposes

- Work in a team oriented and collaborative environment to ensure overall unit goals and deadlines are met

present

Philadelphia, PA

Operational Due Diligence Analyst

Philadelphia, PA

Muller Inc

present

Philadelphia, PA

Operational Due Diligence Analyst

present

- Working closely and effectively with key stakeholders across the wealth and investment management businesses

- Develop ideas of possible improvements to the process

- Write detailed reports containing comprehensive information and analysis related to the business and operational environment at the hedge funds which are published to the investment team

- Review manager and fund documentation including Formation Documents, Offering Memorandums, Service Provider and Financing Agreements

- Evaluate the overall quality of hedge fund systems, controls, infrastructure and personnel in order to identify issues relevant to the overall investment decision

- Prepare BAA ODD Primary for onsite operational reviews with hedge fund managers CFOs, CCOs, and other operational management and personnel

- Conduct onsite due diligence reviews on third party managers and service provider operational support, internal controls, trade processing, and employees

Education

Education

Bachelor’s Degree in Finance

Bachelor’s Degree in Finance

Rowan University

Bachelor’s Degree in Finance

Skills

Skills

- Demonstrate ability to make quick, yet sound decisions, and communicate negative and adverse messages professionally

- Demonstrated ability to make quick, yet sound decisions, and communicate negative and adverse messages professionally

- Strong attention to detail

- Strong written and verbal presentation skills; excellent client-facing public relations skills

- Excellent PC Skills, including Internet Research, Microsoft Excel, Access, Word; ability to learn new database applications

- General knowledge of Retail Investment products with Alternative Investment Product Due Diligence

- Excellent research skills including experience with online search tools

- Excellent organizational, time management and project management skills

- Knowledgeable of laws, regulations and guidance related to Senior Public Figures (PEPs), Global Economic Sanctions Programs, AML, Consumer Fraud Prevention Programs

- Knowledge of conversational Hindi is major

15 Due Diligence Analyst resume templates

Read our complete resume writing guides

1

Due Diligence Analyst Resume Examples & Samples

- Participates in analyst teams to provide job related input

- Participates in maintaining "A Closer Look", the Due Diligence booklet of RJCS manager portfolio characteristics and performance reports, published on a quarterly basis

- Attends conference calls and meets with portfolio managers and analysts concerning investment processes and products

- Assists in generating creative new projects from Excel, Access, Word, Informa PSN, FactSet, Callan, Morningstar, and Mercer

- Maintains spreadsheets and databases related to portfolio analysis

- Assists with requests for immediate projects and also investment performance-type questions from AMS Sales Team and Financial Advisors

- Fundamental concepts, practices, and procedures of Due Diligence

- Quantitative and qualitative understanding of the investment management business and performance measurement

- Performance calculations

- Analyzing financial information

- Operating standard office equipment and using required software application to produce correspondence, reports, electronic communication, and spreadsheets

- Meet many deadlines to provide quarterly and monthly data to internal associates and external Financial Advisors

- Work independently as well in a team environment

- Bachelor's Degree (B.A.) in related field and a minimum one (1) year of experience at a broker/dealer or investment firm

2

Operational Due Diligence Analyst Resume Examples & Samples

- Assist in the development and maintenance of a formal AIG operational due diligence plan. Update design as needed on a regular basis

- Perform operational risk reviews of funds. Prepare written reports based on these reviews

- Conduct onsite due diligence reviews on third party managers and service provider operational support, internal controls, trade processing, and employees

- Evaluate accounting and reporting processes and controls including cash management, valuation practices, and NAV analysis

- Review financial statements and any other relevant reports on the firms' control environments

- Analyze funds' adherence to internal compliance policies and regulatory requirements

- Create and execute an annual project plan to cover all required operational due diligence reviews

- Willingness to embrace technology and employ lessons learned to improve operational due diligence processes

- Interact with Raymond James Financial Advisors to answer questions about the operational infrastructure of funds on the Raymond James platform

- Actively support the AIG product teams' efforts to ensure platform competitiveness and advisor satisfaction while meeting the firm's regulatory/oversight responsibilities

- Develop and/or distribute topical reports to educate advisors on pertinent regulatory updates or industry trends related to operational due diligence topics

- Maintain an archive of relevant regulatory updates and educational materials that may be easily referenced by advisors and other employees of the AIG team

- Operations of broker dealers, hedge funds, and private equity firms

- Fund accounting procedures and audit

- Understanding of major securities acts and how they apply to alternative investment funds

- Analyzing financial information including audited financial statements

- Produce accurate information on products and projects

- Exhibit excellent written, verbal and interpersonal communication skills, as this position will be a contact point for Financial Advisors who wish to talk in detail about all aspects of AIG and specifics about investment managers and performance reporting

- Attend to detail while maintaining the big picture orientation

- Bachelor's Degree (B.A.) in accounting or finance and a minimum of five (5) of experience at a broker/dealer or hedge fund or private equity firm

3

Senior Operational Due Diligence Analyst Resume Examples & Samples

- Assisting with the ongoing monitoring of existing external managers within the AI and EMS platforms

- Performing initial due diligence reviews of external managers. This involves preparation for and participation in manager operational due diligence meetings including onsite interviews with CFOs, COOs, CCOs and other back office operations personnel as well as a review of the external managers’ operational infrastructure, internal controls, trade process and valuation practices

- Performing reviews of fund legal documents, audited financial statements and documents related to the back office operations and compliance of prospective and existing investment managers

- Reviewing third party service provider relationships and agreement terms as well as performing onsite reviews of these service providers

- Forming opinions related to potential operational risks and presenting findings to the Head of Operational Due Diligence and to Senior Management

- Preparing detailed operational due diligence and risk assessment reports

- Keeping abreast of market developments, industry trends and regulatory matters that could impact alternative and long only investment managers or due diligence procedures

- Assisting and performing ad hoc projects and reviews related to the operational due diligence function as necessary

- Bachelor’s degree required, preferably in finance or accounting

- A minimum of 5 years relevant experience conducting operational due diligence reviews of investment advisors in the alternative investments space including hedge funds, private equity and real estate

- Ability to document a thesis and form opinions and articulate concerns/issues effectively to other team members

- Flexible attitude

- Highly motivated and self-starter

- Flexibility to travel

- Proficiency in Microsoft Word, Excel, Outlook, and PowerPoint a must

4

Ipb-due Diligence Analyst Resume Examples & Samples

- At least 1 year of relevant experience in KYC/AML/Due Diligence or 2 years of banking experience preferred

- Knowledge of AML/KYC policies including bank systems, applications and due diligence processes

- Strong analytical and comprehension skills, with ability to analyze and document large amounts of data

- Strong documentation skills to clearly articulate disposition

- Adherence to controls and compliance standards

- Detailed, well organized, self starter, capable of working under minimum supervision

- Able to multi-task and meet deadlines in a high-pressure environment

- Strong interpersonal skills; results-oriented team player

5

Operational Due Diligence Analyst Resume Examples & Samples

- Support the work and processes of the lead operational due diligence analyst

- Prepare detailed operational diligence write ups

- Follow the protocols of Guggenheim’s operational risk management effort

- Maintain qualitative and quantitative information for prospective and approved hedge fund managers within the firm’s proprietary databases

- Participate in ad hoc research projects

- Provide support to internal investment professionals and other business partners

- 1-2 years of experience in an accounting, auditing, or regulatory role/internship

- Undergraduate degree in accounting or finance, with top grades and strong quantitative background

- Knowledge of and interest in capital markets, business/operational risk analysis, and hedge fund investing

- Ability to communicate well, both orally and in writing; excellent attention to detail

- Proactive approach and an active listener/interpreter

- Demonstrated ability to work effectively in a team-oriented environment

- Fluency in Arabic, Hindi, Portuguese, French, or Turkish preferred but not required

6

Operational Due Diligence Analyst Resume Examples & Samples

- Prepare BAA ODD Primary for onsite operational reviews with hedge fund managers CFOs, CCOs, and other operational management and personnel

- Execution of onsite due diligence reviews on hedge fund operational support structure, internal controls, trade processing environments and process flows

- Evaluate accounting and reporting processes and controls including cash management, valuation practices, and NAV analyses

- Audited financial statement reviews to validate appropriateness and evaluate risks

- Review third party vendor relationships, agreement terms and perform onsite reviews of certain providers

- Obtain detailed understanding of counterparty exposures, financing terms and conditions and unencumbered cash

- Review hedge funds’ legal documentation

- Assess appropriateness of compliance procedures, regulatory reporting and examination results

- Contribute to the overall operational risk measurement, monitoring, and reporting environments

- Prepare operational due diligence reports for communication to management

- Develop market intelligence and industry best practice by liaising with fund managers, administrators, valuation agents, non-executive directors, prime brokers, external auditors, and attorneys

- Experience of 2-6 years direct hedge fund industry experience or in public accounting focusing on hedge fund clients

- BA/BS required; CPA desirable as well as interest in pursuing CFA charter

- Superior analytical and organizational skills

- Strategic planning and ownership of outcomes

- Demonstrated track record of sound and accurate judgment

- Ability to balance the need to be highly hands-on in a team oriented environment

- Naturally aligned with a defined set of key corporate values, including fiduciary responsibility, passion for performance, team orientation and innovation

7

Business / Operational Due Diligence Analyst Resume Examples & Samples

- A minimum of five or more years of experience in the analysis of hedge funds and their operations, as a credit analyst, auditor, or fund of funds analyst,

- Bachelor's degree from a top- tier educational institution is required, preferably in Accounting, Business,Computer Science, Economics, Finance or a related field

- Deep knowledge of the hedge fund industry and financial/operational aspects of managers is required

8

Client Due Diligence Analyst Resume Examples & Samples

- Track record in excellent service delivery

- Ability and willingness to use discretion appropriately

- Ability to successfully manage complex and non-routine issues

9

Due Diligence Analyst Resume Examples & Samples

- Assists in maintaining and publishing various reoccurring reports in regards AMS products and investment topics

- Identifies potential process improvements to increase efficiency in processing or analyzing due diligence

- Assists in interpreting investment performance, with thorough knowledge of all performance formulas, calculations, and understanding of CFA/GIPS and SEC Compliance

- Attends or hosts conference calls and meets with portfolio managers and analysts as well as other subject matter experts concerning investment processes and products

- Assists in generating or maintaining projects from Excel, Access, Word, Informa PSN, FactSet, Callan, Morningstar, EnCorr and Mercer

- Intermediate concepts, practices, and procedures of AMS investment research

- Intermediate investment concepts, practices and procedures used in the securities industry

- Assist in leading meetings and contribute to team efforts by ensuring all relevant information is included in the outcomes

- Bachelor's Degree (B.A.) in related field and a minimum of three (3) of experience at a broker/dealer or investment firm

10

Client Due Diligence Analyst Resume Examples & Samples

- 5 years financial services experience

- 3 or more years of experience in documentation, compliance, legal or client service operations

- Prior experience interpreting policies and procedures associated with AML/BSA

- Basic knowledge of banking services and products

- Knowledge of MS Office: Word, Excel and Outlook, internet search engines

11

Senior Client Due Diligence Analyst Resume Examples & Samples

- Complete due diligence on new accounts to ensure compliance with requirements of the BSA and bank’s policies

- Verify Client Profile requirements and AML guidelines and approve new accounts

- Perform searches and sanction checks as required for client due diligence

- Escalate all High Risk clients to AML Compliance in line with current policy. Regularly review, maintain and update Client On-boarding documentation, policies and procedures to ensure seamless correlation with AML and Client Due Diligence policies established by Compliance

- Comply and provide guidance as to compliance with controls and procedures of Client due Diligence policy covering all aspects of account opening and maintenance process

- Liaise with and provide advice to front office and documentation staff in Compliance issues related to other RBC affiliated businesses

- Perform periodic reviews of accounts as required by policy

- Actively participate in developing, testing and implementing new or enhanced processes and other process improvement initiatives

- Proactively resolve queries received from front office and documentation unit, or highlighting and escalate issues on timely manner

- Establish and maintain effective relationship with business partners

- Maintain highest standards of audit and compliance requirements

- Provide training and guidance to new staff

- Proactively seek for process improvements and delivering the ideas

- Provide the senior management team with accurate and informative data and reports on account opening metrics, current workloads, quality of client profiles and new account documentation, as well as comments on issues that have impacted the account opening process (quality controls)

- 6 years financial services experience in a compliance, AML/BSA oversight type role

- Demonstrated understanding of KYC, client due diligence and AML/BSA regulations

- Ability to multitask and manage to tight timelines and deliverables

- Ability to work on a fast paced environment, able to prioritize and work in an organized fashion

- Ability to work under pressure with a heavy work load

- Ability to operate successfully in a rapidly changing environment

- BA/BS degree in Business, Finance or similar field

12

Enhanced Due Diligence Analyst Resume Examples & Samples

- Performs initial and ongoing EDD reviews of the highest-risk customers in the Payment Services lines of business

- Conducts qualification reviews of high- and moderate-risk customers and determines the appropriate risk rating

- Creates risk acceptance documentation to support the raising or downgrading of high-risk customers for management approval

- Ensures Payment Services lines of business are in compliance with applicable laws, rules, regulations, and corporate policies related to EDD

- Maintains a high level of compliance awareness and knowledge to effectively support EDD and other related areas of responsibility

- Recommends customers for closure and for further investigation where risk tolerances are exceeded based on EDD reviews; and

- Three to five years of financial experience in the compliance, BSA/AML, or Sanctions Screening (OFAC) disciplines, including

- Comprehensive understanding of AML/BSA/OFAC regulations. A self-directed and independently motivated individual, who places a high value on organizational skills and maintains strong business acumen

- Successful employment record with a multitude of resources, including varying knowledge, tenure, and managerial skill levels

- Ability to be flexible in a dynamic environment and can adapt to situational changes with ease and fluidity

- Knowledge of government (federal, state and local) and regulatory laws and regulations

- Strong organization and analytical skills

- Excellent interpersonal, verbal, and communication (including presentations) skills

- Prior card issuing or merchant acquiring background

13

Operational Due Diligence Analyst Resume Examples & Samples

- Conduct on-site operational due diligence meetings of external asset managers as part of the ODD program. These meetings discuss all areas of operations to assess the strength of the organization and its ability to mitigate operational risk

- Document due diligence meetings conducted in the specified report template and present findings to the regional research committee

- Perform regulatory research and reviews for managers

- Analyze underlying manager financial statements

- Research foreign markets to assess regulatory and tax issues involving trading/establishing a local presence in those markets

- Assist team members on special projects

- Perform due diligence reviews on administrators that support underlying hedge fund managers

- Meet with prime brokers and other industry participants

- Work closely with the global research teams

- Work will primarily be New York based, but there is some travel across USA

- 3-5 years working in within an audit firm auditing investment products (hedge funds, mutual funds, private equity or venture capital) or the operations and/or audit departments of an asset management firm or; operational due diligence preferred

- Bachelors degree required; other advanced degree or industry certifications a plus

- Working knowledge of industry standards for the asset management industry, specifically hedge fund, including familiarity with policies, procedures and “best practices”

- Knowledge of hedge funds and pooled investment products

- Strong audit and/or operations experience required

14

Enhanced Due Diligence Analyst Resume Examples & Samples

- BSA / AML Operations team members will work on wire monitoring reports, Searchspace alerts, and suspicious activity referrals

- Experience with case management systems, databases and similar automation

- Knowledge of the Bank�s mainframe systems and applications

- Ability to multi-task and set priorities

15

Operational Due Diligence Analyst Resume Examples & Samples

- Gather and organize prescribed data from hedge fund managers

- Read and assimilate information provided by individual hedge fund managers

- Read and analyze fund financial statements and other quantitative reports

- Initiate and manage support provided by internal and external service providers

- Field visits to hedge fund managers to interview staff and evidence operations

- Conduct additional follow-up as needed

- Write-up meetings

- Assessment and score based on established Operational risk architecture

- Organize results for filing and capture in firm relational database

- Bachelors degree from accredited university. Finance or similar degree helpful, but not required

- 4-6 years’ work experience. Operational Due Diligence or comparable experience preferred

- Strongly preferred (CPA, JD, CAIA, CFA) or similar designation

- Excellent written and analytical skills

- Experience with research databases (e.g. Lexis-Nexis)

- Sound knowledge of finance and capital markets

- Proficient with Microsoft Word, Excel, Powerpoint

- Able to work independently with modest supervision

- Ability to articulate information to both internal and external customers in a manner that is clear and easily understood

- Able to mentor junior staff

- Able to work with managers in a thoughtful and professional manner

- Able to travel as needed (less than 25% of time)

16

Operational Due Diligence Analyst Resume Examples & Samples

- Perform detailed operational due diligence on potential long-only investments and/or alternative investment managers, which include manager evaluation, verification, and documentation review

- Monitor operational aspects of approved investments on an ongoing basis

- Stay on top of regulatory changes in the financial industry

- Perform other operations related responsibilities

17

Due Diligence Analyst, Ams Resume Examples & Samples

- Participates in manager research teams to scrutinize professional money managers and their products for potential inclusion or exclusion from a multi-billion dollar fee-based platform

- Participates in maintaining various Due Diligence materials and research reports that may include portfolio characteristics and performance data, published on a regular basis

- Obtain and apply a working knowledge of FactSet to conduct holdings-based analysis and Callan for performance-based analysis of managed portfolios

- Exhibit excellent written, verbal and interpersonal communication skills, as this position will be a contact point for Financial Advisors who wish to talk in detail about all aspects of AMS and specifics about investment managers and performance reporting

- Read, interpret, analyze and apply information from professional publications

18

Bank Anti-money Laundering Enhanced Due Diligence Analyst Resume Examples & Samples

- Conducting enhanced due diligence reviews of clients during the account opening process

- Utilizing various third-party and internal databases to assist with due diligence searches

- Assisting with the review of client accounts for potential matches to designated sanctions targets and prohibited persons lists

- Participating in AML trainings of targeted divisions within the Firm

- Have a 4 year college degree with outstanding academic credentials

- Have excellent written and verbal communications skills, attention to detail and strong time management skills

- Have developed investigative skills – inquiry and analysis, interviewing, testing, organization and presentation (both written and verbal)

- Have the ability to interact in a mature and professional manner with a variety of individuals

- Have general knowledge of investing and markets and the ability to research or must evidence the ability to learn and adapt quickly

- Have the ability to handle a fast paced environment with minimum supervision and successfully meet established deadline requirements; and

- Be able to interact with branch and business unit personnel and be willing to receive and apply feedback on work product from supervisor(s)

- Be certified as an Anti-Money Laundering Specialist by ACAMS or equivalent AML certification/license – or certification within 15 months of hire

- 1-3 years of previous experience with a bank government agency (e.g., OCC, FRB, or FDIC) or in a regulatory, compliance, or internal audit capacity within the banking industry

- Compliance and/or regulatory experience, with knowledge of the financial service industry, regulatory requirements, and experience in analyzing business risk and best practices

- Experience with Office of the Comptroller (“OCC”) regulations and bank safety and soundness guidance provided by the Federal Financial Institutions Examination Council (“FFIEC”)

- Experience with mortgage, retail, institutional lending or FX businesses

19

Operational Due Diligence Analyst Resume Examples & Samples

- Perform operational due diligence on alternative investment funds and managers (fund-of-funds, hedge funds, private equity, real estate, etc.) for new perspective managers and part of the ongoing monitoring process for existing relationships

- Operational assessments include onsite meetings with senior professionals at the investment manager as well as meetings/calls with key service providers such as administrators, valuation agents, auditors, etc

- Areas of focus for the review process include: Organizational Structure & Staffing, Fund Structure, Internal Operations & Controls, Valuation, Service Providers & External Oversight, Legal & Compliance, Information Technology & Business Continuity Planning, etc

- Assess operational infrastructure and identify key risks, documenting findings in a written report

- Work with managers to find solutions to correct any operational deficiencies identified during the operational due diligence process

- Present findings and results to internal product approval committees, as necessary

- 7 to 10 years investment experience with operational knowledge related to alternative investment products and managers (fund-of-funds, hedge funds, private equity, etc.)

20

Wealth Management Anti-money Laundering Enhanced Due Diligence Analyst Resume Examples & Samples

- 4 year college degree with outstanding academic credentials

- 3-5 years AML experience and strong analytical skills

- Excellent written and verbal communications skills, attention to detail and strong time management skills

- The ability to interact in a mature and professional manner with a variety of individuals

- General knowledge of investing and markets and the ability to research or must evidence the ability to learn and adapt quickly

- Excellent judgment, initiative and adherence to deadlines

- Ability to interact with branch and business unit personnel and be willing to receive and apply feedback on work product from supervisor(s); and

- Certification as an Anti-Money Laundering Specialist by ACAMS or equivalent AML certification/license – or certification within 15 months of hire

- Must be able to maintain a positive and professional attitude in a fast-paced environment

- Spanish or Portuguese a plus

21

Rmg-enhanced Due Diligence Analyst Resume Examples & Samples

- Conduct enhanced due diligence reviews on higher risk counterparties and third party introducers / agents / vendors including analysing source of wealth, beneficial ownership, potential economic sanction programme breaches and other risk relevant information

- Conduct risk assessments through the performance of investigative internal research using a variety of internet and third-party sources

- Liaise with external third party vendors to undertake enhanced due diligence / business intelligence analysis of prospective / existing clients

- Daily surveillance of clients accounts for adverse information

- Liaise with various members of the AML and Sanctions Compliance Teams, the Client Onboarding Team and the businesses regarding enhanced due diligence research, findings and recommendations

- Analysis of business specific and counterparty specific information and documentation to research and resolve issues

- Analysis of country risk issues and performance of jurisdictional specific assessments

- Degree educated with extensive research or AML compliance experience in a major international institution

- In depth knowledge of financial markets and products

- Knowledge / exposure to emerging markets and commodities would be an advantage

- Strong analytical and risk assessment skills

- Ability to adapt to new changes and new challenges

- Client focused with persuasive communication skills both written and verbal, confidence in being challenged

- A team member who builds strong, open relationships with clients and colleagues, but is also able to work independently, determine priorities and meet deadlines

- Ability to prioritise work flows and ensure deadlines are met

- Proactive, self motivated, detailed oriented and well-organised

- Proficient project management skills

- Foreign language skills would be desirable

22

Ipb-due Diligence Analyst Resume Examples & Samples

- Conduct in-depth and timely due diligence reviews of IPB customers identified as 'high risk' to comply with the AML/KYC policies and procedures

- Evaluate reasonableness of RM’s conclusion and highlight/escalate issues to management and/or compliance and follow up on corrective actions

- Ensure completeness of documentation required during the review (e.g. disposition of name screening results)

- Provide adequate documentation of the work performed for each case

- Perform transaction reviews (large cash and overlay reports) to determine any potential AML concerns

- At least 1 year of relevant experience in KYC/AML/Due Diligence or 2 years of banking experience is preferred

- Strong analytical and comprehension skills with the ability to analyze and document large amounts of data

- Detailed, well-organized, self-starter and capable of working under minimum supervision

- Able to multitask and meet deadlines in a high pressure environment

- Strong interpersonal skills and results-oriented team player

23

Operational Due Diligence Analyst Resume Examples & Samples

- Perform operational due diligence on alternative investment funds and managers for new perspective managers and part of the ongoing monitoring process for existing relationships

- Operational assessments will consist of either a review of DDQs/various manager documents for desk reviews or onsite meetings with senior professionals at the investment manager. Additionally, meetings/calls with key service providers such as administrators, valuation agents, auditors, etc. are conducted as necessary

- Areas of focus for the review process include: Organizational Structure & Staffing, Fund Structure, Internal Operations & Controls, Valuation, Service Providers & External Oversight, Legal & Compliance, Information Technology & BCP, etc

- 3-7 years of job experience including some operational knowledge related to alternative investment products and managers (alternative mutual funds, fund-of-funds, hedge funds, and/or private equity). This includes candidates with prior experience in audit of alternative investment funds, hedge fund counter-party credit, and/or operational due diligence experience

- Looking for candidate that has some knowledge of alternatives and the desire to expand their skill set into other product areas within a growing team of experienced operational due diligence professionals

24

Operational Due Diligence Analyst Resume Examples & Samples

- 5+ years of post-qualified experience

- Background analyzing hedge funds or proprietary trading operations or other relevant background

- Familiarity with the different service providers and their roles with hedge funds

- Familiarity with back and middle office operations and systems

- Understanding of risk management methodologies

- Experience understanding securities valuation and pricing analysis and a good understanding of the different types of financial instruments

- Proficient with MS Office (Word, Excel, Access, and PowerPoint)

25

Operational Due Diligence Analyst Resume Examples & Samples

- Communicate and establish good working relationships with senior business personnel of hedge funds. Establishing and maintaining a network of contacts in the industry

- Review various forms of documentation and conduct interviews (on-site with hedge funds) to establish facts pertaining to business and operational risk (Note that the on-site visits will require some business travel in Europe and Asia. Possibly some travel to the U.S.)

- Evaluate the overall quality of hedge fund systems, controls, infrastructure and personnel in order to identify issues relevant to the overall investment decision; Work with the client information team on ad hoc projects as required; Develop ideas of possible improvements to the process

- Write detailed reports containing comprehensive information and analysis related to the business and operational environment at the hedge funds which are published to the investment team

- Perform regular monitoring of ongoing investments. Determine necessity of “as-needed” monitoring of current investments that undergo significant change over time

26

Due Diligence Analyst Resume Examples & Samples

- Assess whether an investment is within the parameters of the company operational due diligence underwriting standards

- Evaluate of the adequacy and efficacy of the processes and systems used by hedge funds and private equity funds to monitor and manage the risks associated with the operations of hedge funds and private equity funds (e.g., the overall design of such hedge fund manager’s internal control environment)

- Negotiate specific terms and requirements as agreed to by Investment Committee and / or Operations Committee prior to investment

- Consider of the optimal way to structure an investment with the Investment Manager

- Determine whether the structure and terms of commingled investment vehicles are appropriate and designed to achieve the goals and objectives of the relevant managed account and create a competitive advantage through the negotiation of terms

- Monitor and report all operational risk at hedge funds and private equity funds as well as the documentation of operational procedures and ongoing developments

- Design, participate in and document results of interviews of senior personnel at underlying managers, administrators, audit firms and other fund service providers, including on-site fieldwork at underlying investment managers and documenting results

- Review and analyze hedge fund and private equity fund financial statements, correspondence and regulatory filings as part of operational due diligence reviews of underlying managers and document findings

- Participate in the due diligence of potential new investments with hedge fund and private equity managers and making written recommendations to the operational due diligence group and operations committee

- Review and analyze background investigation reports received from third party private investigation firms and document findings and action plan

- Prepare and review fund governing document abstracts for underlying fund governing documents including a review of underlying fund liquidity provisions

- Read current periodicals to identify any current hedge fund and private equity fund frauds, failures or regulatory proceedings and perform ‘root cause’ analysis

- Coordinate periodic information sweeps of underlying managers and report the results to the operational due diligence team and senior management

- Participate in the negotiation of side letter agreements and other documents

- Review the timeliness and accuracy of investment performance and valuations as reported by the Investment Manager, while staying abreast of current developments affecting the Investment Manager’s personnel, infrastructure, operations, and third-party service providers

- Analyze internal and external business risks based on available data and assisting management to implement a plan to address the most important risks

- Prepare operational risk and operational procedures documentation

- Maintain good working relationships with appropriate industry contacts, hedge fund and private equity fund managers and internal and external stakeholders

- Conduct special projects as needed and communicate results to senior management

- Bachelor’s Degree in Accounting, Finance or equivalent with a superior grade point average as well as a graduate degree and professional accounting and/or financial designations

- 3-8 years of experience including the evaluation of internal control environments, operational risk management, negotiating agreements, or related area

- Experience in the alternatives space, including private equity, real estate, infrastructure and hedge funds

27

Operational Risk Due Diligence Analyst Resume Examples & Samples

- The selected candidate must also maintain excellent organizational and time management skills with a high focus on attention to detail and accuracy

- Collection and assessment of beneficial ownership

- Assist Senior Level Analysts and management with escalating potential compliance driven risks

28

Due Diligence Analyst Resume Examples & Samples

- Support Global Due Diligence Standards of Practice for CPB and across segments of Citi’s Global Consumer Bank business in the Americas (North America and Latin America)

- Partner with Investment Manager Research Team in delivery of various investment-related performance metrics of third-party strategies

- Preparation of various internally generated data reports for use by senior management

- Perform initial and periodic due diligence monitoring of IMC’s and their investment strategies

- Maintain working inventory of U.S. and Offshore mutual funds, separately managed accounts, exchange-traded funds and closed-end funds available for distribution across multiple businesses of Citi

- Maintain performance data on numerous third-party single strategies and multi-asset class portfolios

- Manage statistical database to perform various analytical tasks such as CPB’s proprietary performance scorecard, performance outlier analysis, dispersion analysis, performance attribution analysis and other required analytical reporting

- Designs/ create reports and charts with data pulled from various sources such as Morningstar, eVestment Alliance and/or other external/internal sources to improve information value to end users

- Assists with various projects and ad hoc requests that require individual to gather, analyze and present data

- Bachelor’s Degree Required preferably in Statistics, Math or Finance

- One to three years of experience in financial services, specifically with firm focused on wealth or investment management

- Candidates should have Series 7 and 66 license or willing to obtain within six months of employment

29

Due Diligence Analyst Resume Examples & Samples

- Support timely documentation and communication of any initial and ongoing operational due diligence reviews by working closely with the MD – Operational Risk and Operations Department supporting these efforts

- Assist the MD – Operational Risk in assessing and communicating the level of operational risk exposure with respect to our sub-advisors

- Support the review of annual audited financial statements for all external hedge fund investments

- Support certain reporting requirements between the Corporate and the Client Service team

- Support an efficient on boarding process for new managed account sub-advisors by communicating effectively with the Operations Department and Investment Department As it relates to initial operational due diligence and the hand off of trade capture implementation and daily production to the Operations Team

- 2 to 4 years of big 4 (financial services clients preferred)

- 2 to 4 years of due diligence

- Bachelor's Degree in Accounting with at least a minimum of 3.2GPA on a 4.0 scale

30

Operational Due Diligence Analyst Resume Examples & Samples

- 1-3 years of accounting, audit, operations, compliance or legal experience

- Solid academic record

- Independent and critical thinking skills

31

Due Diligence Analyst Resume Examples & Samples

- Validate and confirm accuracy of individual report findings on the Bank's prospective and existing clients, researched, documented and prepared by analyst. Research includes: negative media, PEP & sanctions

- Ensure that all public records collected, relate to specific customer/client

- Ensure proper compliance protocols/procedures are adhered to and applied correctly by analyst

- Determine what additional research steps are needed by the analyst

- Conduct specialized research to determine disposition of any open records, properly identifying risks and escalating derogatory/high risk findings to Senior Management; risks include but not limited to - PEP, High Risk Global Jurisdictions and SDN/OFAC matches

- Summarize and communicate derogatory information in written form to Senior Management

- Exercise sound judgment and observe the highest degree of confidentiality

- Ability to read and translate Dutch into English is essential though spoken Dutch is not a necessity

- Experience in AML/KYC preferred. Expertise may include Compliance, Risk or Fraud but is not essential

- Knowledge of AML/KYC/BSA policies including bank systems, applications and due diligence processes is preferable

- Strong research, analytical and comprehension skills, with ability to analyze and document large amounts of data

- Attention to detail skills are essential

- Able to multi-task and meet deadlines in high -pressure environment

- Effective verbal and written communication skills for report summarizations and escalations

- Proficient in MS Office and strong typing skills required

32

Alternative Invesment Due Diligence Analyst Resume Examples & Samples

- Perform initial and ongoing investment due diligence on alternative investment strategies and managers, including Real Estate and Commodities focused strategies

- 5-10 years of job experience in the financial markets with experience in alternative investment research. Knowledge of various alternative investment strategies including hedge funds, alternative mutual funds, real estate and commodities

- Looking for candidate that has a strong knowledge of alternatives and the desire to expand their skill set across alternative investment strategies and products

- CFA, CPA, and/or CAIA not required but viewed favorably

- Appropriate securities licenses required or will need to be obtained upon hire

33

Due Diligence Analyst Resume Examples & Samples

- Serves as the central point of contact for outside investment manager representatives

- Attend and host conference calls and home office visits with portfolio managers and analysts scrutinizing investment processes and products aiding manager research form an investment opinion

- Obtain and apply command of Excel, Access, Word, Informa PSN, Morningstar, and Mercer for manager analysis and new manager research projects as they arise

- Create and maintain complex data spreadsheets, databases, and templates utilizing various systems to analyze holdings and performance of managed portfolios on a multi-billion dollar fee-based platform

- Assists in the investment manager approval process for the firm’s dual contract platform. Responds to requests for immediate projects and also detailed commentary in response to investment performance questions from the AMS Sales Team and Financial Advisors

- Bachelor’s Degree (B.A.) in related field and a minimum one (1) to three (3) years of experience at a broker/dealer or investment firm

34

Wcob Due Diligence Analyst Resume Examples & Samples

- Validate accuracy of data and ensure completeness of document package

- Validate all documentation uploaded into the KYC tool

- Comfortable working as a team or individually to deliver results

35

Due Diligence Analyst Resume Examples & Samples

- Maintains knowledge on current and emerging developments/trends for assigned area(s) or responsibility, assess the impact, and collaborates with management to incorporate new trends and developments in current and future solutions

- Conducts the due diligence analysis of the investment products offered through LFS and LFA, which includes the assessment of the structure, risks, and benefits of the product offerings

- Prepares verbal and written due diligence reports on investigations of investment issuers and products in compliance with internal guidelines as well as guidelines established by the FINRA, SEC, and other federal and state regulatory agencies

- Makes recommendations to the broker-dealer management team and product review committee related to new investment products, services, and sponsors as well as their availability through LFA and LFS

- Advises on field representatives’ requests for new investment products, applying product knowledge and evaluating level of risk to the organization

- Educates internal staff and field force with product information through written articles, product profiles, electronic publications, internal presentations, and via telephone

- Advises internal stakeholders on appropriate training, education, transaction approval, and suitability review of investment products

36

Due Diligence Analyst Resume Examples & Samples

- Conduct detailed interviews with investment candidates and references

- Collect and corroborate all datapoints relevant to an applicant’s candidacy

- Qualitatively and quantitatively assess the candidate’s skills for the role, as well as their inherent talent and fit for the firm and relevant investment team

- Convey findings and a recommendation in detailed reports to be presented to senior management and hiring committees

- Work collaboratively with the team to investigate and assess new techniques to enhance the effectiveness of our investment talent assessment process

- Expand their expertise of the investment management industry via self-directed study and/or coursework

- Track record of academic success

- Fluency in spoken Mandarin

- Superior interpersonal skills and the ability to quickly develop rapport on the phone

- Willingness and eagerness to commit to learning the investment management business

- High level of skepticism and objectivity

- Educational background in a quantitative discipline

- Rigorous attention to detail and organized thinking

- Sound judgment and the ability to work independently and cooperatively

- Preference will be given to candidates who are CFA Charterholders or are working towards the CFA designation

37

Due Diligence Analyst Resume Examples & Samples

- Complete due diligence questionnaires from participating broker-dealers/RIAs/third party due diligence firms

- Provide competitive analysis on the company’s peer group

- Communicate portfolio updates to broker dealers

- Respond to ad hoc requests/research projects from the management team to assist with product development

- Work closely with the sales team to provide support and assist with communication to financial advisors

38

Due Diligence Analyst Resume Examples & Samples

- Bachelor’s degree required; CFA preferred; master’s degree a plus

- 5-7 years of financial services experience required; Series 7 and 63 licenses preferred

- Strong knowledge base and understanding of the financial markets and its components, including fundamental analysis, financial modeling, asset allocation, market research, etc

- Superior analytical and broad-based business management skills; demonstrated excellence in leadership

- Demonstrable track record of being an effective and enthusiastic team player and collaborator

- Strong product, marketing, and sales sense; innovative and creative thinker

- Strong written and verbal presentation skills; excellent client-facing public relations skills

- Located in New York City, New York office; extensive travel is required

39

Counterparty Due Diligence Analyst Resume Examples & Samples

- Understand and operate the CDD process, to ensure accurate and timely delivery of services in accordance with SLAs

- Conduct on demand CDD screening for counterparties in accordance with the risk based CDD process

- Monitor the continuous monitoring reports for new matches

- Review any matches to establish validity and, if appropriate, recommend next steps which may include moving to a higher level of rigor, or escalate – include recommendations on action based on precedents

- Ensure that the rationale for all decisions is annotated as needed in relevant systems

- Securely store all information in accordance with the requirements of the CDD Practice and policy, ensuring compliance with any data privacy requirements

- Instigate follow-up reviews at frequencies determined by the risk rating for the counterparties or agents

- Ensure documentation is kept current for any changes to the processes

- Prepare and provide input to the regular reports, as required by management

- Proactively acts to understand business reporting needs and identify solutions to non-standard tasks/ queries

- Minimum 3 years of working experience in CDD/ AML, Compliance, Finance, Business or related field

- Good written and verbal communication skills, as the role requires communication to all levels in the organization

- Good analytical skills and in using MS Excel

- Able to work on shift

- Experience working in a fast-paced environment and ability to adapt to changing priorities

40

Ipb-due Diligence Analyst Resume Examples & Samples

- Conduct in-depth and timely due diligence reviews of IPB customers identified as "high risk" to comply with the AML/LYC policies and procedures

- Evaluate reasonableness of RM's conclusion and highlight/escalate issues to management and/or compliance and follow up on corrective actions

- At least 5 years of relevant experience in KYC/AML/Due Diligence or 5 years of banking experience is preferred

41

Due Diligence Analyst Resume Examples & Samples

- Review KYC for completeness and accuracy as part of customer validation in order to assess and document the risks associated with that customer

- Identify and address items through day-to-day assignments to ensure the Bank's KYC and CIP standards have been met

- Ensure ongoing due diligence efforts and KYC are maintained while identifying substantive changes to customer profiles

- Perform AML Screening/CDD/EDD reviews on prospects and new/existing customers in accordance with the Bank's policies and procedures

- Review and resolve EDD Verifier alerts; escalate findings to Manager when appropriate

- Perform searches utilizing Internet sources and/or third-party vendors (i.e. Google, Lexis Nexis and/or World Compliance) to determine negative news and obtain due diligence information for prospects and new/existing customers

- Respond to daily inquiries from peers, front-line and management regarding KYC/CIP and due diligence matters, when appropriate

- Communicate effectively with peers, front-line and management when requesting information or documentation and addressing concerns or findings

- Adhere to all designated time frames, manage workflow to the specified deadlines and complete responsibilities in a satisfactory manner

- Report and escalate all concerns or negative findings clearly and objectively to Manager

- Interact with bank examiners, internal auditors, and compliance personnel during BSA and AML related audits, if necessary

- Complete all job-related training in a timely manner and attend seminars or continuing education, as directed

- Participate in team meetings

- Perform any other assignments as directed by Manager

- Ensure all customer records are properly completed and communicate deficiencies to appropriate party and/or Manager

- Exercise discretion in setting priorities, identify customer records that require further review and take action to obtain and follow-up on attaining the information and/or documentation requested

- Report positive EDD Verifier PEP matches and negative news findings to Manager

- Actively assist the Manager in special projects that are both system related or involve special investigations or reviews

- Minimum 5-7 years banking experience, with emphasis on BSA Compliance and due diligence in accordance with KYC, CIP, AML/BSA guidelines

42

Senior Due Diligence Analyst Resume Examples & Samples

- Undertake Enhanced and Anti-Bribery and Corruption (ABC) customer due diligence to make recommendation on the suitability of business relationships

- Liaise with external counterparties to collate required company information/documentation

- Analyse and verify evidence collated during the customer due diligence process to ensure authenticity

- Collaborate with commercial and functional stakeholders to enhance their understanding of the financial crime on-boarding requirements to raise the profile of the financial crime team and ensure the smooth onboarding of new and existing customers

- Prepare customer due diligence files and ensure all internal and regulatory records management standards are adhered to

- Develop an understanding of the Trading & Supply financial crime systems and controls including a working knowledge of the Compliance, Financial Crime and ABC manuals

- Advise internal and external stakeholders on customer due diligence requirements in a timely fashion

- Provide support to the compliance deal team lead on special projects and new initiatives

- Escalates matters requiring investigations appropriately

- Support Due Diligence Analysts in the Financial Crime Lead – East absence

43

Due Diligence Analyst Resume Examples & Samples

- Reviews new higher risk customer accounts and determines level of risk

- Identifies current customers who may have added to their level of risk by recent increases in transactions in cash, ACH/IAT, wires or other suspicious activity

- Conducts customer reviews by using various tools available such as the internet, CLEAR, public data bases, websites and government resources

- Ensures that all required documentation for account opening, as required by the Bank’s CDD/EDD procedures is received and imaged

- Identifies FFIEC designated higher risk customers and performs enhanced due diligence reviews to determine associated risks

- Continues monitoring of designated high risk customers

- Identifies customers who may exceed the risk appetite of the bank and recommends exiting the relationship

- Refers any identified suspicious activity to the BSA/AML Investigations Manager for investigation and possible suspicious activity report filing

- Works closely with Deposit Operations and Retail on customer due diligence issues that may arise

- Identifies and reports to the FIU Officer any bank-wide due diligence training weaknesses that need to be addressed

- Assists the FIU Officer in the preparation of reports and documents at the request of auditors, examiners or Senior Management

- Regularly exercises good judgement in the performance of all job functions

- Assists the FIU Officer, BSA/AML Investigations Manager and other BSA Management as necessary

- Achieves and maintains appropriate professional certifications by attending required training for CPE’s

- Assists the BSA Organization as otherwise required

- Knowledge of the FFIEC BSA/AML regulations

- Ability to multi-task and prioritize work projects

- Investigative techniques using Internet, Public Websites and ancillary solutions

- Ability to drive an automobile on company business

- Mobility sufficient to coordinate activities within the assigned department is helpful, but not essential

- Ability to sit or stand, intermittently or for an extended period of time (up to and including four hours per day), and

- Ability to lift a typical office-sized storage container (box) for shipment of records being retained (up to 30 lbs.)

- Experience with BSA/AML or Fraud account monitoring software (Bankers Toolbox, Patriot Officer, JHA Yellow Hammer, Verafin or similar monitoring solution)

- Experience with creating reports

- Professional Certification (CAMS, CFE, CBAP, CRCM, or commensurate BSA/Risk Management certification) preferred, or required to be obtained within 6 months of hire (bank sponsored)

44

Counterparty Due Diligence Analyst Resume Examples & Samples

- Understand and Operate the Standardized R&M ACDD process

- Understand and assist in operating the High Risk Agent Group Control Process (HRAGCP)

- Participate in periodic reviews of the ACDD or HRAGCP process with fellow practitioners and subject matter experts from E&C, Legal, PSCM etc

- Ensure that the Sentinel screening database remains aligned with the active counterparties in our ERPs

- Provide subject matter expertise to requestors to ensure that the appropriate level of rigor is applied to ACDD and HRAGCP evaluations of counter-parties

- Conduct on demand ACDD screening for new counterparties in accordance with the risk based ACDD process. Monitor the continuous monitoring reports for new matches

- Ensure that the rationale for all decisions is annotated as needed in Sentinel

- Where the rigor level is escalated from Simplified to Standard, liaise with internal customers and the external counter-party to obtain the necessary additional information

- Securely store all information in accordance with the requirements of the ACDD Practice and HRAGCP ensuring compliance with any data privacy requirements

- Track actions relating to High Risk Agents and follow-up with sponsors where necessary

- Input to the regular quarterly metrics reported by the Control Function. Report and monitor key process metrics

- Bachelor’s degree in Accounting, Finance, Business or related field

- More than 5 years of working experience in Finance, Accounting, Business or related field

- Within 12 months the successful candidate will be expected to obtain an Advance Certificate in Anti-Money Laundering via training and examination.(offered by E&C) or, with prior approval from E&C, an equivalent level of professional certification

- Strong written and verbal communication skills – the role requires communication to all levels in the organization

- Demonstrated attention to detail and the ability to adhere to process

45

Counterparty Due Diligence Analyst Resume Examples & Samples

- More than 2 years of experience with ACDD/AML or related compliance areas

- Experience using World Check or Sentinel application

- Experience working in a global shared services environment

- Familiarity with BP’s Procurement, Order to Cash or Credit operations

- Exceptional analytical skills and demonstrated proficiency in IT applications

- Courage to say no when appropriate and to speak up when potential issues are observed

46

Due Diligence Analyst Resume Examples & Samples

- Conducts customer reviews by using various tools available such as the internet, Lexis/Nexis, public data bases, websites and government resources

- Thorough knowledge of the FFIEC BSA/AML regulations

- Investigative techniques using Internet, Public Websites and Lexis/Nexis

- Experience with BSA/AML monitoring software (Bankers Toolbox, Patriot Officer, JHA Yellow Hammer, Verafin)

- Professional Certification (CAMS, CFE, CBAP, CRCM)

47

Gcg-senior Due Diligence Analyst Resume Examples & Samples

- Bachelor’s degree from recognized university

- CFA advantageous

- Major in Business Finance, Investments or Legal

- Min. 6 years of relevant working experience

- Robust understanding of traditional mutual funds and liquid alternatives

- Able to work in fast-paced oriented environment

- Able to contribute as a team member

- Cooperative, supportive and responsible for duties assigned

48

AML Enhanced Due Diligence Analyst Resume Examples & Samples

- Responsible for requesting and reviewing necessary supporting documentation for EDD depending on the type of review

- Follows all Bank policies and procedures, compliance regulations, and completes all required annual or job-specific training

- Maintain a working knowledge of Bank's written policies and procedures regarding Bank Secrecy Act, Regulation CC, Regulation E, Bank Security and other regulations as applicable to this job description

- Takes personal initiative and is a positive example for others to emulate

- Embraces our vision to become "The World's Greatest Bank."

- Bachelor’s degree in business, business management, leadership, criminal justice, law, accounting, or related field required

- 1-3 years of previous banking experience, preferably in AML operations or AML Compliance

- Knowledge of the Bank Secrecy Act, USA PATRIOT Act and its requirements

- Possess high level of analytical skills with the ability to apply that analysis to complex transactional and customer situations

49

AML / KYC New Business Due Diligence Analyst Resume Examples & Samples

- Liaise with client on-boarding / sales for required documents and sign-off

- Review all KYC entries / records and liaise with client on-boarding for any issues or questions

- Follow up with Compliance for approvals of High Risk clients, and with Sales/Bankers for all other clients

- Complete remediation efforts and projects to clean up data and documentation and coordinate with other areas as needed (COB, Compliance, Sales, Client Service)

- Minimum 1-3 years' experience in financial services operations, compliance, or client service preferred

- AML/KYC experience needed - CAMS certification is a plus

- Individual must be detail oriented and self-directing

- Strong verbal and written communication skills are a must

- Excellent client and time management skills

- Adaptable, flexible and willing to work in a dynamic environment

- Understanding of banking infrastructures, applications, and businesses/products is a plus

50

Operational Due Diligence Analyst Resume Examples & Samples

- Qualitatively assess investment manager operations, internal controls and risks as well as assessing third party providers through thorough onsite reviews

- Review manager and fund documentation including Formation Documents, Offering Memorandums, Service Provider and Financing Agreements

- Conduct ongoing reviews of investments

- Write formal assessments of reviews for internal and external distribution

- Maintain operational due diligence policies and procedures with industry best practices and develop future enhancements of Citi's Ops due diligence program

- Coordinate the service provider and counterparty confirmation process globally, and reconcile prime broker, fund accounting and audit data

- Attend and assist in performing manager and service provider due diligence reviews

- 3-5 years related experience with Financial Services, preferably private equity / real estate / hedge fund related work experience (e.g. operational due diligence, auditing or accounting and back office operations)

- Knowledge of hedge fund strategies and trades, valuation and reconciliation issues and best practices of the industry

- Knowledge of global regulatory and compliance rules and regulations

- Bachelor's degree, preferably in finance or accounting

- Critical, organized with the ability to articulate concerns/issues effectively to senior investment management professionals (i.e. CFO, controllers, prime brokers, Administrators, etc.)

- Excellent interpersonal and communication skills, oral and written required

- Proactive attitude focusing on creating ideas and plans for correcting issues

- Must have attention to detail and accuracy

- CPA and/or CFA designation

51

Due Diligence Analyst Resume Examples & Samples

- Identify and address items through day-to-day assignments to ensure the Bank’s KYC and CIP standards have been met

- Assist in ensuring ongoing due diligence efforts and KYC are maintained while identifying substantive changes to customer profiles

- Assist in conducting AML Screening/CDD/EDD reviews on prospects and new/existing customers in accordance with the Bank’s policies and procedures

- Assist in the execution of special projects, investigations or reviews, as directed

- Perform searches utilizing Internet sources and/or third-party vendors (i.e. Google, Lexis Nexis, and/or World Compliance) to determine negative news and obtain due diligence information for prospects and new/existing customers

- 3-5 years experience in banking or 1-3 years BSA/AML compliance experience

52

Counterparty Due Diligence Analyst Resume Examples & Samples

- Conduct on demand CDD screening for counterparties in accordance with the risk based CDD process. Monitor the continuous monitoring reports for new matches

- Securely store all information in accordance with the requirements of the CDD Practice and policy ensuring compliance with any data privacy requirements

- Provide subject matter expertise for the CDD process to requestors to ensure that the appropriate level of rigor is applied to CDD and HRAGCP evaluations of counter-parties

- Participate in periodic reviews of the CDD or HRAGCP process with fellow practitioners and subject matter experts from Ethics & C, Legal, etc

- Prepare and provide input to the regular reports and metrics, as required by management

- Bachelor’s degree in Finance, Business or any related field; or professional certification such as ACAMS or ICA

- Minimum 5 years of working experience in CDD/ AML, Compliance, Finance, Business or related field

- Strong written and verbal communication skills, as the role requires communication to all levels in the organization

- Strong analytical skills and demonstrated proficiency in IT applications

53

Due Diligence Analyst, Mid Resume Examples & Samples

- Experience with conducting investigative research using online databases and public record resources

- Experience in dealing with client relationships

- Knowledge of the structure, policies, and directives of national intelligence agencies and organizations

- BA or BS degree and 4+ years of experience with counterintelligence, investigative, or intelligence analysis work

54

Senior Due Diligence Analyst Resume Examples & Samples

- Undertake and perform Enhanced Due Diligence assessments and Anti-Bribery and Corruption (ABC) customer due diligence to make recommendation on the suitability of business relationships

- Liaise with external counterparties to collate required company information/documentation and verify evidence obtained during the customer due diligence process to ensure authenticity

- Working to tight deadlines often under pressure and be able to prioritize your workload with shifting demands and priorities in a fast paced commercial environment

- Ability to analyse substantial amounts of data, identify red flags, other areas of concern and escalate matters requiring the attention of the Team Lead or Money Laundering Reporting Officer appropriately

55

Due Diligence Analyst Resume Examples & Samples

- 3+ years of Financial Services experience at a Broker Dealer, Product Sponsor or Law firm

- Bachelor's Degree in Finance and/or a related field

- Client Service background

- General knowledge of Retail Investment products with Alternative Investment Product Due Diligence

56

Senior Due Diligence Analyst Resume Examples & Samples

- Undertake enhanced, standard and ABC customer due diligence to make recommendation on the suitability of the business relationship (end to end process)

- On-board new customers and re-review existing customers across all client types ensuring all internal and regulatory records management standards are adhered to

- Independently research companies and individuals to identify PEPs and adverse news

- Analyse and verify evidence collated during the review process to ensure authenticity

- Manage internal and external stakeholders to keep them appraised of progress and or articulate the requirements to perform the due diligence

- Deputise for the Europe Financial Crime Prevention Team Lead

- Assist with adhoc financial crime investigations and projects

- Bachelor Degree with a minimum of 3 years’ experience in financial crime/customer due diligence environment

- Detailed knowledge of financial crime risks with the ability to articulate and document concerns in a clear and concise manner

- Well versed in JMLSG guidance notes and FCA guidelines

- Ability to appropriately MiFID classify clients in line with COBS

- Working knowledge of corporate structures and understanding of complex entity structures including SPVs, Trusts and Funds

- Excellent attention to detail with the ability to work under pressure in a fast paced commercial environment

- Ability to analyse substantial amounts of data and identify red flags

- Team player with excellent communication skills, both written and verbal and strong interpersonal skills to manage relationships with internal and external stakeholders

- Have experience in commodity market

- Fluent in English and either Russian/German/Spanish/Italian or French

- Attained a professional qualification in Financial Crime

57

Operational Due Diligence Analyst Resume Examples & Samples

- Assisting with the operational due diligence reviews of external Hedge Fund, Private Equity, Real Assets, and Long-only investment managers. Long-only investment manager reviews include managers that are part of the External Manager Solutions long-only advisory programs as well as managers selected as sub-advisors by Bessemer’s internal mutual funds

- Assisting with obtaining and reviewing the legal documentation, audited financial statements as well as operations, compliance, and trading policies and procedures of the external managers prior to investment and as part of ongoing monitoring

- Maintaining periodic communications with managers to gather updated information related to their business operations and documenting changes that relate to operational risk

- Liaising with the internal Legal and Compliance Departments on matters related to operational due diligence

- Assisting with the distribution of annual questionnaires and reviewing the information obtained

- Assisting with the preparation of written reports and manager risk ratings

- Keeping abreast of market developments, industry trends and regulatory matters that could impact alternatives and long-only investment managers or due diligence procedures

- Performing ad hoc duties related to the operational due diligence function as necessary

- Two to three years direct operational due diligence experience or experience working in related areas of hedge fund/mutual fund accounting, audit, legal and compliance or broader back office operations (trade reconciliation, asset pricing, NAV calculation, credit agreements etc.)

- Exceptional planning and organizational skills with attention to detail

- Team player mentality

58

Due Diligence Analyst Resume Examples & Samples

- Summarize key findings/notes for Financial Due Diligence, Management Fit and Capability and Capacity from extensive researches, 3rd party analysis, and answers from the Deal Information Document and the Supplier Information Document

- Analyze gaps and identify risks from the key findings for Financial Due Diligence, Management Fit and Capability and Capacity

- Provide risk mitigation for Financial Due Diligence, Management fit and Capability and Capacity

- Populate DD supplier summary dashboards with our standard tools

- To participate in consistent supplier relationship management program to ensure that contractual obligations are adhered to and continuous improvements are realized

- Subcontract review to identity key risk areas and provide the findings to the contract manager

- Industry analysis and solution review to evaluate the stability of the solution

- Preferably graduate with Accounting/ Finance/ IT related degrees

- Some legal background or exposure desirable

- Basic understandings of the IT industry

- Excellent written and spoken in English

- Have experience in Supplier evaluation/ Risk management

- Good research and analysis skills

- Issue resolution and problem solving skills

- Working experience in multinational corporations is preferred

- Team members are located in Dalian

59

Due Diligence Analyst Resume Examples & Samples